ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Chip Materials Market Takes a Soar With HPC Surge

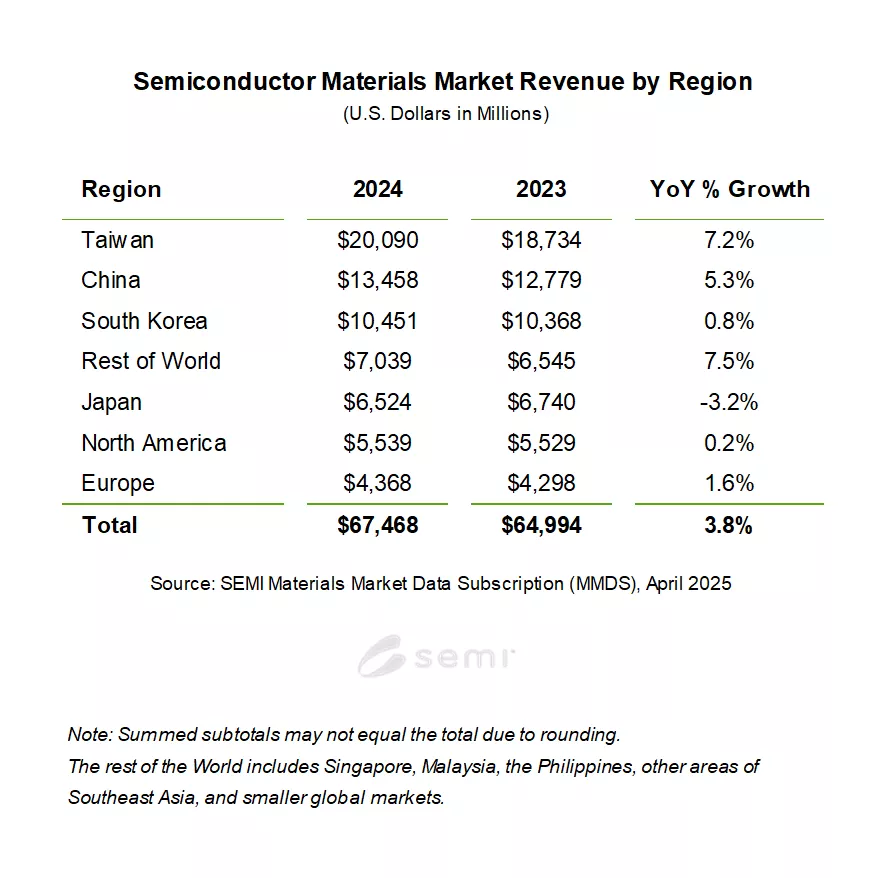

Global industry association SEMI said the semiconductor materials market revenue worldwide increased 3.8 percent to US$67.5 billion in 2024. SEMI, the global industry association representing the electronics design and manufacturing supply chain, detailed the said report in its Materials Market Data Subscription.

Accordingly, the recovery of the overall semiconductor market as well as the increasing demand for advanced materials for high-performance compute and high-bandwidth memory manufacturing supported 2024 materials revenue growth.

Wafer Fab Materials Growth

Wafer fabrication materials revenue increased 3.3 percent to US$42.9 billion in 2024, while packaging materials revenue grew 4.7 percent to US$24.6 billion last year.

Meanwhile, the chemical mechanical planarization (CMP), photoresist, and photoresist ancillaries segments experienced strong double-digit growth driven by increased complexity and number of processing steps required for advanced DRAM, 3D NAND flash and leading-edge logic integrated circuits (ICs).

All semiconductor materials segments, except for silicon and silicon-on-insulator (SOI), registered year-on-year increases. The demand for silicon, particularly in the trailing edge segment, remained weak in 2024 as the industry continued to work through excess inventory, resulting in a 7.1 percent decline in silicon revenue in 2024.

Furthermore, Taiwan led as the world’s largest consumer of semiconductor materials with US$20.1 billion in revenue. Most importantly, Taiwan has been taking this top spot for 15th consecutive year already.

On the other hand, China came next at US$13.5 billion in revenue. Specifically, it continued to register year-over-year growth, ranking second in 2024. Korea followed as the third largest consumer with $10.5 billion in revenue.

Meanwhile, all regions, except for Japan, posted single-digit increases in 2024.

SEMI’s annual MMDS includes quarterly updates for the materials segment and reports revenue for seven market regions (North America, Europe, Japan, Taiwan, South Korea, China and Rest of World). The report also features detailed historical data for silicon shipments and revenues for photoresist, photoresist ancillaries, process gases and lead frames.

29 April 2025