ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Philippine Electronics to Soar Grit Amid Trying Times

Recent geopolitical tensions have changed global economic landscapes, prompting companies to expand and collaborate beyond their traditional borders. For that reason, Southeast Asia has not only emerged as a viable alternative, but its semiconductor industry has also scored remarkable growth.

The Philippines is one of the countries in the region that has continuously expanded its role in the ecosystem of chip manufacturing. However, global and domestic challenges have caused setbacks to its output for two consecutive years. In an interview with Asia Electronics Industry (AEI), Semiconductors & Electronics Industries in the Philippines, Foundation Inc. (SEIPI) President Dan Lachica said the industry expects flat export growth for 2025, revising the 5 percent growth it forecasted in 2024.

“SEIPI anticipates flat export growth for 2025 due to a slump in demand and a tough business environment. This forecast is a revision from our initial expectation of 5% growth, which we adjusted due to weak external demand,” Lachica said.

“Despite these challenges, we remain committed to promoting investments and exploring strategies for seizing new opportunities,” he added.

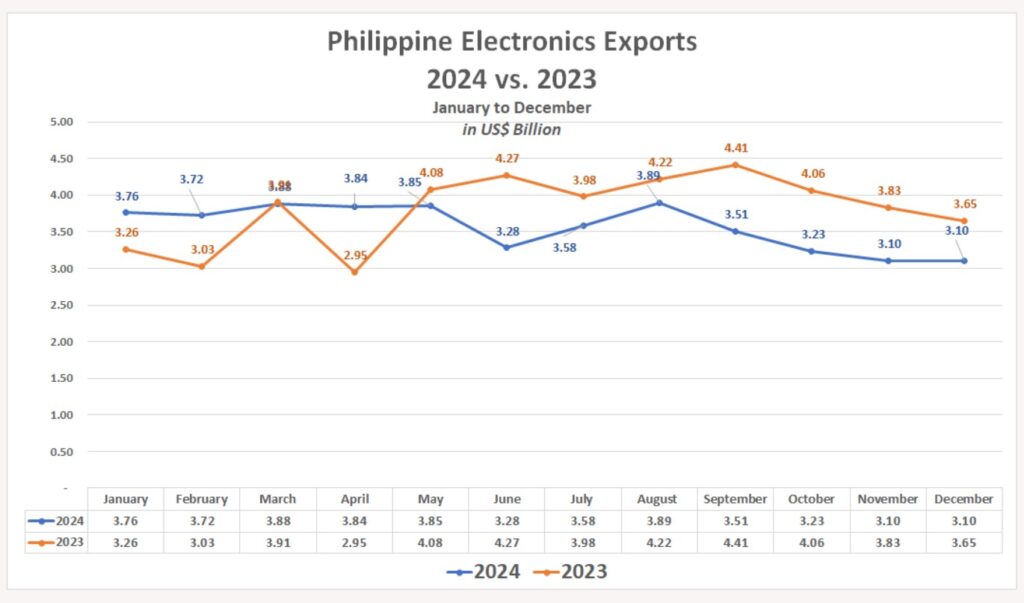

Two-Year Exports Downtrend

The country’s electronics exports declined 6.37 percent from US$45.65 billion in 2023 to US$42.74 billion in 2024. This is the second consecutive year the country’s electronics exports suffered a year-on-year downtrend as 2023 results shrunk 8.08 percent to US$45.64 billion from 2022’s US$49.66 billion.

“The business environment of the Philippine electronics industry in 2024 was marked by a mix of challenges and opportunities. On one hand, the semiconductor and electronics export sector showed signs of modest recovery after a challenging 2023,” said Lachica.

Nonetheless, electronics remains the country’s biggest export chunk at 58.38 percent of the US$73.21 billion total exports in 2024.

Exports from three sectors went down from 2023 data. Specifically, Semiconductor Components/Devices fell 13.47 percent from US$33.70 billion to uS$29.16 billion in 2024. Moreover, the Communication/Radar sector and Office Equipment fell 8.55 percent and 2.02 percent respectively.

Meanwhile, Automotive Electronics increased by 85.83%, from US$ 41.49 million to US$ 76.69 million. It was followed by Consumer Electronics (42.35%), Medical Industrial Instrumentation (28.67%), Electronic Data Processing (24.36%), Telecommunication (14.94%), and Control and Instrumentation (7.21%).

The top five destination countries of the Philippines’ electronics exports include the United States (16.49 percent); Hong Kong (15.56 percent); China (10.36 percent); Singapore (7.86 percent); and Japan (6.55 percent).

Addressing Industry Challenges

On top of the industry concern is the Corporate Recovery and Tax Incentives for Enterprises Act (CREATE) enacted during the previous administration. Lachica said the CREATE rationalization of incentives without commensurate mitigation of high operating may have caused capital flight. To address this, Lachica said SEIPI engaged with government agencies to advocate for improvements in CREATE MORE and its implementing rules and regulations (IRR).

“Additionally, SEIPI intensified its advocacy for infrastructure improvements, energy cost reductions, and regulatory streamlining to help attract investments and spur growth. These efforts were complemented by initiatives like industry briefings, networking events, and public-private dialogues to address pressing issues while promoting the Philippines as a global hub for semiconductor and electronics manufacturing.”

Aside from incentive rationalization, Lachica also said the continuing geopolitical uncertainties, such as the ongoing U.S.-China trade tensions and the situation in Taiwan have posed risks in the supply of semiconductor wafers. At the same time, he also cited the country’s lack of FTA with the US leading to restricted access to federal contracts.

“However, with proactive measures and government support from the government, SEIPI is optimistic about addressing these challenges and avoiding another contraction in 2025.” In addition, Lachica said the government’s investment promotion agencies have been actively seeking to attract more companies in the electronics manufacturing services.

Moreover, Lachica said the industry continues to rely on the strength of the U.S-Philippine trade relations under the new administration of President Donald Trump. The Philippines is one of the probable countries earlier identified by the U.S. government as recipients of its CHIPS Act incentives, specifically through the International Technology Security and Innovation (ITSI) Fund.

Emerging Trends

Meanwhile, Lachica said SEIPI is optimistic megatrends such as artificial intelligence (AI), 5G, and electric vehicles (EVs) will improve global demand for semiconductors and electronics. Thus, will benefit the ecosystem in the Philippines.

“Looking ahead to 2025, we anticipate that the adoption of advanced technologies such as AI, IoT, and 5G connectivity will continue to reshape the consumer electronics landscape, enhancing product functionality and personalized experiences,” said Lachica.

“Furthermore, government initiatives promoting digital transformation and infrastructure development are expected to boost demand for premium and high-quality consumer electronics,” he added.

21 March 2025