ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

TDK Beefs up Production of MLCCs for Automobiles

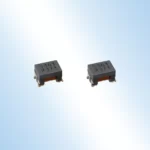

TDK Corporation is bringing forward its plan to increase the production of multilayer ceramic capacitors (MLCCs) for automobiles to meet robust demand.

Accordingly, the company will start mass production at a new manufacturing building of Kitakami Factory of TDK Electronics Factories Corporation in Kitakami-shi, Iwate Prefecture, Japan. This aims to meet increasing demand for MLCCs for electrified vehicles (xEVs) and advanced driver-assistance systems (ADAS). Specifically, the factory will commence production around April 2024, five months earlier than its initial plan.

Earlier than Planned

In May 2022, TDK announced its plan to put up a new manufacturing building on the premises of Kitakami Factory of TDK Electronic Factories to bolster its production system of MLCCs. Initially, the company planned to complete construction in June 2024 and start mass production in Sept. 2024. However, “As the demand for high-performance, high-reliability MLCCs for xEVs and ADAS continues to increase steadily, we have decided to accelerate the implementation of the plan,” said Noboru Saito, Representative Director, President & Chief Executive Officer, TDK Electronics Factories Corporation. Furthermore, the company is also considering infusing new investments to increase production in 2025 and onward.

By implementing these plans, TDK will continuously strengthen its capabilities to supply high-reliability MLCCs and enhance its competitiveness in automotive MLCCs. At the same time, the company will further bolster its development capabilities for MLCCs.

Strategic Focus on MLCCs

In FY2021 ending March 2022, TDK started a three-year medium-term management plan, “Value Creation 2023.” In the new plan, the company identified strategies to nurture new businesses and diversify revenue sources. In the past, the company focused on small rechargeable batteries, which drove its business performance for the past 10 years.

Among the new businesses, the company planned to focus on passive components, including MLCCs mainly for automobiles and industrial equipment. As a result, “The passive components business mainly for xEVs has grown greatly, becoming a revenue source following rechargeable batteries,” noted Saito.

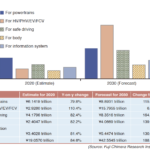

Sales of the passive component business in FY2022 ending March 2023 increased 13.4 percent from the previous year to 575.9 billion yen (US$4.14 billion). Although sales of components for the ICT market were sluggish, sales of components for the automotive market, mainly for xEVs, steadily increased. Also, sales of MLCCs for the automotive market steadily went up. Moreover, TDK expects sales of the passive components business in FY2023 to increase 9 to 12 percent from the previous year. Automotive MLCCs, film capacitors, and inductive devices for automobiles and industrial equipment will drive this trend.

Accordingly, TDK has revised its capital allocation for its three-year medium-term management plan. Mainly, the company dramatically increased capital investments for the passive components business to 210 billion yen (US$1.51 billion) from 150 billion yen (US$1.08 billion) initially.

Automotive Trends

Generally, the recent automotive market has seen the popularity of EVs around the world. In addition, automobiles come with increasingly multiple functions, including autonomous driving technologies and driving support technologies, such as ADAS. Thus, the number of MLCCs incorporated in a vehicle has been increasing.

The new manufacturing building at Kitakami Factory has a system in place to enable integrated production from materials through finished products to meet more demand from customers.