ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Novel Trends Boost Further Next-Generation Materials

The technological development of electronic materials is gaining momentum. Meanwhile, electronic technologies enter an era of further sophistication, and the need for sustainability and decarbonization has also grown as well.

For that reason, the electronic materials industry realizes its crucial role in developing advanced materials using core technologies. Particularly, focusing on central applications, such as connected cars, autonomous driving, and shared and electric (CASE) and next-generation communications standards. Equally important are next-generation semiconductor processes and sustainable energy use.

Because of this, materials companies are also increasing their investments in production capacity expansion and mergers and acquisitions.

Materials Suppliers Supporting New Trends

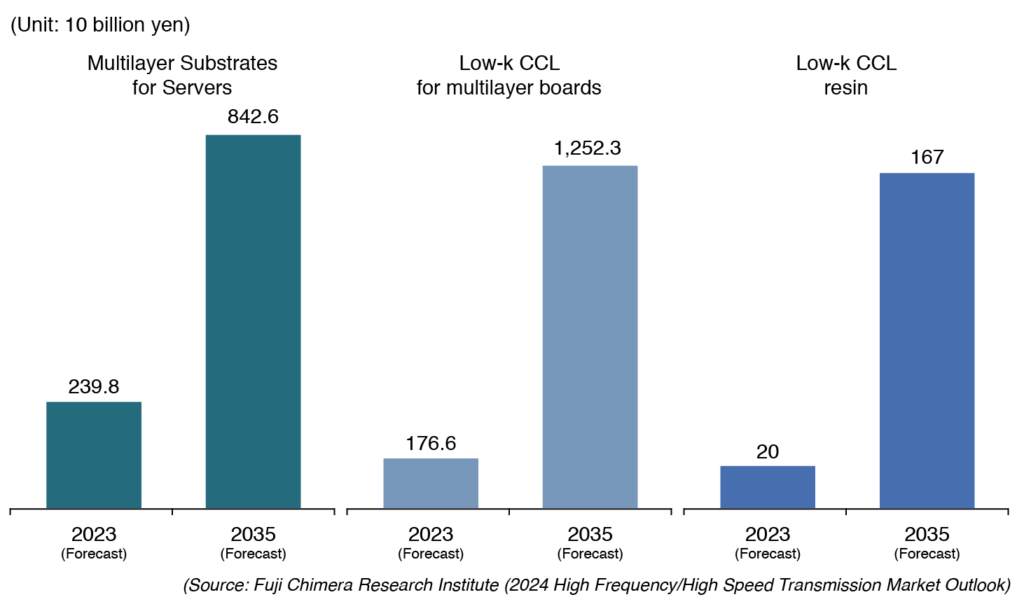

In the IT electronics and automotive markets, new trends are advancing as drivers. Among them, are the CASE megatrend, the high-speed and large-capacity transmission in communications, as well as miniaturization of semiconductors. There has also been an increase in demand for cloud data driven by artificial intelligence (AI) and carbon neutrality.

Thus, sophisticated and advanced materials are far more necessary now to support these trends. Electronic materials companies are setting their sights on these technological advancements and strengthening their technological development, marketing, and investment strategies from a medium- to long-term perspective.

Emerging Demand in Automotive

By application, the development of power electronics materials and battery materials for Battery Electric Vehicles (BEVs) and other electrically powered vehicles has been active. Moreover, resin material manufacturers are focusing on the development of new grades of polyphenylene sulfide (PPS), polybutylene terephthalate (PBT), and polyamide. Particularly, eyeing on higher voltages for EVs, among others.

In the ADAS/autonomous driving application, novel materials contribute to the improved performance of ADAS components and onboard sensors. Thus, resin materials with high dimensional accuracy, heat resistance, and high rigidity, among others, are emerging to improve the performance of ADAS components and in-vehicle sensors.

For high-performance mobile devices such as smartphones, tablets, and wearable devices, efforts will be focused on the development of materials with excellent high-frequency characteristics that support high-speed, large-capacity transmission at 5G/millimeter wave, high-performance materials that contribute to high-density mounting of devices, and next-generation display materials.

In the semiconductor area, the development of next-generation semiconductor process materials will remain active. The same is true with power semiconductors, where technological innovation is progressing. Thus, there is active development and production capacity expansion of SiC and GaN materials as next-generation semiconductor materials. These suffice the need for energy conservation and higher efficiency in the automotive and industrial equipment markets. In addition, the technological development of gallium oxide as a wide bandgap material with better cost performance than SiC and GaN is also underway.

Semiconductor-Related Processes

In the semiconductor lithography field, the company is developing process materials and expanding its supply system for ArF and EUV lithography.

Meanwhile, the miniaturization of circuit patterns on semiconductor chips will continue to advance due to faster processing speeds and higher integration of semiconductors. For that reason, semiconductor process material manufacturers will continue to aim to expand their market share by developing materials that meet next-generation needs. At the same time, demand for older process materials, such as those for i-line, is also on the rise due to the recent expansion of the semiconductor market base.

In the area of decarbonization, there has been a bigger focus on developing materials for next-generation solar cells, storage batteries, and all-solid-state batteries.

Recently, electronic materials saw a favorable outlook in the first half of 2022 due to the solid expansion of the electronic components and semiconductor markets. However, demand stagnated in the second half due to a decline in demand for electronic components. Particularly, caused by sluggish demand for IT equipment and a slowdown in the semiconductor market.

In 2023, conditions remained harsh throughout the year due to deteriorating semiconductor market conditions. Thus, a further decline in ICT-related demand and stagnant capital investment demand. Despite this, demand from the automotive industry remained relatively firm.

Expectations for Increased Demand

In 2024, the electronic materials market is likely to see continued growth in automotive-related demand. Moreover, the consumer- and industrial equipment-related demand will likely experience gradual recovery as well. Specifically, demand for electronic materials will feel a boost from the progress of digitization and electrification of automobiles. In addition, the increase in demand related to 5G and expanding investments in the environment and new energy will also serve as tailwinds.

There has been huge progress as well in efforts to improve productivity through digital innovation using AI, among others. Thus, a growing number of companies are introducing material informatics (MI) to improve efficiency and speed up R&D.