ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

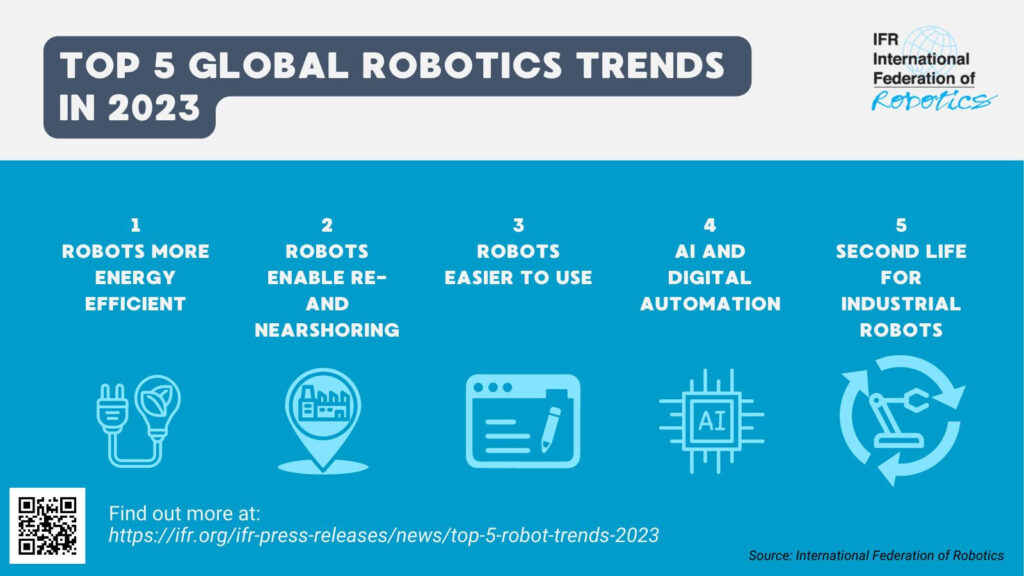

IFR Reports Top Five Robotics Trends in 2023

The International Federation of Robotics (IFR) analyzes top five trends shaping robotics and automation in 2023.

Globally, the stock of operational robots hit a new record of about 3.5 million units. Meanwhile, the value of installations reached an estimated US$15.7 billion. “Robots play a fundamental role in securing the changing demands of manufacturers around the world,” says Marina Bill, President of the International Federation of Robotics. “New trends in robotics attract users from small enterprise to global OEMs.”

Energy Efficiency

Energy efficiency is key to improve companies’ competitiveness amid rising energy costs. The adoption of robotics helps in many ways to lower energy consumption in manufacturing. Compared to traditional assembly lines, reduced heating achieves considerable energy savings. At the same time, robots work at high speed thus increasing production rates for more time- and energy-efficient manufacturing.

Today’s robots are designed to consume less energy, which leads to lower operating costs. Companies use industrial robots equipped with energy-saving technology to meet sustainability targets for their production. A case in point, robot controls convert kinetic energy into electricity and feed it back into the power grid. Specifically, this technology significantly reduces the energy required to run a robot. Another feature is the smart power-saving mode that controls the robot´s energy supply on-demand throughout the workday. Since industrial facilities need to monitor their energy consumption even today, such connected power sensors are likely to become an industry standard for robotic solutions.

Reshoring

Resilience has become an important driver for reshoring in various industries. Specifically, car manufacturers invest heavily in short supply lines to bring processes closer to their customers. These manufacturers use robot automation to manufacture powerful batteries cost effectively and in large quantities to support their electric vehicle projects. Such investments make the shipment of heavy batteries redundant. This is important as more and more logistics companies refuse to ship batteries for safety reasons.

Also, relocating microchip production back to the U.S. and Europe is another reshoring trend. Nowadays, most industrial products require a semiconductor chip to function. Thus, their supply close to the customer is crucial.

Robots play a vital role in chip manufacturing, as they live up to the extreme requirements of precision. Specifically designed robots automate the silicon wafer fabrication, take over cleaning and cleansing tasks or test integrated circuits. Intel´s new chip factories in Ohio or the recently announced chip plant in the Saarland region of Germany run by chipmaker Wolfspeed and automotive supplier ZF are examples of reshoring.

Easier-to-Use Robots

Robot programming has become easier and more accessible to non-experts. Providers of software-driven automation platforms support companies, letting users manage industrial robots with no prior programming experience. Moreover, OEMs work hand-in-hand with low code or even no-code technology partners, allowing users of all skill levels to program a robot.

The easy-to-use software, paired with an intuitive user experience, replaces extensive robotics programming and opens up new robotics automation opportunities. Especially, software start-ups are entering this market with specialized solutions for the needs of small and medium-sized companies. For example, a traditional heavy-weight industrial robot can be equipped with sensors and a new software that allows collaborative setup operation. This makes it easy for workers to adjust heavy machinery to different tasks. Companies will thus get the best of both worlds – robust and precise industrial robot hardware and state-of-the-art collaborative robot (cobot) software.

Easy-to-use programming interfaces, which allow customers to set up the robots themselves, also drive the emerging new segment of low-cost robotics. Many new customers reacted to the pandemic in 2020 by trying out robotic solutions. Robot suppliers acknowledged this demand. For example, they developed robots featuring easy setup and installation with pre-configured software. These robots are designed to handle grippers, sensors or controllers to support lower-cost robot deployment. Such robots are often sold through web shops and program routines for various applications are downloadable from an app store.

Artificial Intelligence and Digital Automation

Propelled by advances in digital technologies, robot suppliers and system integrators offer new applications and improve existing ones regarding speed and quality. Connected robots are transforming manufacturing. Robots will increasingly operate as part of a connected digital ecosystem. Cloud computing, big data analytics or 5G mobile networks provide the technological base for optimized performance. Specifically, 5G standard will enable fully digitalized production, making cables on the shopfloor obsolete.

Artificial Intelligence (AI) holds great potential for robotics, enabling a range of benefits in manufacturing. The main aim of using AI in robotics is to better manage variability and unpredictability in the external environment, either in real-time, or off-line. This makes AI supporting machine learning play an increasing role in software offerings where running systems benefit, for example with optimized processes, predictive maintenance or vision-based gripping.

This technology helps manufacturers, logistics providers and retailers dealing with frequently changing products, orders and stock. The greater the variability and unpredictability of the environment, the more likely AI algorithms will provide a cost-effective and fast solution – for example, for manufacturers or wholesalers dealing with millions of different products that change on a regular basis. AI is also useful in environments in which mobile robots need to distinguish between the objects or people they encounter and respond differently.

Second Life for Industrial Robots

Since an industrial robot has a service lifetime of up to 30 years, new tech equipment is a great opportunity to give old robots a “second life”. Industrial robot manufacturers like ABB, Fanuc, KUKA or Yaskawa run specialized repair centers close to their customers to refurbish or upgrade used units in a resource-efficient way. This prepare-to-repair strategy for robot manufacturers and their customers also saves costs and resources. To offer long-term repair to customers is an important contribution to the circular economy.