ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Robust Capital Investments Pull up FA, T&M Markets

The aggressive roll out of COVID-19 vaccines in 2021 has brought normalization to global economic disruption. Successively, manufacturers in China and other parts of Asia, the United States and countries in Europe resumed normal operations. Japanese manufacturers followed suit. These affected positively the revenue performance of manufacturing equipment companies.

Business Recovery

Factory automation (FA) equipment makers reported V-shaped recovery in their latest business results. These reflect active investments in plants and equipment in the manufacturing industry. Most companies posted new record profits, while others revised upward forecasts of their business results for the entire fiscal year.

Yaskawa Electric Corporation made a V-shaped recovery, and exhibited good business performance with double the profit in the first half (February to August) of FY2021.

Giving his assessment of the market, Hiroshi Ogasawara, Representative Director and President of Yaskawa Electric, explains, “Manufacturers across the board made active investments in plants and equipment targeting advancement and automation of production. In China, investments in new infrastructure, including fifth-generation (5G) communications and new energy continued. Capital investments in these areas will continue in the second half of the year.”

Shortages of Components Escalate

“Investments in plants and equipment by manufacturers have increased rapidly, and orders have been increasing at fast pace to new record high. However, the production of FA equipment cannot catch up with orders due to shortages of semiconductors, electronic components, and other components,” notes Tomoaki Kotani, Group Vice President, Industrial Products Marketing Division, Factory Automation Systems Group, Mitsubishi Electric Corporation.

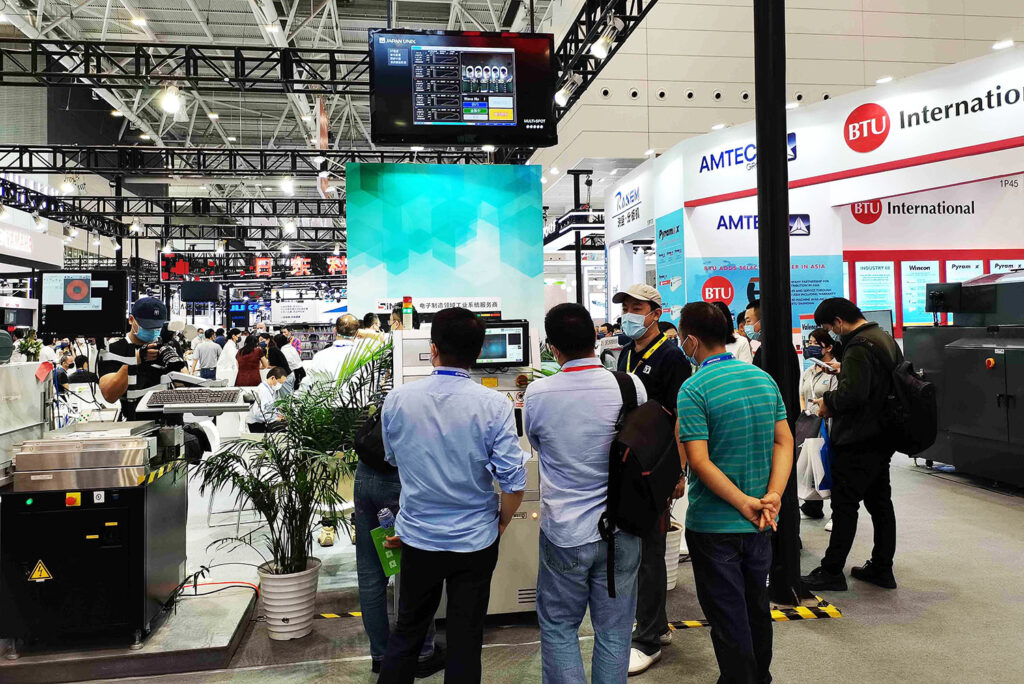

FUJI Corporation also saw its business performance recover in an instant. Shinsuke Suhara, President & Chief Operating Officer, says, “In China, there is an increase in demand for equipment for the manufacture of electronic components and semiconductors. Meanwhile, equipment for automobiles and industrial equipment in the United States and countries in Europe recovered and demand steadily increased. (FUJI’s) profit in Q2 of the fiscal year ending March 2022 rewrote record high. In another front, production could not meet market demand because of shortages of semiconductors, components, and metal products.”

In 2021, the demand for electronic products has been influenced by changes in the new era. These fields include electric vehicles (EVs), 5G, internet of things (IoT), carbon neutrality, digital transformation (DX), e-commerce, new work styles, and automation of production. These led to business recovery of equipment manufacturers. However, these changes caused shortages of various components, such as semiconductors, electronic components, steel, and resin. Supply-demand balance has been disrupted and prices of components skyrocketed.

Manufacturers are unable to produce products because of components shortages and continue to have a large volume of unfilled orders.

Measurement Trends

In the measurement industry in 2021, efforts toward achieving advanced driver-assistance systems (ADAS) and autonomous driving attracted attention.

Anritsu Corporation delivered a simulator that simulates 5G base stations to Toyota Motor Corporation for use in its test environment. It is the first attempt to use 5G as radio frequency (RF) test system for over the air (OTA), a communication test in wireless environment.

Anritsu’s MT8000A tester evaluates communications protocols and RF performance. Thus far, it has been widely used in tests for smartphones and other mobile terminals. Now it is expanding its domain to OTA test of automobiles.

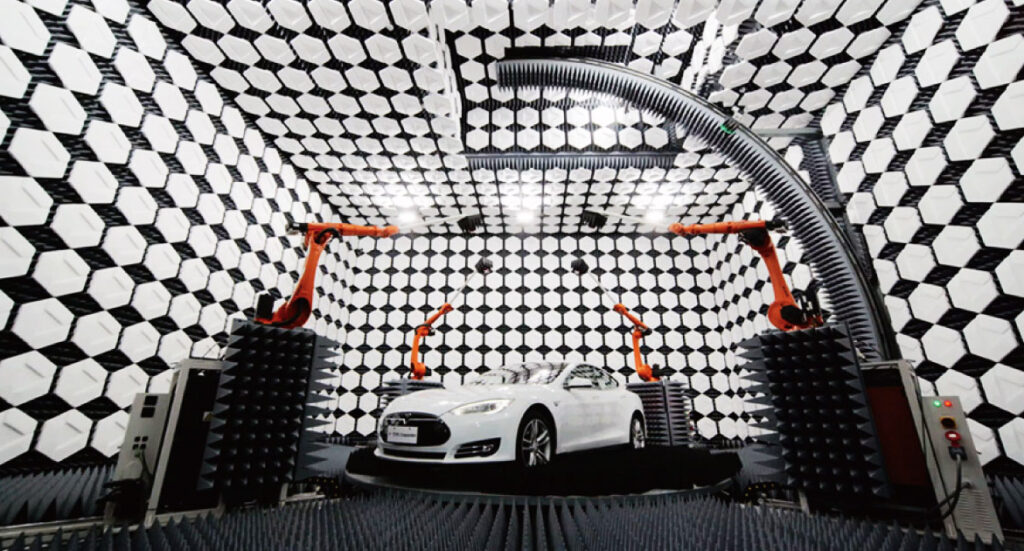

Measuring instruments from Anritsu and Keysight Technologies, Inc. have been adopted in automotive OTA test system of China Intelligent and Connected Vehicles (Beijing) Research Institute Co., Ltd. (CICV), a state research institute.

Toyo Corporation has also received an order from CICV for a test system that tests full vehicle in an anechoic chamber to evaluate performance of onboard communication devices. The company will deliver the test system in June 2022. It tests communication sensitivity and speed of vehicle-to-everything (V2X) wireless communications technology that connects between vehicles (V2V) and vehicle-to-infrastructure.

In Japan, Level 3 self-driving cars, which enable autonomous driving on expressways during congestion, are in practical use. The Japanese government aims to put Level-4 private cars to practical use by 2025. With such development, the importance of performing OTA test using full vehicles will further increase in the coming years.

Aside from wireless communications, manufacturers actively introduced measurement solutions for the development of next-generation vehicles in 2021.

HIOKI E.E. CORPORATION started in December shipment of the PW8001 power analyzer, which features enhanced measurement accuracy. This is in response to development needs to measure a broad frequency range with high accuracy

With EVs, the development of dual inverters with independent drive systems for the front and rear wheels advances. PW8001 has met the needs to simultaneously measure multiple systems, measuring power of eight channels with a single unit. Noncontact sensors for obtaining controller area network (CAN) on-board network’s data are also globally supported.

Proposals of measurement solutions have also been strengthened in conjunction with the global movement toward achieving zero carbon.