ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Henkel Strengthens Thermal Interface Materials Business in New Buyout

Henkel AG & Co. has completed the acquisition of the Thermal Management Materials business of Nanoramic Laboratories (Nanoramic) headquartered in Boston, MA, USA, marketed under the brand Thermexit™ (Thermexit). With this acquisition, Henkel aims to strengthen the position of its Adhesive Technologies business unit in the growing markets for thermal interface materials (TIM) by expanding its capabilities in high-performance segments.

Nanoramic is an R&D company focused on developing high-end energy storage and thermal management technologies based on carbon composites. Nanoramic is known known as FastCAP Systems Corporation until 2018.

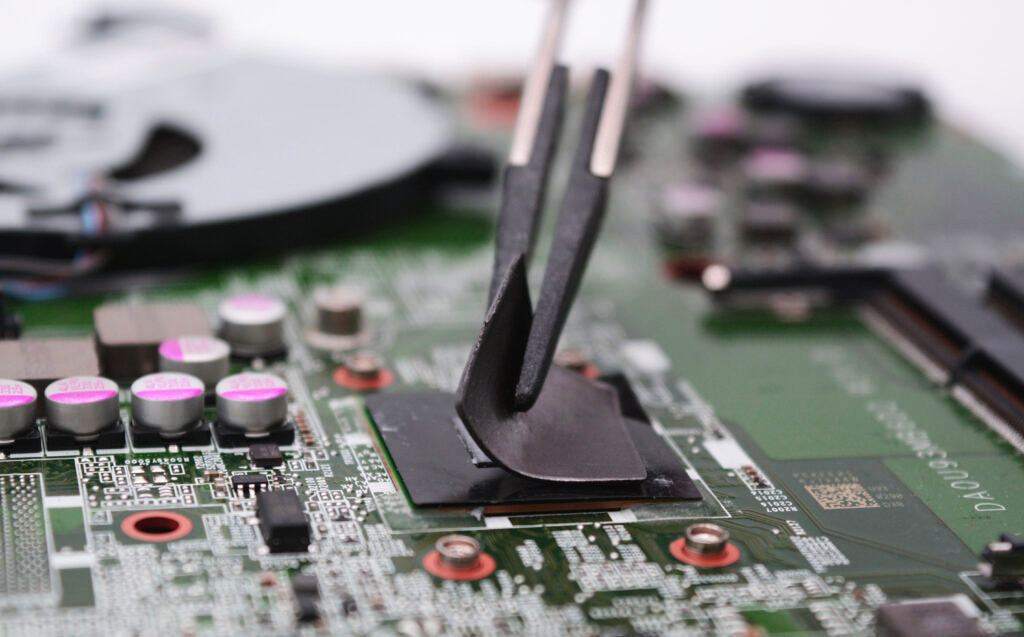

Specifically, the Thermexit portfolio includes patented, high-performance thermal interface gap pads based on an innovative nano-filler technology. This technology provides unique materials with extremely high thermal conductivity and excellent stability.

Particularly, the acquisition strengthens Henkel’s position in the growing TIM market. Also, it expands its offerings for applications in high-growing market segments that require specialized know-how with regards to heat management in electronics. These include 5G infrastructure, semiconductors, and power conversion for industrial and automotive electronics.

“Thermal management solutions are an important growth technology within our materials portfolio. They play a major role to further drive innovations with regards to global megatrends, such as connectivity, mobility and sustainability,” explained Jan-Dirk Auris, Executive Vice President Henkel Adhesive Technologies. “The acquisition of Thermexit complements our existing portfolio with offerings in high-growing market segments to further create value for our customers.”

Both parties agreed to not disclose any financial details of the transaction.