ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Despite Challenges, IC Industry Looks to New Trends

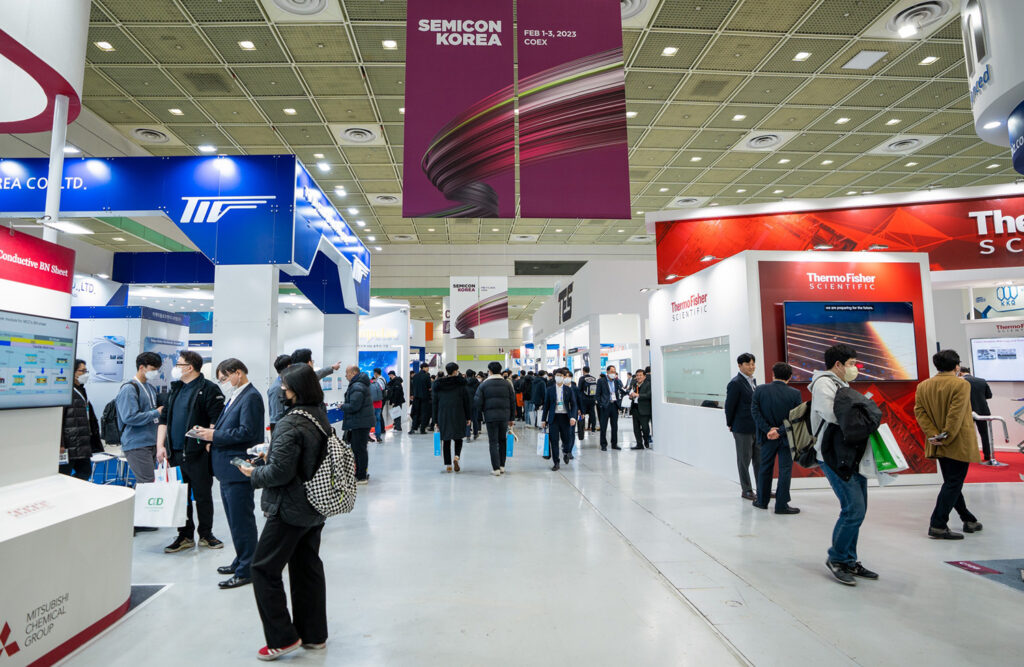

SEMICON Korea 2023 ended its three-day annual exhibition at COEX Exhibition Center in Seoul, Korea. Most importantly, about 450 exhibitors took part in this year’s edition occupying 2,100 booths spread across 30,000sq.m exhibition space.

Incidentally, this year’s event has been clobbered by the lingering challenges in the global semiconductor industry. Particularly, supply chain issues in the ecosystem and steep downturns in chip demand. For one, Samsung Electronics reported the worst earnings results ever in 14 years blaming the nightmarish slump on sluggish demand for memory chips.

Semiconductor Trends, Technologies

SEMICON 2023 served as a sneak peak of the things to come to the industry from 2023 and beyond. This as more than 120 industry gurus and analysts joined a series of keynote and technology forum sessions and gave their respective visions and insight on future market and technology trends and challenges.

Especially, the show is a typical place where semiconductor equipment and raw materials makers can share and exchange tips and details about how chip makers will work on their respective capital spending plans.

At an opening press conference held on Feb. 1, Choe Jeongdong, Senior Technical Fellow with TechInsights said, “As chip scaling technology comes nearer to 5nm and 3nm, chip makers are working on nanosheet gate technologies like Samsung’s MBCFET (multi-bridge channel field effect transistor), rolling out prototype samples . When it comes to DRAM chips, chip makers are working on EUV and 3D DRAM technologies to further scale down the width of gates without compromising capacitance value, focusing on high-k metal dielectric technologies. Inna Skvortsova, market analyst, industry research and statistics pointed out that the 2023 is the beginning year of downturn cycle of global semiconductor industry. This is because the three-year growth period between 2020 and 2022 came to an end.

Skvortsova forecasted that semiconductor revenue will decrease 7% to US$550 billion. Hence, the semiconductor equipment market will decline by 16% to hit US$91.2 billion. Yet, the 2024 will become another bonanza year for equipment maker, SEMI predicted.

Chip Packaging Technology

Joseph Marci, CTO with AMD opened the show’s keynote and charted out a roadmap on chip packaging technologies under the title of “Beating Moore’s Law in the Interconnected World”.

According to him, the industry’s decades-old maxim “Moore’s Law” is neither dead, nor slowing down. Yet, it is getting more and more unsustainable, as it is getting tougher and tougher to keep up with the industry’s requirements for savings in energy bills and costs.

For that reason, Marci shared AMD’s battle plan to race ahead of “Moore’s Law” mapping out its roadmap to interconnect dies with dies on a wafer level called heterogeneous computing architecture concept – a chiplet packaging technology.

Eric Beyne, VP R&D with imec, also shared his vision and insight on chiplet packaging technology. Particularly, he introduced a 3D integration technology – a technology enabler to realize heterogeneous system scaling.

“Electronics systems are getting more and more complex, coming built with tones of heterogeneous subsystems and devices. CMOS scaling technologies are becoming more specialized, too. So, it requires a variety of heterogeneous technologies to achieve such complex integration,” Beyne said.

Furthermore, Benye said, “In turn, this integration requires a functional partitioning of the system in separate dies (chiplets) that call for high bandwidth, low latency, and low energy 2.5D and 3D integration technologies.”

Among 450 exhibitors are Samsung Electronics, SK Hynix, Horiba, Tokyo Electron, JSR, Dongjin Chem, Dongbu HiTek, Advantest, Lam Research, KLA, and Merck.

SEMI Korea, the organizer of the SEMICON 2023, said about 60,000 industry professionals visited the three-day event.