ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

AI, 5G, DX to Drive Japan’s IT Industry

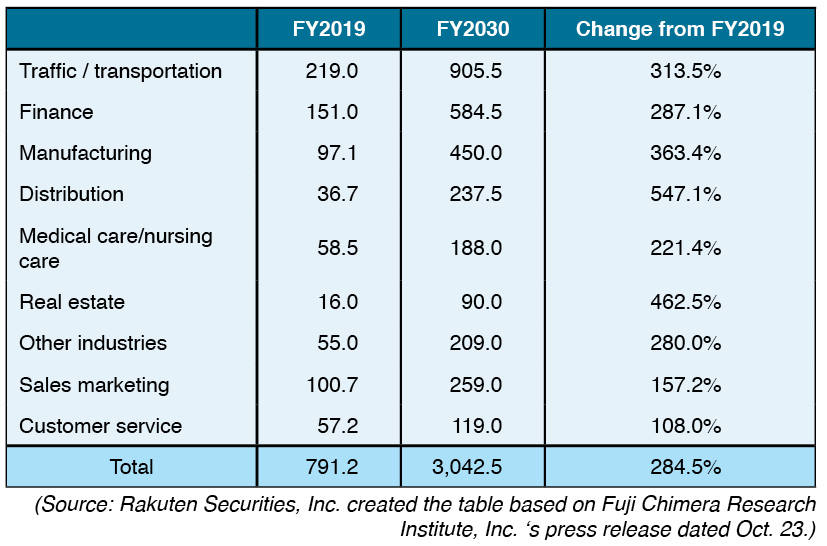

At present, Japan’s economy is breaking out of the effects of the COVID-19 pandemic. Some of the driving factors are digital transformation (DX), artificial intelligence (AI), and fifth-generation (5G) communications.

AI, machine learning, and big data analysis began to penetrate Japan’s industrial world after Toyota Motor Corporation embarked on research and development of autonomous driving on full scale around 2017 to 2018.

Around the same time, moves to use AI in retail sales, online shopping and communications became active. Trials of voice automatic reply services using AI also started around this time. Companies also began to embed AI in information systems they construct.

Proliferation of AI Applications

In manufacturing

Today, these moves have spread to manufacturers’ factories. The COVID-19 pandemic has significantly deteriorated the operation rate of factories of various industries. However, it is rapidly recovering at present. On the other hand, many factories are facing shortages of semiconductors and components. These factories are increasingly introducing big data analysis and AI to predict supply of semiconductors and components and to estimate production of their own factories.

Towards carbon neutrality

Furthermore, the decarbonization trend that is spreading around the world has been propelling the moves to introduce AI and big data analysis. The people must become aware of where and what amount of global warming gases are emitted in the factory. To this end, manufacturers are installing sensors and wireless networks inside factories to conduct big data analysis. AI is also needed to optimally control the entire factory. These moves have been advancing among finished car manufacturers and leading components manufacturers.

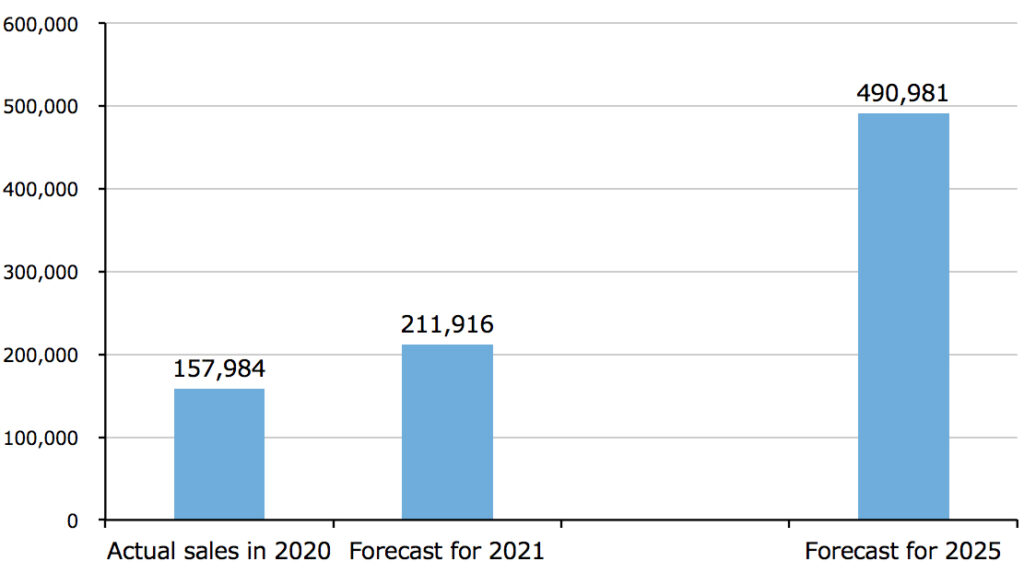

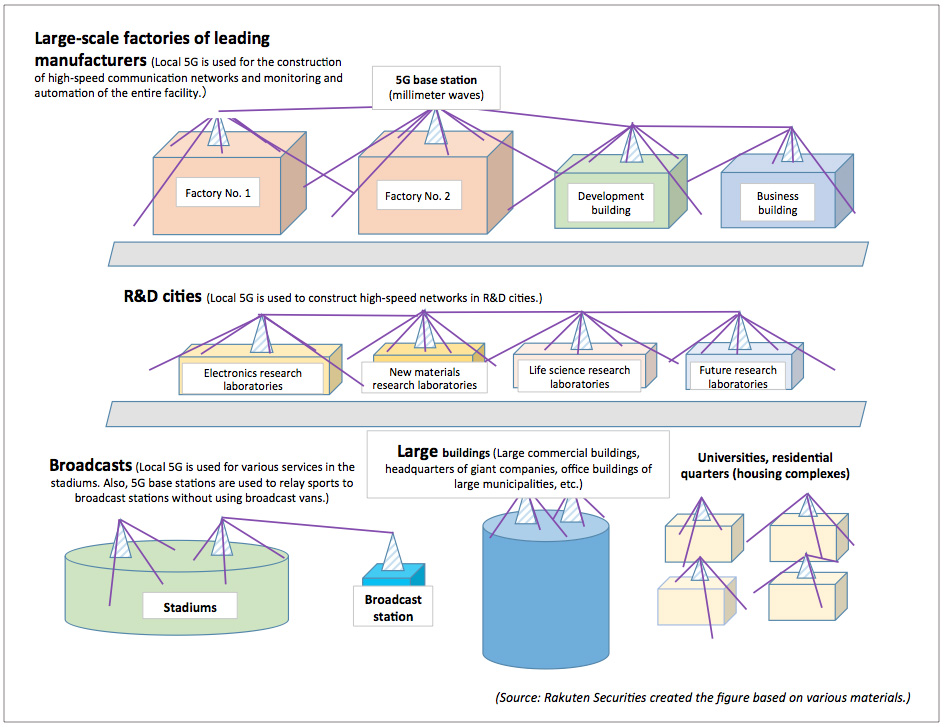

5G Adoption on Full Scale

Japanese companies are also expected to begin using 5G on full scale in 2022. Telecommunications companies plan to significantly increase the installation of millimeter wave base stations that enable high-speed large-capacity communications in the fiscal year ending March 2023. Millimeter wave-compatible smartphones available in Japan are also expected to increase. Companies that use local 5G, which Fujitsu Limited and NEC Corporation have actively promoted, will also increase.

DX boom is occurring in Japan about two years behind the United States. However, the speed is not fast. This holds true with AI and 5G.

Companies and Industries Do not Grow Simply by AI, 5G, DX

Is the future stable for Japanese companies? The effects of AI and DX are limited to specific factories and products or particular processes and have not reached the entirety of companies. In many cases, they are simply maintaining the status quo.

A typical example is the automotive industry. First, Japan’s automakers completely misread the global decarbonation trend. European Union (EU) countries will effectively ban sales of gasoline- and diesel-powered vehicles by 2030, and hybrid vehicles by 2035. China, India and the United States will likely follow these moves. Japanese automakers can lose business in the main markets.

They are also slow to respond to Tesla Motors, their greatest threat. Tesla Motors has been steadily establishing a mass production system for EVs. Among Japanese automakers, Toyota Motor has at long last announced its target to achieve global sales of 3.5 million EVs per year by 2030. At the same time, Toyota Motor is also enthusiastic about hydrogen vehicles but it is not known when they will become practical. At a time, when implementation dates for environmental regulations are already set and Tesla is an imminent threat, Toyota’s strategies appear to be dispersed in its focus and its moves to be slow. Probably, Toyota desires to maintain its relationships with affiliated components manufacturers.

As it turned out, AI and DX implemented by Japanese automakers are, for now, most likely contributing solely to maintaining internal-combustion-engine vehicles, which are destined to become obsolete.

For this reason, the greatest beneficiaries of the AI, DX and 5G boom will be leading IT companies, Fujitsu, NEC, and NTT Data Corporation that are constructing and selling these technologies.

How Will Japanese Companies Respond to Metaverse

The concept of metaverse existed since a long time ago. However, this time, the scale and technologies are totally different. Meta Platforms, Inc. (formerly Facebook) plans to invest about US$10 billion annually in metaverse starting 2021. The company’s capital investments are expected to increase significantly in the coming years.

In metaverse, all engineers involved, including those at subcontracting companies, will be able to simultaneously see drawings of automobiles and semiconductors using virtual reality (VR) and augmented reality (AR) and conduct various simulations. It will have considerable effects on the monitoring and operation of plants, as well as in education and trainings. It can cause revolution in the manufacturing industry.

In the United States, everybody will seize on metaverse if they find that it is effective. In Japan, many companies are taking a wait-and-see stance. However, there may be no time for taking this position. If metaverse is to bring revolution to the manufacturing industry, Japanese companies should not miss out on the revolution.

About This Article:

The author is Yasuo Imanaka, Chief Analyst, Economic Research Institute, Rakuten Securities, Inc.