ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

China's Huge Robot Market Shows More Room for Growth

Industrial robot market is expanding in China as manufacturers implement labor savings and automation. Although sales ratio of foreign manufacturers in China stays huge, the Made in China 2025 policy is magnifying the in-house production of Chinese companies.

The International Federation of Robotics (IFR) said the robot density in China, which is the number of industrial robots in operation per 10,000 employees, stays low. Japan’s robot density is 364 and is third in the world. China is still low and is currently ranked 15th globally, but this only means there is more room for growth.

Foreign Makers Show Force

Manufacturers in China employ industrial robots for assembly and transport, particularly SCARA and small vertical articulated robots for smartphones and electronic device production. Robots are also used in welding and painting system, particularly for automobile and electric vehicle (EV) production lines. The same goes for the clear transfer system, which is transfer system for flat panel display, wafer, among others; and the actuator system, which uses single-axis robot, Cartesian coordinate robot, among others.

In 2019, the share of overseas manufacturers in the number of robots sold in China is high at 71 percent. At present, Japanese companies including Yaskawa Electric Corporation, FANUC Corporation, Nachi-Fujikoshi Corporation, Kawasaki Heavy Industries, Ltd., Yamaha Motor Co., Ltd., Seiko Epson Corporation, Mitsubishi Electric Corporation, Denso Corporation, Panasonic Corporation, and others are competing in the Chinese market. European and American companies such as ABB, Universal Robots, KUKA, and other Asian companies such as HIWIN and Hyundai, are all vying in the huge Chinese robot market.

The rise of Chinese companies is remarkable as the market expands. Articulated robots with six or more axes, which have been considered technically difficult, are catching up with those of Japanese manufacturers. The Made in China 2025 policy has positioned the robot industry and related machine tools as among the ten priority fields, and the in-house production of industrial robots has been promoted as a national policy. As a result, the market share of Chinese companies has increased from 22 percent in 2017 to 27 percent in 2018; and from 29 percent in 2019 to 30 percent level in 2020.

China Robot Players Emerge, Too

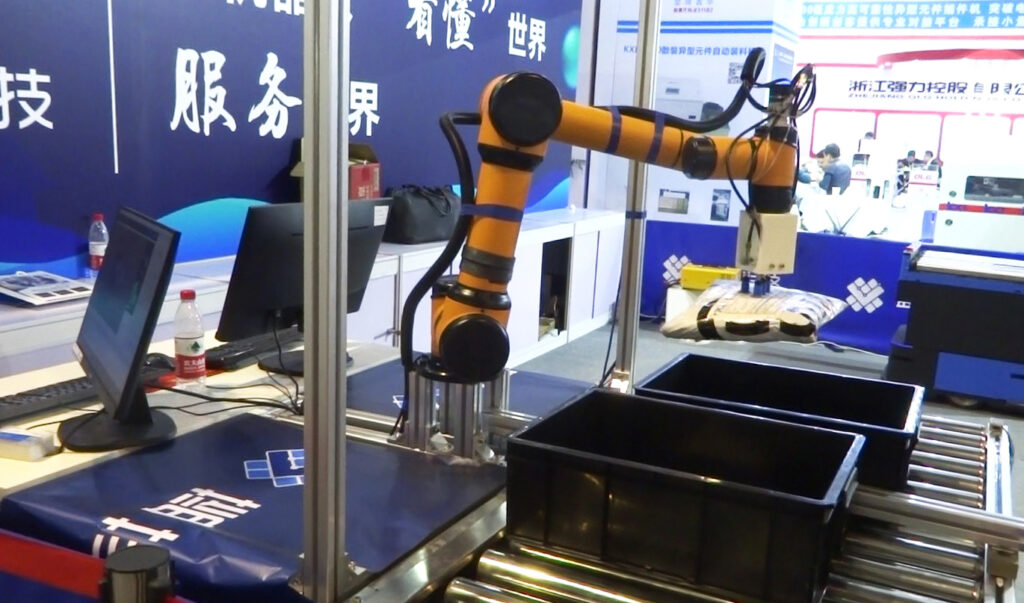

China’s largest robot manufacturer SIASUN Robot & Automation CO., LTD. is a listed company belonging to the Chinese Academy of Sciences, a ranking technology institution in China. Its main factory is in Shenyang City in China’s Liaoning province. It also handles collaborative robots, which are sold by electronics trading company Ryosan in Japan. It showed collaborative robots at SEMICON China held in Shanghai in March.

Nanjing Panda, which is in Nanjing City, is competing with the SIASUN Group, but the drive units inside the robot are made in Japan. A&E in Anhui Province has R&D centers in Beijing, Shanghai, and Anhui.

Standard Robots (Shenzhen City) specializes in the research and development and manufacturing of industrial autonomous mobile robot (AMR). In Japan, its products are handled by THK Intechs CO., LTD. It joins various exhibitions on logistics in Japan. In-house developed SLAM positioning, beacon positioning, inertial navigation, and other technologies of the company have reached an internationally high level. It also supplies its products to many large companies such as HUAWEI, ZTE, Foxconn, and Volkswagen.

Consumer electronics manufacturer Midea has bought KUKA and the white goods division of Toshiba in 2016. Forward X Robotics (Beijing) manufactures collaborative autonomous transfer robots. In addition, ESTUN (Nanjing City), TOPSTAR (Dongguan City) and STEP (Shanghai City) will also play a part in the Chinese robot industry as leading companies.