ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Foundry Fabs Spearhead Speeding Spree in 2022

As global economies are clamoring for more of semiconductor chips, as they are rapidly digitalizing the way that they live, study, work, socialize, entertain, and even interact with cars, machines, and each other.

To keep up with such cry-out for semiconductor chips – the integral part of the digitalization- global chip makers are pumping up more money in their fab facilities.

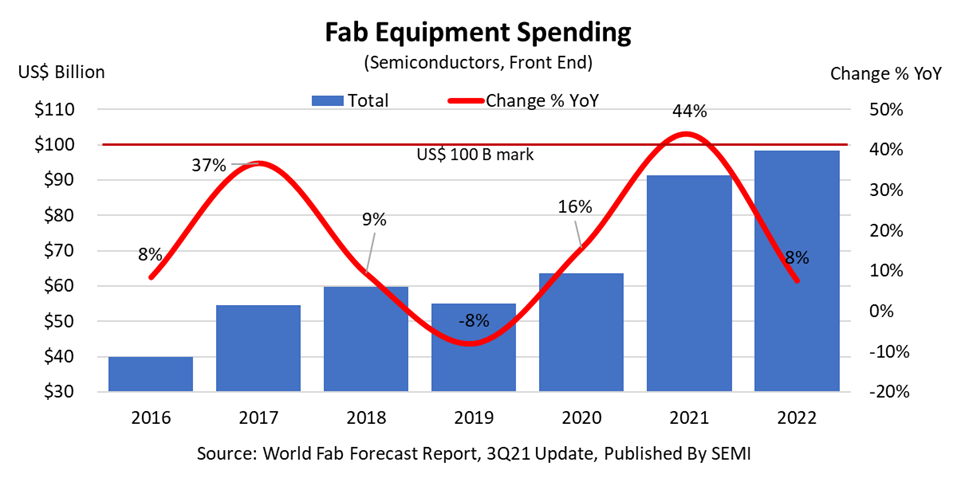

Accordingly, SEMI forecasts that global fab investments would grow by a whopping 44% from a year ago to reach US$900 billion in 2021 and then peak in the neighborhood of US$1,000 billion in 2022.

Foundry fabs will lead the spending spree in 2022, according to SEMI, sucking up US$440 billion, almost half the total investment, to expand or newly build new lines of fab facilities.

The investments rush to foundry fabs reflect challenges and opportunities facing the chip industry, however.

Share costs

As chip design and production costs have been escalating along with the industry’s ramp up to finer design rules of below 10nm as well as prohibitively expensive EUV lithography equipment, there has been growing need to share the cost burden between foundry and fabless chip makers.

One prime example of the cost-sharing movements is IDM or integrated device manufacturer Intel’s diversification into the foundry business to open its chipmaking resources to fabless chip makers.

On the other hand, foundry chip makers are seeing yet untapped market opportunities, as the rapid digitalization of global economies are accelerating market fragmentations, spurring up demand for a wide variety of chips.

Fab investments for memory chips are forecast to hit US$38 billion in 2022 – US$17 billion for DRAM chips and US$21 billion for NAND flash memory chips. Investment in micro/MPUs would hit US$9 billion, while US$3 billion will pour into discrete and power semiconductor chips. Fab investments for analog and others would reach US$2 billion each.

By country, Korea will lead the 2022 fab investments, pouring in US$30 billion, as the country’s two largest memory chip makers are rapidly ramping up to new lines of EUV, or extreme ultraviolet lithography equipment. Coming in second is Taiwan that will invest US$26.0 billion in 2022. China will come third with a fab investment of US$17 billion. Japan will invest US$9 billion, while Europe and Middle East are expected to collectively invest US$8 billion.