ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Increased Investments Buoy Recovery of Japan's FA Industry

Although the trade tensions between the United States and China and the impact of the novel coronavirus (COVID-19) pandemic pose threats on capital investments in manufacturing, renewed investments in plants and equipment started to recover particularly China.

Factory automation (FA) equipment is also gaining ground. Recovery has become apparent from Q1 of Japan’s fiscal year ending March 2022. The industry, in general, expects to yield better business results.

According to the Japan Machine Tool Builders’ Association (JMTBA), orders for machine tools in January to June of 2021 dramatically increased with domestic demand reaching ¥211.409 billion (US$1.9 billion), increasing 33.4 percent on the year, and external demand reaching ¥490.713 billion (US$4.4 billion), an increase of 95.15 percent on the year.

The Japan Robot Association (JARA) said orders for April to June increased 56.5 percent year-on-year while production in value increased 32.7 percent. Both figures significantly increased from the same period of the previous year, renewing record highs for a single quarter.

The shipments statistics of electric control equipment of Nippon Electric Control Industries Association (NECA) said total shipments in April to June 2021 totaled ¥177.7 billion, increasing 21 percent year-on-year. Exports made to China drove the increase.

Supported by Demand Expansion

These data also reflected the strengths of the business results of FA equipment manufacturers from April to June 2021. In the quarter, Mitsubishi Electric Corporation’s Industrial Mechatronics Division reported sales of ¥356.5 billon (US$3.22 billion), an increase of 51 percent on the year, and operating profit of ¥35 billion (US$315.9 million). The FA system business increased on the back of the expansion of demand around the world, centering on investments in plants and equipment relating to semiconductors, electronic components, smartphones, and lithium-ion batteries.

Yaskawa Electric Corporation’s two pillars are motion controls and robots. At the end of the term ending Feb. 2021, Hiroshi Ogasawara, Representative Director and President, said, “China speedily recovered from the pandemic, and production activities of the manufacturing industry, including those products related to fifth-generation (5G) communications, have recovered. We see the same trend elsewhere in the world. We will turn to increases in income and profit in FY2022.”

For March to May 2021, Yaskawa Electric posted a year-on-year increase of 31 percent in sales, and 2.2-fold on profit quarter-on-quarter. In China, active investments in new infrastructures continued. In other parts of the world, demands for automobiles, semiconductors, and electronic components remained at high levels. These market conditions contributed to the company’s robust business results.

Fuji Electric Co., Ltd. posted a significant increase in net profit in April to June 2021, increasing 3.6-fold from the same period of the previous years. The demand mainly for low-volume inverters and FA components in the automation field expanded in Japan and overseas, contributing to the company’s business results. Junichi Arai, Director at Fuji Electric said, “We had good business results in Q1. The automation field grew significantly around the world.”

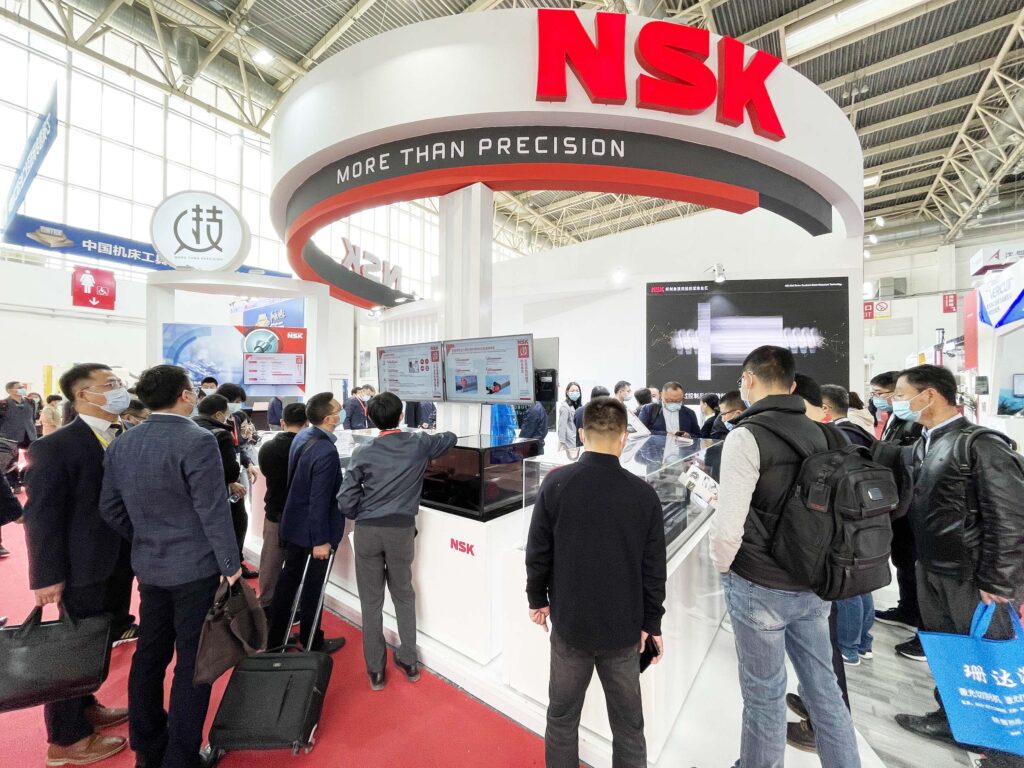

NSK Ltd. reported profit also during the same quarter, showing signs of recovery from previous fiscal year’s loses. The company’s industrial machinery business posted an increase in profit compared with the same period of the previous year, reflecting the recovery in capital investments around the world, mainly in the manufacturing industry, which saw the expansion of demand for semiconductors and improved profit environment.

Saimon Nogami, Senior Executive Vice President, NSK, said, “Sales and profits have been steadily increasing since Q2 of FY2020. Products for machine tools in China remained brisk, and automotive-related investments in plants and equipment are also recovering. Products for semiconductors have a strong showing on the back of the robust market.”

“The demand for products for electric appliances, such as home electric appliances and electrical power tools, has also been increasing. In FY2021, we expect increases in income and profit although there are concerns about the risk of increasing costs, such as rises in the prices of raw materials, and transportation costs, and the spread of coronavirus infections in the Asian region,” Nogami added.

FA Equipment Distributors Recover, Too

Performances of electronics trading companies of FA equipment have also been improving significantly. Ryoden Trading Co., Ltd. posted increases in income and profit in Q1. The recovery of FA systems, which account for about 20 percent of the company’s sales, contributed to the good performance. Although cases of capital investments by the Japanese domestic manufacturing industry, including automotive-related manufacturers, remain sluggish, investments in semiconductor manufacturing equipment and machine tools have been steadily increasing. Sales of FA systems increased 23.8 percent from a year ago, and operating profit increased 5.7-fold on the year. Nobuo Shogaki, President of Ryoden Trading Co., Ltd., says, “There were back orders in March, and sales in April and after increased steadily. FA has come back.”

KANADEN CORPORATION posted increases in income and profit. The rapid recovery of China’s economy and semiconductor and liquid crystal display markets drove the company’s FA systems business, and sales of controllers and drive devices steadily increased.

Nobuyuki Motohashi, President, KANADEN CORPORATION, said, “We aim to grab the demand for FA equipment, such as programmable logic controllers (PLCs) and servos, that will accompany the renewal of factories. The automation systems business by a joint venture in Thailand has got on a track, and we have been aiming to obtain collaborative projects, including Vietnam in the area. The company has been bolstering its FA business.”