ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Lelon Steers Future Growth Prospects with Automotive at Core

Although many manufacturing companies have yet to recover from the onslaught of the novel coronavirus (COVID-19) pandemic, Lelon Electronics Corporation’s business performance has been consistently growing. In fact, the company has sustained and accelerated its revenue growth even at the height of the pandemic.

The latest financial data from the company showed that from January to September of this year, Lelon recorded net sales revenue of NT$7.26 billion, growing an impressive 28 percent from NT$5.68 billion net sales revenue recorded over the same period last year.

In an interview with AEI, Jimmy Wu, Chief Executive Officer (CEO) at Lelon said the company expects to grow further with the automotive fields as a strong driver. Other than the automotive sector, the company also expects 5G equipment and industrial automation to play an important role in its continued growth.

“We predict a strong demand from automotive, 5G equipment and industrial automation. We will continue to gear our efforts toward high-end markets with a focus on strengthening advanced products and meeting customer needs,” said Wu.

Momentum for Automotive-Related Products

Wu said the growth prospects in the automotive industry mainly comes from two main aspects, namely the emergence of electric vehicles (EVs) and the continuing increase of electronic features inside the vehicle. He noted that electronic features have been growing in numbers to meet the demands of various systems such as advance driver-assistance systems (ADAS), active and passive safety, digital instrument board, and various other in-vehicle functions.

“Various (systems inside the vehicle) has doubled the volume of electronic components in cars…In 2021, we have had many new customers and designs for automotive use. This resulted in our revenue for the automotive segment increasing 50 percent year-over-year,” said Wu.

It is not easy for a supplier-manufacturer to penetrate the automotive industry, and Wu noted the vast difference of supplying for household electronics compared with automotive. Furthermore, he said it is necessary for suppliers to fully understand the materials they are supplying for and to improve production and management.

“Suppliers must have a thorough understanding of the quality an automobile requires and all of the innerworkings of the car. In order to fulfil the high requirements of the automotive industry, suppliers need to have in-depth knowledge, expertise and experience,” said Wu.

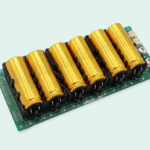

To expand the company’s capacity for surface mount device (SMD)-type aluminum capacitors, Lelon is already installing machinery and equipment necessary for its new plant in Suzhou, China. It will be ready for production by the end of 2021.

“After we complete relevant quality system certifications by the 3rd quarter of 2022, customers can start to audit the factory. Lelon’s service system (for the new plant) is based on flexible lead-time and global logistic capabilities,” said Wu.

Challenges in EV Expansion

Wu underscored that while EV will take off in the future and mass production of such is possible, there are several challenges that can be expected in developing EVs. Among the challenges he cited, they include long charging time, the popularity of charging pile, and technology of ultra-fast charging.

“There is a lack in production capacity of qualified battery suppliers and also battery raw materials. These are bottlenecks for mass manufacturing of EV in the future,” said Wu.

For Lelon’s part, Wu said the company is committed to meeting the need for a revolutionary charger product design which is crucial for ultra-fast charging for EV batteries. He said they will develop new capacitors that will fit in the new design demanded for EV batteries.

It may take some time, Wu noted, for EV to fully mature in the market, noting that petrol cars will most likely not be totally eradicated and that hybrid electric vehicles (HEVs) will remain as the mainstream for the next 10 to 20 years. He said in order for full proliferation of EVs, there are many issues to resolve that will hound this next-generation vehicle trend.

“I don’t think EV will be able to completely eradicate petrol cars. EV is a major factor in trying to be carbon neutral, however there are still many issues that are unresolved for EV,” said Wu.

“By focusing only on the carbon footprint produced by EV in a city is only a snapshot in the whole lifecycle of an EV. To truly understand it’s effects, we need to evaluate the carbon which is produced from the whole supply chain,” he added.

For this reason, Wu said that Lelon will allocate resources to produce components for on-board charger (OBC) system in EVs, and also continue to develop relevant components for hybrid systems.

“Under the long-term goal of being carbon neutral, European Union (EU) countries, United States, and Japan are accelerating the development of new energy cars. The demand for EV is getting stronger and we are continually cooperating with customers to develop and provide them with the best solutions,” said Wu.