ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Korean Makers Make Up About 30% of Apple iPhone 13 Series BOM Costs

Apple iPhone 13 series made a stunning debut with the sales goal of 106 million units. Once the goal is to be achieved, the biggest beneficiaries of the blockbuster sales will likely be Korean parts and components makers.

It was learned that Korean parts and components makers collectively represented about 30% of the total BOM or bill of materials costs for the iPhone 13 series, -the biggest portion.

Cases in point are Samsung Display and LG Display, which will supply 77 million units of premium OLEDs for flagship high-end models of iPhone 13 series – Pro and Pro Max – and 29 million units of OLED screens for iPhone 13 and 13 Mini, respectively, outbidding Chinese maker BOE that supplied display panels for refurbished models of iPhone 12 series.

These figures represent 77% and 23% of the Apple’ target shipments of iPhones 13 series, respectively.

Samsung and LG appealed to Apple for its LTPO low temperature polycrystalline oxide TFTs and in-cell touch systems technologies- the two key building block technologies that constitute its OLED panels.

LTPO TFT technology is a sort of what’s called as TFF backplane – a matrix of thin film transistors in rows and columns deposited on a glass substrate to power pixels -the most basic picture elements.

Only Two Makers for LTPS OLEDs

Unlike amorphous silicon or LTPS or low temperature poly-silicon TFTs, the LTPS is far faster in electron mobility, guaranteeing faster response time, wide aperture ratio and wider viewing angle.

The in-cell touch system is an integrated touch panel system into OLED panel that embed touch sensor film and other components into the panel itself.

The two companies are the only twos in the world that can produce LTPO backplane OLED panels.

Korean parts and components makers’ prevalence doesn’t stop there. LG Innotek was entitled to supply camera modules for the new iPhone 13 series. As Apple’s largest camera module supplier, LG Innotek appealed to Apple for its sensor shift technology that can minimize hand trembling effects.

When it comes to memory chips, Samsung Electronics and SK Hynix are known to collectively supply 80% of the production of iPhones 13 series in terms of value. The remaining 20% are to be supplied by Micron of the U.S.

Secondary batteries are also where Korean makers prevail, as Samsung SDI and LG Energy Solution are known to collectively supply 40%. The remaining 60% will be supplied by ATL of China.

Samsung Electro-Mechanics is chosen as a supplier of MLCCs, or multi-layer ceramic capacitors. BH and Young Poong Electronics of Korea will supply RFPCB, or rigid flexible PCBs for Apple’s iPhones13 series ITM Semiconductor is to supply BMS, or battery management system.

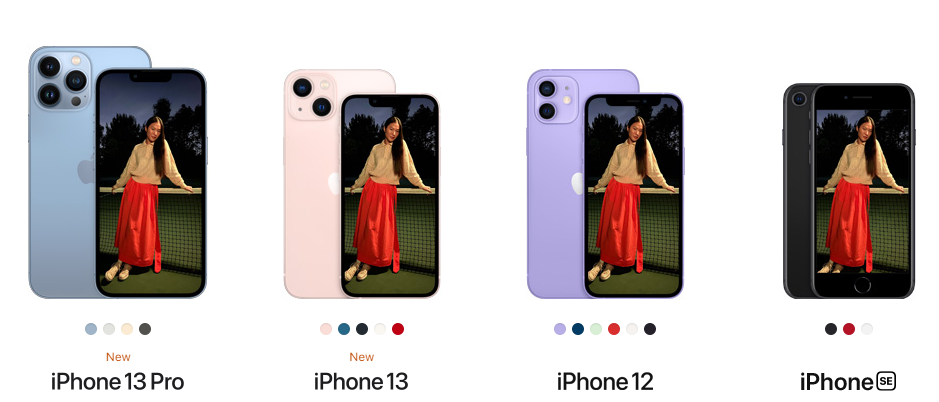

Apple iPhone 13 series come in 4 models -iPhone 13, iPhone 13 mini, and its flagship premium model iPhone 13 Pro and iPhone 13 Pro Max.

Korean parts and components makers represent about 27.3% of the BOM costs for predecessor iPhone 12 series