ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

New Demand Fields Raise Growth Prospects of PCBs

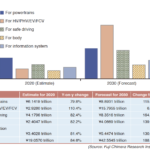

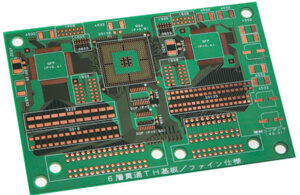

The demand for printed circuit boards (PCBs) has been recovering. While companies that have been manufacturing PCBs for automobiles and smartphones are experiencing significant business decline, manufacturers that are producing PCBs for data centers, servers and IC packages are experiencing strong business performance.

This bipolarization has emerged in the demand for PCBs. Nonetheless, economic activities slowed down by novel coronavirus (COVID-19) pandemic have restarted, and the overall demand for PCBs, including those for automotive electronics, has been picking up month by month since around the summer of 2020.

Sales of personal computers and tablets have been increasing to meet growing demands amid work-from-home and distance learning setups. Also, the production of smartphones has increased as manufacturers have been introducing new models compliant with the fifth-generation (5G) standard one after another. Furthermore, sales of automobiles, the recovery of which was delayed, have also started to pick up, with the popularity of electrified vehicles (xEVs) reflecting the environmental protection and energy saving trends.

Strengthen Capital Investments

For Q2 of Japan’s fiscal year ending March 2021 (Apr. to Sep. 2020), Meiko Electronics Co., Ltd. posted sales of ¥53.2 billion (US$512.90 million), a 10 percent decrease over the same period of the previous year. Orders have been gradually recovering, however. Global auto production has recovered and customers of PCBs for automotive electronics have become visible again after lying low. Deals with new customers for PCBs for smartphones and those for internet of things (IoT) and artificial intelligence (AI) applications are also beginning to start. Sales of PCBs for consumer equipment have remained brisk.

For this reason, Meiko Electronic continues to concentrate capital investments and effort to strengthen production system towards the leading-edge field of automotive electronics and smartphones, as well as 5G and module field. The company expects sales of ¥62.8 billion (US$605.32 million) for the second half of FY2020, an increase of 11.3 percent year-on-year.

Look to Automotive Fields, Too

CMK Corporation saw orders for PCBs gradually recovering after bottoming out in May 2020, with orders received in September 2020 reaching January and February 2020 levels. Sales of PCBs for the automotive electronics field, which are the company’s main products, have been recovering, mainly in China. Sales of PCBs for powertrains and safety travelling system, which are the company’s focus fields, have been recovering strongly. The company expects increase in sales in the second half compared to the first half of the year.

With automobiles, CMK considers connected, autonomous, shared & services, and electric (CASE) era has started to gather steam already. Meeting technological needs for the advancement of the merger of automotive electronics and communications in accordance with the spread of 5G, the company intends to enter the 5G-related market as well.

Setting its sight on the medium to long-term growth, CMK also invests in R&D and equipment. Targeting the establishment of element technologies responding to the proliferation of 5G, the company plans to invest about ¥2 billion (US$19.28 million) mainly in its Niigata Plant, as a first phase investment. The company will concentrate its R&D function to the Niigata Plant to bolster its development capabilities.

Sustain Growth Momentum

Nippon Mektron, Ltd. saw sales of PCBs for specific high-functional smartphones decline caused by the delay in mass production of new products, and those for automobiles decline as well with the decrease in auto production. The company expects sales in the entire fiscal year to decline more than 10 percent compared with the previous year. As the company highly depends on the demand for specific smartphones, it will push forward sales expansion of PCBs for new applications, including automobiles, from now on. At the same time, the company will build a structure resistant to fluctuations.

Manufacturers that incorporate demand related to semiconductor packages, data centers and servers have been increasing sales even amid the expansion of COVID-19 pandemic.

IBIDEN CO., LTD. saw steady demand for package substrates for personal computers reflecting rapid spread of teleworking around the globe. Although sales of motherboards and PCBs for high-end smartphones have decreased, sales of module boards remained strong. In the first half of the year, sales of the electronics business increased 18 percent from the same period of the previous year to ¥74.095 billion (US$714 million). In addition to the increase in sales of personal computers, data centers are viewed to maintain growth surpassing 20 percent as digitization and the use of cloud computing system continue, mainly in corporate activities. IBIDEN expects sales of the electronic business in the entire fiscal year to increase 24.8 percent from the previous year to ¥165 billion (US$1.59 billion).

Shinko Electric Industries Co., Ltd. saw sales of flip chip-type packages for data center servers and personal computers grow significantly. Revenue generated by plastic ball grid array (BGA) substrates increased as a result of the operation of a new line for advanced memories.

For the entire fiscal year, the company expects that strong orders for flip chip-type packages for servers and personal computers will prevail as work-from-home and online learning setups continue and as 5G-compliant products gather steam.

In addition, the production line of flip chip-type packages to which the company has made large-scale investments commenced mass production in Oct. 2020, and the production scale will expand in stages in the coming years. With the operation of the new line for advanced memories, sales of plastic BGA substrates are expected to expand, surpassing initially anticipated figure in terms of revenue. For this reason, the company has revised upward target sales for the entire fiscal year from ¥171.1 billion (US$1.65 billion) to ¥177.3 billion (US$1.71 billion).