ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Vietnam to Soar High in Global Chip Supply Chain

Vietnam has been a formidable force in the southeast Asian region as a destination for chip assembly, test, and packaging. However, the country has been expanding its focus to become one of the major semiconductor manufacturing hubs not just in the region but also globally.

Vietnam Prime Minister Pham Minh Chinh has been steering the country’s wheel towards the semiconductor front-end direction and was certain the country will inaugurate its first domestically-owned semiconductor chip factory in 2026.

Pham made the statement during a recent meeting with the delegation global industry association SEMI in Hanoi City. Moreover, he also called on the delegates, consisted of 32 executives representing 3,700 companies, to help Vietnam to develop a comprehensive semiconductor ecosystem.

2050 Vision: Leading Chip Electronics Hub

Pham has been in the forefront in stirring the country’s momentum to independently design, manufacture, and test several essential semiconductor chips no later by 2027.

The country’s foray to front-end wafer fab vision started to become a reality when Prime Minister Pham signed in September 2024 Vietnam’s national semiconductor strategy. The country’s three-phase semiconductor roadmap until 2050 aims to turn the country into a global semiconductor hub.

The first phase, which covers 2024 to 2030, Vietnam will leverage its geographical and human resources to boost investments and establish 100 chip design companies, a semiconductor plant, and 10 packaging and testing facilities.

Phase 2, which is from 2030 to 2040, will focus on expanding at least 200 design companies, two chip manufacturing plants, and 15 packaging and testing facilities. Meanwhile, the last phase, 2040 to 2050, aims to make the country as the world’s leading hub in semiconductor electronics.

Moreover, Pham also announced the government’s funding of US$500 million for the country’s first chip fabrication plant.

Moreover, the government has also introduced several incentives, such as 30 percent government funding capped at US$400 million for any high-tech chip fabrication operational before December 31, 2030. It has also offered corporate income tax incentives, such as allocating 20 percent of taxable income annually to their science and technology development fund. The country has also launched training and development programs in semiconductor targeting 50,000 skilled professionals by 2030.

Unprecedented Growth Phase

The past years, the country has attracted noteworthy investments from multinational back-end companies with a number of domestic firms are also building up their credible presence in the semiconductor industry.

Among the recent investments included the US$1.6 billion advanced chip packaging facility of American conglomerate Amkor Technology in Bac Ninh; the over US$1 billion investment by South Korean Hana Micron for chip packaging capacity in Bac Giang; as well as Intel’s cumulative US$1.5 billion funding for chip testing and packaging factory in Ho Chi Minh. Furthermore, Foxconn subsidiary Shunsin Technology is reportedly keen to invest a chip factory in Bac Giang while Samsung Electronics is said to increase its capacity in Vietnam with additional investments.

In 2024, Vietnam has approved 174 foreign direct investment (FDI) projects in the semiconductor sector with total capital of approximately US$11.6 billion. Initial reports for the first 10 months of 2025 showed the country already registered almost US$11.6 billion capital from about 170 foreign invested projects.

Meanwhile, domestic companies in Vietnam are also striving to penetrate the country’s semiconductor industry, which is currently dominated by foreign-owned companies. With Vietnam eyeing to launch its first semiconductor plant in 2026, CT Semiconductor is taking the lead as it is expected to inaugurate early next year the phase 2 of its US$100 million semiconductor plant. Accordingly, the facility aims to produce 100 million chips yearly starting 2027.

Viettel is also expanding its chip and R&D and small-scale packaging capabilities while FPT Semiconductor, according to a government news site, is also planning to build up its chip design capability in Vietnam.

US$100-B Industry

Without a doubt, Vietnam’s semiconductor industry has entered an unprecedented growth phase. The country has the know-how in semiconductor assembly, test, and packaging, which it can further harness to propel its semiconductor capabilities in the future.

However, it may not be an easy feat for Vietnam as it needs to propel even further investors to fund its chip manufacturing ecosystem. Industry experts earlier said the US$500 million seed investment of Vietnam may not be enough to fund a wafer factory, which can cost up to US$50 billion.

Nonetheless, Vietnam has shown a formidable aggressiveness to realize its semiconductor strategy roadmap. With its competitive incentives, sound roadmap, and attractive investment viability, the country can soon become a crucial global player in the semiconductor manufacturing industry. There isn’t no other good timing for Vietnam amid the volatility of global chip supply chain and a cautious global market brought about by the United States and China trade conflict.

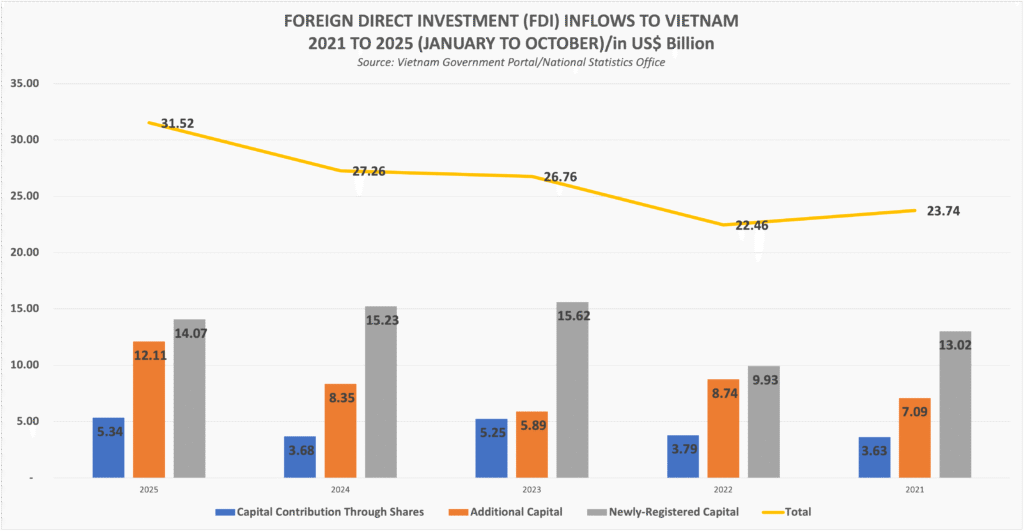

Furthermore, investor confidence in Vietnam is on upward trajectory as it attracted US$31.52 billion of foreign direct investment (FDI) from January to October 2025, growing 15.6 percent year-on-year (Figure 1).

Should the government’s semiconductor roadmap come to fruition, the country should have established at least 300 chip design companies, 20 semiconductor product packaging and testing facilities, and three semiconductor chip manufacturing plants by end of 2050. By that time, the semiconductor and electronics industries are expected to post respective annual revenues of more than US$100 billion and US$1.045 trillion, as well as a growth rate of 20 to 25 percent in added value.

24 November 2025