ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Industry Charts Recovery; Parts Supply Poses Threat

The manufacturing industry is booming once again, and manufacturing equipment companies are doing well with record high sales expected. China is particularly on a roll and so are most Southeast Asian countries, which have been recovering from the wrath of the novel coronavirus disease (COVID-19) pandemic.

Some Japanese electronic manufacturing services (EMS) companies are expanding their factories to increase production. While demand is expanding, the difficulty in meeting delivery dates has been a primordial concern due to shortage of semiconductors, electronic components, and component materials.

Accelerate Manufacturing Innovations

Panasonic Smart Factory Solutions Co. Ltd. is developing its global business mainly on electronic component mounting machines, semiconductor manufacturing equipment, welding machines, welding robots, and the like. Akihiro Akiyama, President and Chief Executive Officer, says, “China, which has recovered from the impacts of COVID-19, is doing well and factories to which mounting machines have been delivered are in full operation. The shortage of semiconductors has surfaced and the challenge is to meet the delivery date.” The company will accelerate manufacturing process innovation in growing fields such as semiconductors and devices with increasing demand, in EV/autonomous driving fields, the spread of fifth-generation mobile communication standard (5G), and construction machinery and shipbuilding, among others.

Yamaha Robotics Holdings Co. Ltd. (YRH), which was established in July 2019 with the business domain of integrating semiconductor back-end processes and electronic component mounting, is developing a full-scale business in its third year. Toshizumi Kato, President and Representative Director, says, “The shipment of mounting machines by Yamaha Motor Co. Ltd. reached a record high in March and April. The bonding equipment of Shinkawa Ltd. of the YRH Group is also in operation. Full-scale investment in 5G and EV have started and the demand for semiconductors will expand. However, the procurement of semiconductors and electronic components has become difficult due to shortages and the delivery time has become a major issue. Semiconductor manufacturers invest in cutting-edge processes, but not in legacy semiconductors such as 60 nano and 40 nano, for which the amount of supply is currently insufficient. Therefore, the shortage of semiconductors will continue in the future.”

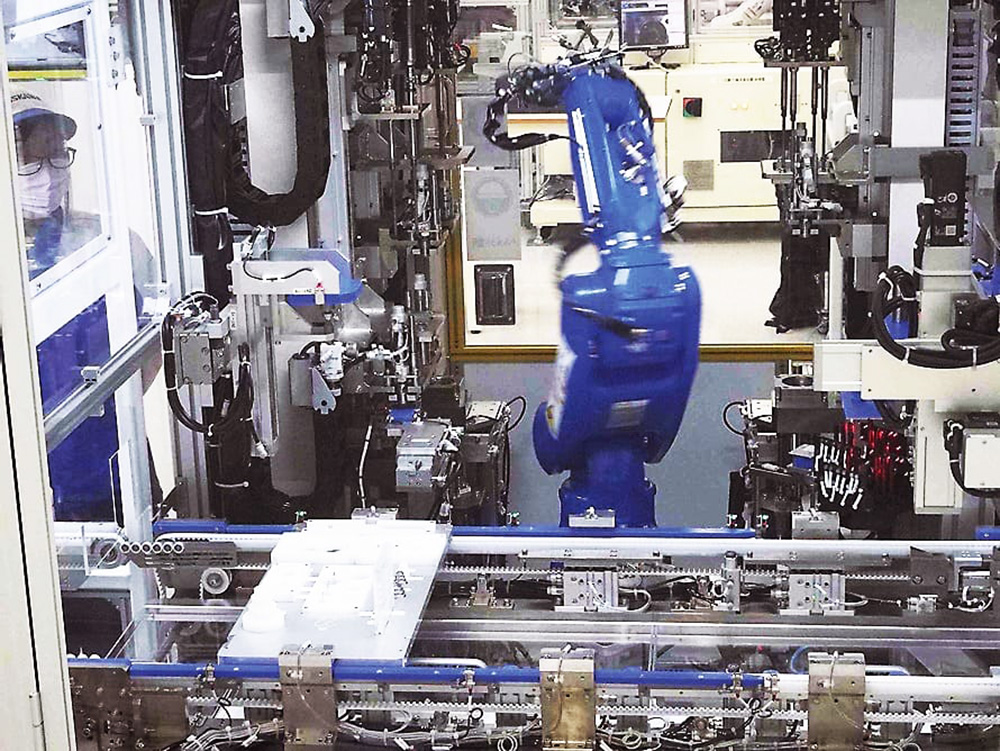

The business of Yaskawa Electric Corporation on AC servo drive is performing well due to active capital investment in 5G, automobiles, semiconductors, among others in China. Sales in regions other than China are also recovering. In March, to accelerate strong demand, the company started accepting orders for the AC servo drive Σ-X Series, which holds one of the highest levels of velocity and frequency response.

TAKIGEN MFG Co. Ltd. develops industrial metal fittings for various industries. It has increased sales through unique manufacturing processes. Expressing concern on material procurement, Mitsugu Tanaka, President of TAKIGEN MFG, says, “Although there are variations between industries this year, overall sales for the full year are expected to proceed as originally planned and exceed those in the previous year. However, we are concerned about the shortage of materials and component materials. Nylon resin, steel, brass, etc. are in short supply, and prices are starting to rise.”

Bullish Prospects for EMS, Too

The EMS field is also going well. Iida Electronics (Tsusho) Co. Ltd. develops EMS business in Dongguan, China, and in Thailand and Myanmar, and increases sales mainly in Thailand. Pertaining business expansions, the company says, “In Thailand, we are developing the EMS business mainly for the high-density mounting and touch panel bonding using the equipment and technology developed by the company. Currently, contracts with Japanese companies are dominant, but those for the laminating business are growing including the increase in the panel size. The business is going well and we have already set up an assembly line.”

Katolec Corporation has production bases for EMS business in Japan (Takamatsu Headquarters Factory, Matsuyama Factory), China (Suzhou, Guangzhou), Vietnam, Malaysia, Thailand, Indonesia, Philippines, Mexico (Tijuana, Guanafat), and India (Pune, Joint venture). Although the business is mainly with Japanese companies, due to the increase in production contracts by local companies, both Vietnam and Indonesia factories have been expanded in 2020. The third building has been newly established at the Philippine factory and completed in June this year. With this third building, the total floor area of the Philippine factory has become 17,130m2, increasing the production capacity further.

MASS Co. Ltd. (Kanagawa Prefecture), a manufacturing equipment trading company, handles a wide range of manufacturing equipment such as mounting machines related to SMT as an agent of Yamaha Motor Corporation (Robotics Division). It has sales offices in China (Suzhou, Shenzhen), Singapore, Malaysia, Philippines, Indonesia, Thailand, Vietnam, Mexico, and India in response to businesses for Japanese companies, which are expanding overseas as well as in Japan.

The company says, “In Japan, the electronic equipment manufacturing industry is actively moving, partly due to the effects of various subsidy systems. Overseas, since the electronic equipment manufacturing in China regained its vitality around the fall of last year, sales of cars, telecommunications, social infrastructure, consumer products, EMS, etc. have continued to be strong, and orders for SMT equipment from Japanese companies have increased. Orders are appreciable also in Thailand, Malaysia, and Vietnam. On the other hand, there is a concern that the supply of products from manufacturing equipment companies may be delayed due to a shortage of materials.”