ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Car Megatrends Spur Creation of Cutting-Edge Components

At present, the automotive market is undergoing transformation that only happens once in a century. Changes in technological and market trends are represented mainly by connected, autonomous, shared & services, and electric (CASE) and mobility as a service (MaaS). Against this backdrop, the importance of information technology and electronic technologies has never been more important.

Electronic component manufacturers recognize technological innovations of vehicles, including advanced driver-assistance systems (ADAS), autonomous driving, and shift to electric vehicles (EVs) as business opportunities; and target high growth of their automotive electronic components business in the future by promoting advanced engineering.

Market Situation

The automotive market is one of the most important fields that drive the growth of the electronic components industry in the medium to long term. In the late 2010s, the annual global auto production combining passenger cars and commercial vehicles grew to over 90 million units.

In 2020, the novel coronavirus (COVID-19) pandemic significantly affected the automotive market. Around spring, it was anticipated that global auto sales in 2020 would drop to about 70 million units. However, the Chinese market recovered quickly around May, and the U.S. market also shifted to recovery around July. Beginning autumn, the global automotive market continued to recover at a faster pace surpassing the initial projection. As a result, the global auto sales in 2020 are estimated to have reached 76 to 78 million units.

Global auto production and sales in January to March 2021 increased steadily. Although the global semiconductor shortage is partly affecting the production of automobiles, steady growth is expected for the entire 2021. While it was pointed out that it will take several years for the new auto sales to fully recover to the level of 2018, they are expected to return to the growth track in 2021 with the end of the pandemic in sight.

In the first half of 2020, various countries implemented lockdown to fight the COVID-19 pandemic, and the production of automobiles dropped dramatically at one time. Nonetheless, even during this period, automakers continued developing next-generation vehicles. This year, new model vehicles with higher performance are expected to be announced one after another.

CASE Trend as Components Driver

The four megatrends in the CASE trend will drive mobility renovation in the future. They are expected to trigger major changes in car electronics technologies and pushes up the market in the medium to long term.

Electronic component manufacturers have been deploying technology and marketing strategies in order to respond to these changes. In particular, under autonomous trend, the technological development toward achieving autonomous driving vehicles/complete autonomous driving vehicles has been gathering steam around the world. In March, Honda Motor Co., Ltd. announced the first car equipment with Level 3 autonomous driving system on production. In the future, various manufacturers are expected to release Level 3 autonomous driving vehicles. In order to meet these moves, electronic component manufacturers have been accelerating the development of high-performance sensors and communications devices, and automotive high-speed transmission components. In line with technological innovations in the automotive industry, the creation of legal systems setting sights on full-fledged autonomous driving is being put in place.

In terms of connected trend, the development of electronic components and modules that support high-speed transmission and improve communication quality has been active.

In terms of electric trends, the development of high-current, high-withstand-voltage components and next-generation power semiconductor-related components for environment-friendly vehicles, such as electric vehicles (EVs), has been advancing.

In terms of shared & services, the construction of new business models targeting the MaaS-related market has begun.

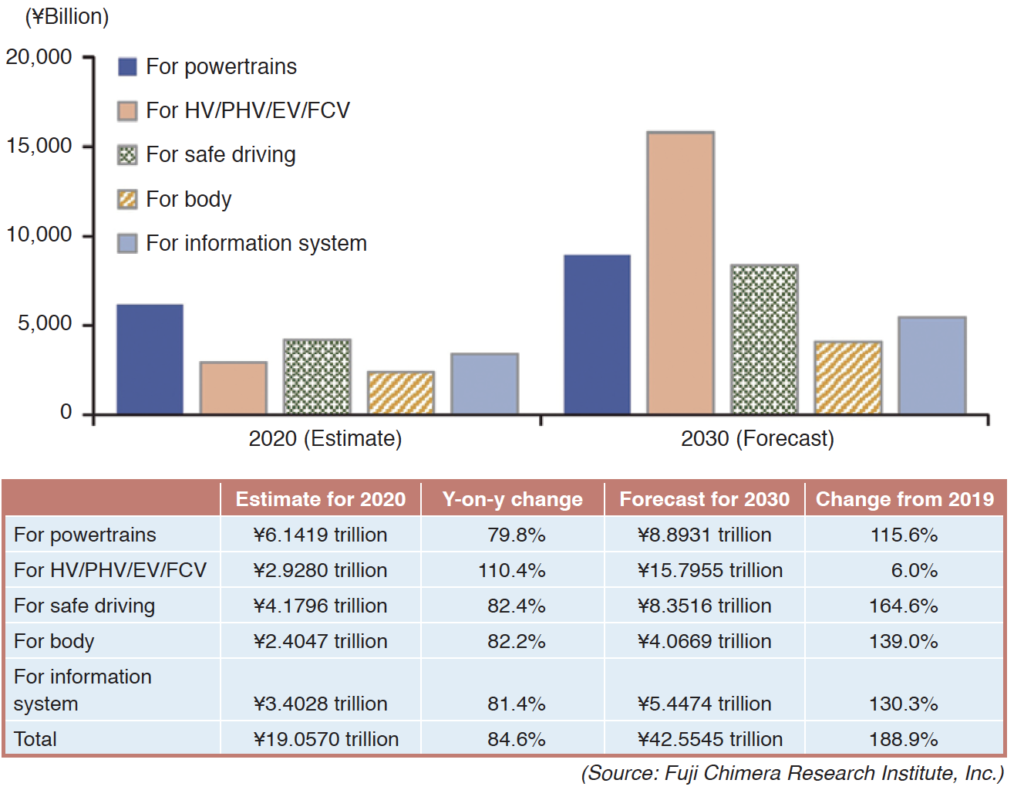

The automotive electronic components market has continued to grow every year surpassing the growth of automotive production. This happens on the back of the increasing functionality of vehicles and the progress in the shift to EVs and hybrid electric vehicles (HEVs).

In particular, sensors, communications devices, and imaging devices, which are key devices for ADAS and autonomous driving, and power devices for EVs and plug-in hybrid vehicles (PHVs), have been growing strongly in tandem with technological advancement of vehicles. Furthermore, in the mid-2020s, demand for fifth-generation (5G) communications for automotive functions will take off on full scale.

Step up Support System

Electronic component manufacturers have been putting strengths into ramping up production and supply and technical support systems in order to meet the increasing demand of the automotive industry for local production and local consumption. Manufacturers aim to improve customer satisfaction and speed up their business processes by constructing systems for supply and technical support near customers. They mainly target major Japanese, U.S. and European automakers and tier one suppliers.

At the same time, they also place importance on the reconstruction of supply chains and global production bases taking into consideration the risks that accompany prolonged U.S.-China trade tension and the COVID-19 pandemic.

Manufacturers make active investments to increase production meeting the anticipated growth in demand, and at the same time, aim to increase profitability by improving production efficiency and maximizing production facilities.