ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

SEMI Says 300mm Fab Equipment Spending to Grow Further

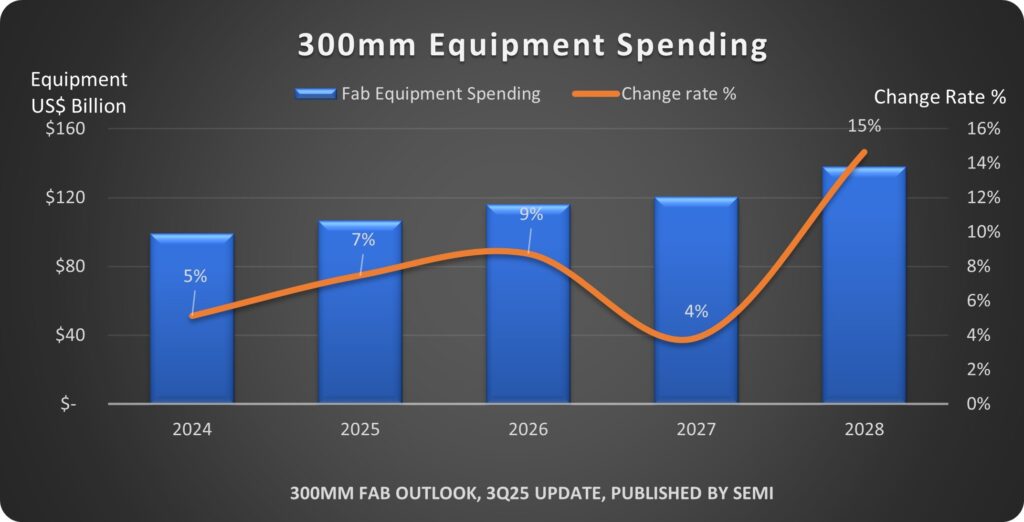

Electronics industry association SEMI said global 300mm fab equipment spending is likely to reach US$374 billion from 2026 to 2028.

SEMI said in its latest 300mm Fab Outlook, the body said the robust investment reflects fab regionalization and surging AI chip demand for data centers and edge devices. At the same time, it also underscores the growing commitment to semiconductor self-sufficiency across key regions through localized industrial ecosystems and supply chain restructuring.

Worldwide 300mm fab equipment spending is expected to surpass US$100 billion for the first time in 2025, growing 7% to US$107 billion. The report projects investment will increase 9% to US$116 billion in 2026, then 4% to US$120 billion in 2027. By 2028, investment will grow at double-digit rate at 15% to US$138 billion.

Ajit Manocha, President and CEO of SEMI, said, “Strategic global investments and collaboration are driving robust, advanced supply chains and faster deployment of next-generation semiconductor manufacturing technologies. The global expansion of 300mm fabs will enable progress in data centers, edge devices, and the digital economy.”

Segment Growth

SEMI forecasts Logic & Micro segment to lead equipment expansion with US$175 billion in total investments from 2026 to 2028. Accordingly, foundries are expected to be the primary drivers of this growth, fueled by sub-2nm capacity build-outs.

Key enablers include advanced technologies such as gate-all-around (GAA) architecture and backside power delivery, which are essential to enhancing chip performance and power efficiency for increasingly demanding AI workloads. More advanced 1.4nm process technology is expected to enter volume production by 2028-2029.

Additionally, AI performance improvements are anticipated to drive massive growth in edge-devices including automotive electronics, IoT applications, and robotics. Beyond advanced processes, demand across all nodes and various electronics devices is expected to surge significantly, fueling mature process equipment investment.

The Memory segment is projected to rank second with US$136 billion in spending over the three-year period, marking the beginning of a new growth cycle for the segment. DRAM-related equipment investment is expected to exceed US$79 billion from 2026 to 2028. Specifically, 3D NAND investment reaching US$56 billion over the same period.

AI training and inference have driven comprehensive demand increases across various types of memory. AI training requires greater data transmission bandwidth and extremely low latency, significantly boosting high bandwidth memory (HBM) demand.

On the other hand, analog-related segments’ anticipated investment is projected to exceed US$41 billion over the next three years. Including compound semiconductors, the power-related segment is expected to invest US$27 billion from 2026 to 2028.

Regional Growth

SEMI forecasted China to lead in 300mm equipment spending with US$94 billion in projected investments from 2026 to 2028 while Korea is projected to rank second in with US$86 billion invested.

Meanwhile, Taiwan is expected to invest US$75 billion in 300mm equipment over the three years, ranking third. Investment will concentrate primarily on 2nm and sub-2nm capacity.

Moreover, the report projects Americas to invest US$60 billion from 2026 to 2028, rising to fourth position. U.S. suppliers are expanding advanced process capacity to meet surging AI application demands while catalyzing domestic industrial and investment upgrades to maintain global technology development leadership.

Finally, Japan, Europe & Middle East, and Southeast Asia are projected to invest US$32 billion, US$14 billion, and US$12 billion, respectively, over the three-year period.

Part of the SEMI Fab Forecast database, the SEMI 300mm Fab Outlook lists 391 facilities and lines globally. The report reflects 173 updates and nine new fabs/lines projects since its last publication in January 2025.

09 October 2025