ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

New Robot Installations in 2023 Sustain Momentum

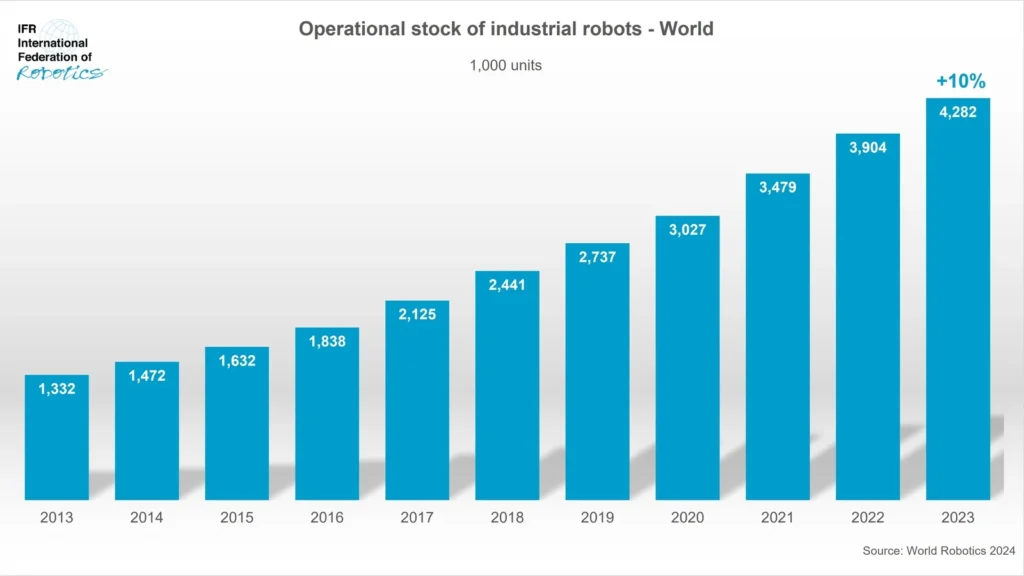

The International Federation of Robotics (IFR) has released the World Robotics 2024 Report. Specifically, the report recorded 4,281,585 units operating in factories worldwide – an increase of 10%. Meanwhile, annual installations exceeded half a million units for the third consecutive year. By region, 70% of all newly deployed robots in 2023 were installed in Asia, 17% in Europe and 10% in the Americas.

“The new World Robotics statistics show an all-time high in the number of industrial robots automating production around the world,” says Marina Bill, President of the International Federation of Robotics. “The annual installation figure of 541,302 units in 2023 is the second highest in history. It is only 2% lower than the record of 552,946 units installed in 2022.”

Asia, Europe and the Americas – Overview

China as largest robot market

By far, China is the world’s largest market. The 276,288 industrial robots installed in 2023 represent 51% of the global installations. Specifically, this result is the second-highest level ever recorded (2022: 290,144 units). The share of Chinese manufacturers in the domestic market has grown considerably since 2022, reaching 47% in 2023. It has fluctuated around 28% over the past decade.

Also, the operational stock was just shy of the 1.8-million-unit-mark in 2023. This makes China the first and only country in the world with such a large robot stock. Demand for robots is expected to accelerate in the second half of 2024, contributing to a more stable market by the end of the year. In the longer term, there is still a lot of growth potential in Chinese manufacturing, with the potential for 5-10% average annual growth until 2027.

Meanwhile, Japan remained the second largest global market for industrial robots, behind China. Robot installations reached 46,106 units in 2023 – down 9%. This followed two strong years, peaking at 50,435 units in 2022 – the second-best result after 2018 (55,240 units). Mainly, demand for robots is expected to remain stagnant in 2024 but to recover in 2025 and the following years to medium and upper single-digit rates.

The market in the Republic of Korea is trending sideways: Installations reached 31,444 units in 2023 – down 1% year-on-year. The country was the fourth largest robot market in the world in terms of annual installations, after the United States, Japan, and China.

India is one of the fastest growing emerging Asian economies. Robot installations increased by 59% to 8,510 units in 2023, a new high. Demand from the automotive industry soared to 3,551 units – an increase of 139%. Both car manufacturers and suppliers contributed to this development.

Favorable trends in Europe

Meanwhile, industrial robot installations in Europe rose 9% to a new high of 92,393 units. In total, 80% of installations in 2023 could be attributed to destinations in the European Union (73,534 units, up by 2%). Delayed projects were completed, and the backlog was cleared in 2023. Also, robot demand in the region benefited from the nearshoring trend. In 2023, growth was strongly driven by the automotive industry investing in traditionally strong car manufacturing countries such as Spain (5,053 units +31%), but also in smaller markets such as Slovakia (2,174 units, +48%) or Hungary (1,657 units, +31%).

Installations in Germany, the largest European market and the only European one in the global top five, were up 7% to 28,355 units. Installations in the second largest European market, Italy, declined by 9% to 10,412 units. The third largest European market, France, was down 13%, installing 6,386 units.

In the U.K., industrial robot installations increased by 51% to 3,830 units in 2023. Investment was driven by installations in the automotive industry, mainly for assembly tasks.

Automotive-driven demand in The Americas

Mainly, robot installations in the Americas exceeded 50,000 units for the third year in a row: 55,389 units were installed in 2023, just 1% below the record level reached 2022.

The United States, the largest regional market, accounted for 68% of installations in the Americas in 2023. Robot installations were down by 5% to 37,587, this is the third highest record figure after 2022 and 2018. Demand from the automotive industry fell by 15% to 12,421 units. This was in line with the average for the past decade. Installations in the metal and machinery industry were up 8% to 4,171 units. Installations in the US electrical/electronics industry remained steady at 3,900 units (+1%).

Meanwhile, in Canada, robot installations rose 37% to 4,311 units. Installation figures in Canada largely depend on automotive investment cycles. The share of the car industry was 58% in 2023.

Robot demand in Mexico is driven by the automotive industry, which accounts for 70% of the market: Installations from this sector fell by 5% to 4,087 units, showing the cyclical demand pattern well known in this customer segment. Total installations reached 5,832 units in 2023, a decrease of 3%.

Economic and Industry Outlook

Generally, the OECD expects global growth to stabilize. However, geopolitical headwinds are still perceived as a major risk and uncertainty factor. Also, recent crises have raised political awareness of domestic production capacity in strategic industries.

Meanwhile, automation allows manufacturers to locate production in developed economies without sacrificing cost efficiency. By 2024, the global economic downturn will have bottomed out. Global robot installations are expected to level off at 541,000 units. Moreover, growth is expected to accelerate in 2025 and continue in 2026 and 2027. Generally, there are no signs that the overall long-term growth trend will end in the near future.

-27 September 2024-