ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Smart Manufacturing Spending to Top US$950B in 2030

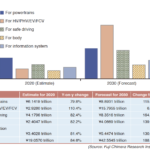

ABI Research said spending on smart manufacturing will grow from US$345 billion in 2021 to more than US$950 billion in 2030 as manufacturers advance their digital transformation initiatives. This market refers to factories that adopt Industry 4.0 solutions, like autonomous mobile robots, asset tracking, simulation, and digital twins.

“While most of the revenue today is attributed to hardware, a greater reliance on analytics, collaborative industrial software, and wireless connectivity (Wi-Fi 6, 4G, 5G) will drive spending on value-added services, namely connectivity, data management, and enabling platforms, to more than double over the forecast,” explains Ryan Martin, Industrial & Manufacturing Research Director at ABI Research.

Top Spender

The top producing manufacturing regions are China, the United States, Japan, and Germany (in that order). The transportation industry, more specifically automotive manufacturing, is the top industry in terms of revenue in all regions except China. Meanwhile, in China, automotive lands second and electronics manufacturing is first.

These regions are also the early adopters of advanced manufacturing technology and are the most developed manufacturing economies globally. In terms of automation, the automotive industry leads, having automated close to 50 percent of operations.

Innovation Leaders

“Manufacturers and their technology partners are acutely focused on supporting the shift to digital threads. This is aimed for better data management and enrichment throughout the manufacturing lifecycle,” says Martin. “A common data backbone allows manufacturers to operate more efficiently across teams and departments. There are a range of suppliers helping manufacturers with their digital threads.”

Siemens, PTC, and Hitachi Vantara are some of the leaders in terms of overall innovation and ability to execute. Other important players focus on core aspects of the manufacturing data lifecycle. They include modeling and simulation (Autodesk, Ansys, Dassault Systèmes, MSC Software); connectivity (Nokia, Ericsson); quality (Hexagon, Instrumental, Cognex, Keyence); and industrial automation (Rockwell, Emerson, ABB).

“Increasingly, there are more data sources (including spatial data) that can be layered and compared in real time for more contextual and predictive operations. The most advanced manufacturers are starting to think along these lines while the majority have started their digital transformation journey but have yet to fully scale,” Martin concludes.

These findings are from ABI Research’s Digital Factory Data market data report.