ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

SEMI: AI to Drive Chip Tool Sales to New Highs

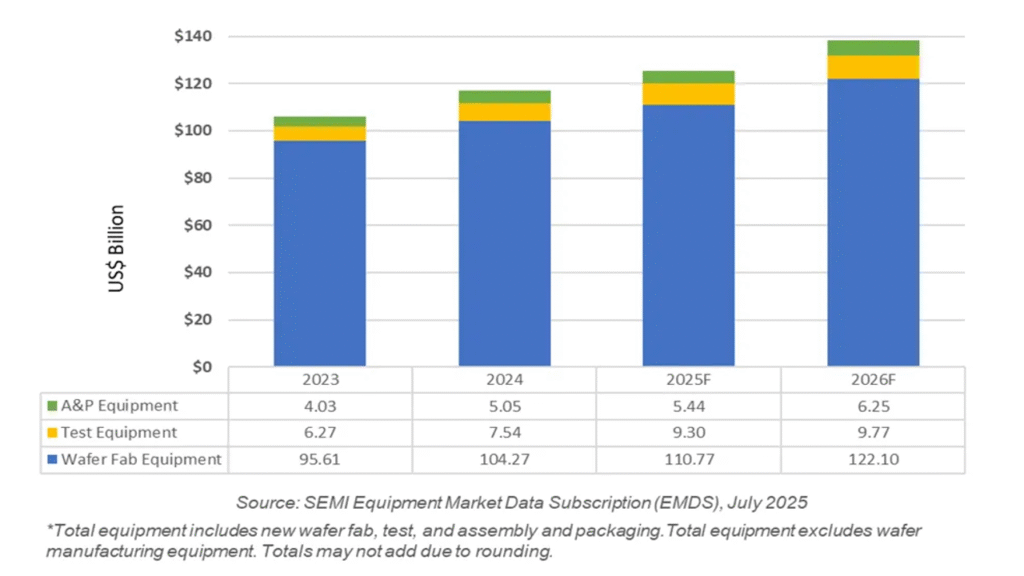

Electronics industry association SEMI said global sales of total semiconductor manufacturing equipment by original equipment manufacturers (OEMs) are forecast to set a new industry record of US$125.5 billion in 2025.

In its Mid-Year Total Semiconductor Equipment Forecast – OEM Perspective, SEMI said the forecast will represent a 7.4% year-on-year increase. Semiconductor manufacturing equipment growth is expected to continue in 2026, with sales projected to reach a new high of US$138.1 billion, driven by leading-edge logic, memory and technology transitions.

Ajit Manocha, SEMI president and CEO said the projected 2025 growth is a follow through of the strong 2024 growth of the global semiconductor manufacturing equipment sales. Moreover, it will set a new record in 2026.

“While the semiconductor industry is closely monitoring macroeconomic uncertainty, AI-fueled demand for chip innovations is driving investments in capacity expansions and leading-edge production,” said Manocha.

Semiconductor Equipment Sales by Segment

After registering a record US$104.3 billion sales in 2024, the Wafer Fab Equipment (WFE) segment, which includes wafer processing, fab facilities and mask/reticle equipment, is to increase 6.2% to US$110.8 billion in 2025. This upward revision from SEMI’s 2024 Year-End Equipment Forecast of US$107.6 billion is largely driven by increased sales to foundry and memory applications. Looking ahead to 2026, WFE segment sales are projected to expand 10.2%, reaching $122.1 billion.

It is important to note that capacity expansions in leading-edge logic and memory to support AI applications, along with ongoing process technology migrations in many segments, are driving the capacity expansions.

Meanwhile, SEMI said the back-end equipment segment is likely to continue its strong recovery that began in 2024. Following that year’s robust 20.3% year-on-year growth, sales of semiconductor test equipment are to rise another 23.2% in 2025 to a new record of US$9.3 billion.

Assembly and packaging equipment sales grew 25.4% in 2024 and are forecast to increase 7.7% to US$5.4 billion in 2025. Back-end equipment segment expansion is expected to continue in 2026, with test equipment sales rising 5.0% and assembly and packaging sales increasing 15.0%, marking three consecutive years of growth.

The expansion is driven by significant increases in the complexity of device architectures and the robust performance requirements for AI and high-bandwidth memory (HBM) semiconductors.

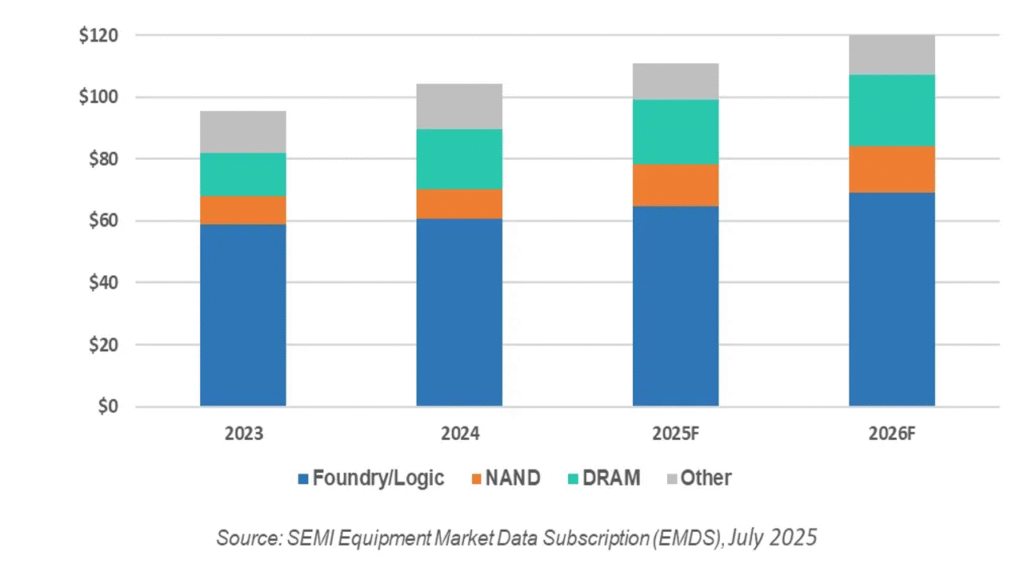

WFE Sales by Application

SEMI said WFE sales for foundry and logic applications are likely to show stable growth of 6.7% year-over-year to US$64.8 billion in 2025, growing further to US$69 billion in 2026.

Memory-related capital expenditures may see an increase in 2025 and in 2026. NAND equipment sales continue to recover from a 2023 sharp contraction. After registering a modest 4.1% increase in 2024, the NAND equipment market is likely to see 42.5% expansion to US$13.7 billion in 2025 and 9.7% to US$15.0 billion in 2026, driven by advancements in 3D NAND stacking and capacity expansion. Meanwhile, DRAM equipment sales, which surged 40.2% in 2024 to US$19.5 billion, are projected to grow at 6.4% and 12.1% in 2025 and 2026, respectively, supporting investments in HBM for AI deployment.

Semiconductor Equipment Sales by Region

Furthermore, SEMI said in its report China, Taiwan and Korea are expected to remain the top three destinations for equipment spending through 2026. China continues to lead all regions over the forecast period, though sales in the region are expected to decline from 2024 record investments of US$49.5 billion. All other regions except Europe are expected to see significant increases in equipment spending starting in 2025. However, heightened trade policy risks may impact the pace of growth across regions.

24 July 2025