ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Automotive to Cast Growth Spell to Components Market

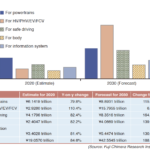

The recovery trend of global demand for electronic components since summer of 2020 continued in 2021, and demand steadily increased in 2022. By application, on the back of the economic recovery from the COVID-19 pandemic, demand for components for industrial equipment, automotive electronics, and high-end smartphones increased.

Particularly, rapid progress in the depreciation of the Japanese yen in spring 2022 and onward pushed up shipments in value by Japanese electronic components manufacturers. However, orders began to slow down since summer of 2022.

Thus, experts see electronic components market in the first half of 2023 to remain weak. Nonetheless, for the entire 2023, the industry can still expect growth trajectory amid expected recovery of the market starting in the middle of the year.

Passive Components

Stable Demand for Passive Components for xEVs, 5G

In the first half of 2023, demand for passive components in consumer electronics, including personal computers and smartphones, will remain weak. Nonetheless, stable increase in demand will prevail for the entire 2023 amid the acceleration of the shift to electrified vehicles (xEVs). Add to this, the progress in advanced driver-assistance systems (ADAS)/autonomous driving technologies and increased demand for 5G-related products will spur growth. In addition, the decarbonization trend will also help create demand for passive components.

The demand for passive components dropped in the first half of 2020 with the impacts of the COVID-19 pandemic. However, it gradually recovered in the second half of 2020. Orders received increased momentum in 2021. Many passive components manufacturers saw expansion in orders received at a pace with B/B ratio far greater than 1.0 on the back of increased demand from automotive, industrial equipment and information and communications technology (ICT)-related products. For that reason, supply chain issue occurred for various components, including chip registers and capacitors.

In 2022, the market continued to be brisk in the first half. The demand for consumer equipment-related components slightly dropped amid the slowdown of the Chinese economy and the reactions to the demand brought about by the stay-at-home trend. Nonetheless, brisk demand for industrial equipment-related components, and xEV- and ADAS-related components drove the market. Overall, steady demand continued in 2022.

Automobiles to Drive Growth, Too

Going forward, the increase in the number of components installed in a vehicle accompanying higher functionalities of automobiles will support the growth in demand for passive components. The advancement of ADAS functions and connected cars, and the acceleration of the shift to xEVs targeted at full-fledged autonomous driving will push up the demand for high-value-added components.

There are also high hopes for 5G-related products. High frequency components and high reliability components for base stations for use in 5G terminals and 5G base stations will lead to the increase in the number of passive components incorporated in these terminals and stations. Furthermore, 5G smartphones with higher functionalities will also contribute to the increased number of passive components installed in those smartphones. The demand for ultrasmall and high-performance components for high-end smartphones will increase.

In 2022, the demand for passive components for industrial equipment also markedly increased. Specifically, the demand for labor-saving robots and manufacturing equipment for xEVs is forecast to steadily increase. Furthermore, the increase in environment-related investments in plants and equipment targeting carbon neutrality will also likely to push up the demand for related components.

Connection Components

Buoyed by Demand for Decarbonization, Energy-Saving Products

The global demand for connection components steadily increased in 2017 through the first half of 2018. However, in the second half of 2018, it slowed down affected by the decrease in the demand for equipment amid the intensifying trade tension between the United States and China and sluggish sales of smartphones. Further slowdown continued in 2019.

In 2020, severe environment continued in the first half affected by the pandemic. However, the demand for connection components picked up in the middle of the year and onward reflecting the recovery of automotive production in the U.S. and China. In 2021, orders received for automotive components gained momentum and the demand for industrial equipment-related components also fully recovered. Connection components for high-end smartphones and game machines also increased steadily. Therefore, the connection components market in 2021 grew dramatically surpassing the initial forecast.

In 2022, the demand steadily increased in the first half driven by the automotive and industrial equipment-related field. In April and May, some deliveries had to be postponed caused by lockdown in Shanghai, China. From June and onwards, recovery in demand advanced. By sector, ICT-related orders received were somewhat weak. However, steady increase in orders received for xEVs, factory automation (FA) equipment and machine tools, and semiconductor manufacturing equipment drove the connection components market in 2022.

Automotive as Important Market

In 2023, the demand may level off in the first half caused by reactions to special procurement during the stay-at-home normed as well as prolonged production adjustment of smartphones by Chinese makers.

Furthermore, the temporally lull in the demand for FA equipment and machine tools. Nonetheless, growth will likely continue in the whole year buoyed by catch-up production of vehicles and further shift to xEVs. Add to these, the completion of production adjustment of smartphones by Chinese makers and new demand for decarbonization- and energy-saving-related equipment.

Connection components manufacturers position the automotive market as one of the most important markets. Automobiles are increasingly incorporating higher functionalities in line with the megatrend toward connected, autonomous, shared and services, and electric (CASE).

In this market, the demand for high-value-added components that meet the needs for safety and security; high-speed, large-capacity transmission; high current and high withstand voltage; and reduced vehicle body weight is expected to increase.

In the ICT-related field, the demand is growing for narrow-pitch, low-profile, and space-saving board-to-board connectors. In addition, there is growth as well for small battery connection connectors that support high current and compact slide switches for use in smartphones and wearable devices.

With industrial equipment, high-speed transmission connectors and high-speed solutions for next-generation communication infrastructure that meet high-speed, high-performance, and large-capacity FA equipment and robots are expected to create demand. Medical and security-related equipment will also create demand for connection components for industrial equipment.

Conversion Components

Brisk Demand Buoyed by Production of Automobiles

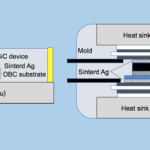

In 2018, the global demand for conversion components increased steadily supported by the demand increase for use in automobiles and industrial equipment. In 2019, it slowed down with the impacts of the sluggish automotive and industrial equipment markets and intensified competition in the smartphone market. In 2020, the demand for automobile and industrial equipment stagnated with the onset of the COVID-19 pandemic. It was a severe year for conversion components manufacturers.

In 2021, improvement in the automotive-related demand since the second half of the previous year and the recovery of the industrial equipment-related demand turned around the global demand for conversion components. Hence, the demand for conversion components increased steadily throughout the year.

In 2022, the conversion components market steadily increased as a whole, reflecting automobiles and industrial equipment-related demand increase. Although acoustic components and sensors were weak, actuators drove the growth. Overall, conversion components achieved a high level of growth in 2022.

In 2023, consumer electronics will likely to weaken in the first half. Nonetheless, the industry can expect a steady growth for the whole year with the recovery production of automobiles as a tail wind.

Increased Demand for Motors

With motors, higher installation rate of electronic equipment in vehicles and the progress in the shift to xEVs have been heightening the potential per one vehicle. A single luxury vehicle can install more than 100 motors. The number of motors installed in medium-sized cars, compact cars and mini cars has also been increasing year after year.

Going forward, addition of new functions targeted at the improvement of ADAS and the enhancement of the comfort of drivers will propel the growth.

On the product development front of motors, pursuit for energy-saving, high efficiency, long life, compact size and lightweight will accelerate further.

With the on-vehicle electrical equipment-related area, seatbelt pretensioners, intake-exhaust devices for engine, and grill shutter functions will create demand for motors.

On other hand, with acoustic components, the expansion in demand for high-value-added products, such as headphones with a noise cancellation function, will likely happen as well. Furthermore, the expansion of new applications of internet of things (IoT), and augment reality (AR)/virtual reality (VR)-related products will also lead to the demand increase for acoustic components.

With on-board speakers, the number of factory-installed speakers in a vehicle has been increasing, primality in premium cars of European carmakers. Moving forward, growth of on-board speakers will be higher than the growth of the number of vehicles. The development of products setting sight on high-end acoustic systems has been active, targeting autonomous driving.

Meanwhile, the demand for magnetic heads will continue to increase for use in high-capacity hard disc drives (HDDs) for data centers.