ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Samsung SDI turns profit in EV secondary battery business

The hard-won economies of scale help swing back to profitability

Powered by buoying sales of secondary batteries and energy storage system, Samsung SDI chalked up an all-time high in its quarterly revenue in the 2nd quarter ended June 30.

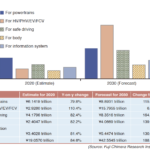

The secondary battery and energy-related affiliate of Samsung Electronics said on July 27 that it has logged an operating profit of 295.2 billion won, a 184.4% jump from a year ago on consolidated revenue of 3.334 trillion won, which was 30.3% up year-on-year, too.

The 2nd quarter revenue was the highest on record.

What drove the stellar second quarter earnings performance was its energy-related business that includes ESS (energy storage system) and secondary batteries.

Driven by cylindrical secondary batteries for EVS as well as ESS, the sector chalked up 2.7118 trillion in the 2nd quarter revenue, up 41.2% from a year ago. Especially, the company turned a profit in the sales of secondary batteries for EVs. Shipments of pouch-type batteries for high-end premium smart phones also improved.

It is the first time in 6 quarters since the fourth quarter of 2019 that the company swung back to profits in its secondary battery business for EVs.

The company attributed its return to profitability mainly to its hard-won economies of scale, which was gained through its constellation of EV battery factories spanning the globe from Europe to the U.S.

Samsung SDI disclosed in its IR event held on August 27 that it will supply NCA (nickel, cobalt, and aluminum)-based EV batteries for BMW starting from sometime in the third quarter. Called as a 5th generation of EV battery technology, the NCA battery is a next generation of high-energy density EV battery that can guarantee a maximum driving range of more than 600 km per charge.