ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Lelon Sees Automotive, AI as Growth Prospects for 2024

Taiwanese manufacturer Lelon Electronics Corporation thinks the bleak market outlook for the electronic components industry will likely extend until 2024 to 2025. This as macroeconomic uncertainties will continue to create a dent in the global consumption trend. Thus, severely impacting the production curve across many industries.

In an interview with AEI, Jimmy Wu, Chief Executive Officer at Lelon said weakened purchasing power will continue to dampen its forecast for full-year 2023. In fact, the company expects sales to drop 20 percent compared to the previous year. Moreover, profit is likely to make a steep drop of up to 30 percent as against the 2022 level.

“In regions like Europe and America, prices have been increasing 20 to 30 percent. People don’t want to spend on (electronics)…People are afraid to spend money. They would rather spend on food, education, and the like,” said Wu as he explained the rationale for how the weak electronics demand is impacting the electronics components business.

Furthermore, Wu said, “This year (2023), the overall market is not good and demand is weak. We are trying to keep the turnover, rather than focus on the profit.”

Automotive, AI Fuel 2024 Prospects

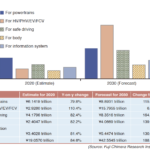

Among the segments, Wu said automotive fields remain as Lelon Electronics’ driver for 2023, accounting for the highest market share of 30 percent. This represents an increase compared to the segment’s 2022 share of 22.8 percent.

Meanwhile, Lelon Electronics expects other segments to sustain similar share ranking.

On the other hand, the rest of the application fields, such as EMS/distribution, Telecom/Networking, Power and Green Energy, Consumer and Home Appliances, IT/Cloud, and Industrial and Medical segments will likely retain their respective sales ratio as in 2022.

Wu said many of their customers have made conservative orders that resulted in shorter inventory lead time. As a matter of fact, he expects a cautious outlook until next year, and might even extend until 2025.

For 2024, Wu expects the automotive segment to drive sales for the company. Particularly, he noted the need for automotive companies to introduce new in-vehicle features and functions will boost prospects from this segment even further for next year.

“For 2024, we expect sales on the quantity side to be the same as this year…However, automotive companies want to add everything onto the car to attract more sales. This will increase the electronic components in the car,” said Wu.

In addition, the growing trend towards electric vehicles will grow even further in 2024. This, Wu said, will also give a little lift for the business prospects next year.

“Automotive electronics application will be one of the key projects, including fast charging of EV. As the charging power increases, aluminum capacitor requires higher voltage and ripple current,” Wu said.

Aside from automotive, Wu said Lelon Electronics is also looking at the prospects of the Telecom/Network segment in 2024. Particularly, in application fields requiring artificial intelligence (AI).

“The infrastructure construction of broadband networks in many countries will drive the need for network equipment upgrades. The AI server market will also be one of the growth momentum,” Wu said.

Braces for Market Recovery

Lelon Electronics has recently announced an investment of 260 million Thailand Baht to set up a factory in Amata City in Thailand’s Chunburi. Particularly, the said factory will build environmental protection and energy recycling facilities.

Wu said the new investment in Thailand is in response to “China + 1” market trend. In the third quarter of this year, Lelon Electronics’ new Suzhou plant in China has started full operations.

“Thailand will be the largest automobile manufacturing center in Southeast Asia in the future, with sufficient energy capacity, less restriction in labor force,” said Wu, adding that this will shorten delivery time as many of its Japanese and other area automotive customers have factories in Thailand.

Despite the cautious market prospects in 2024, Wu said the company will continue to create added value to its products and maximize production processes and investments in equipment to provide its customers with reliable products and services.

“Inflation, rate, and geopolitical factors will continue to affect the world economy, but the overall situation (in 2024) will be stable compared to this year,” Wu said. “The economic environment is changing rapidly, but what remains constant is our commitment to quality. Lelon will continue to respond to customer needs to make the most appropriate products and services.”