ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

New Japanese Facilities Roll for IC Materials

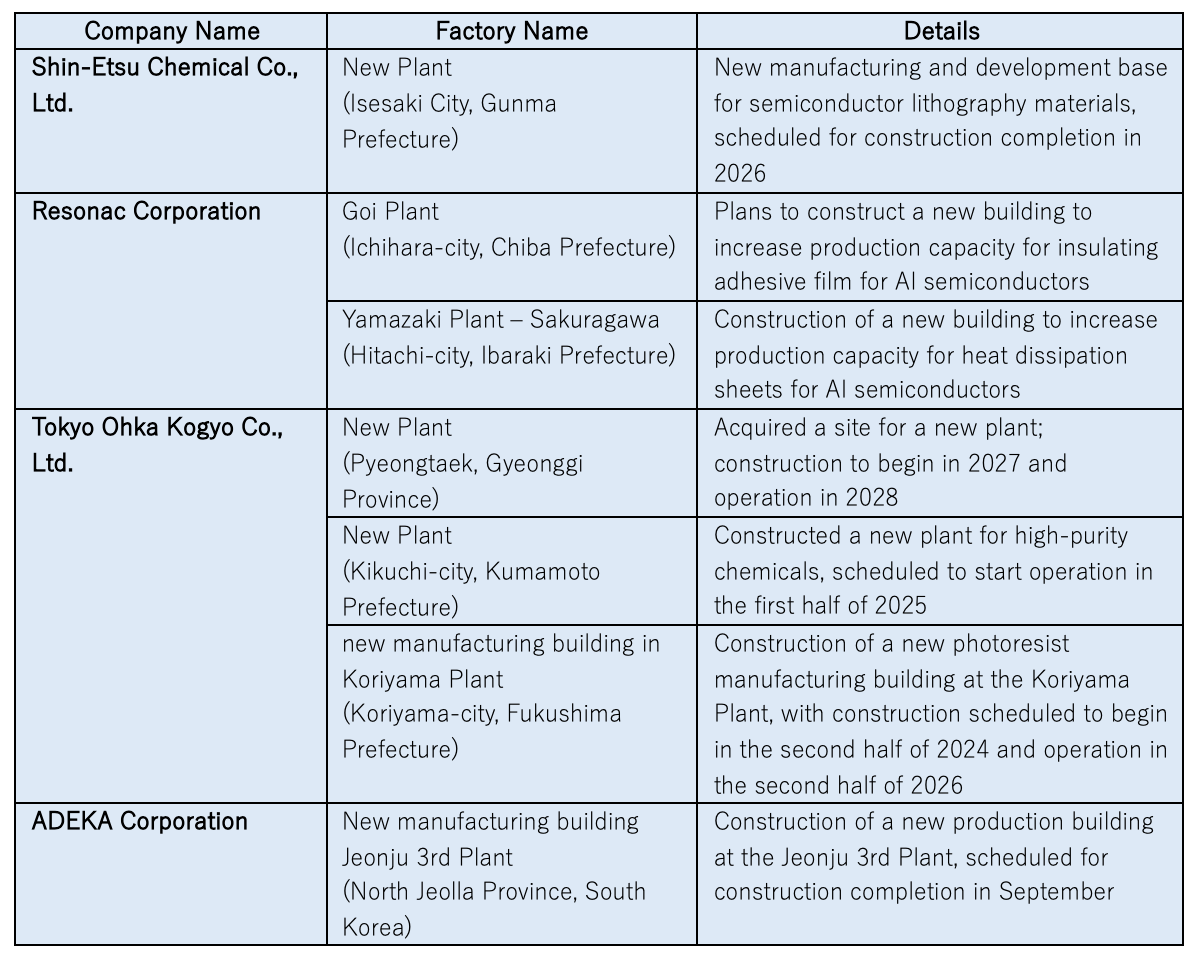

Recently, Japanese electronic materials manufacturers have been constructing new plants and additional buildings primarily to boost production. This step aims to meet the increasing need for high-performance semiconductor materials for the artificial intelligence (AI) era. Accordingly, these companies aim to drive business growth with a timely capital investment.

Generally, the global market for semiconductors will continue to grow over the medium to long term. In 2023, the global semiconductor market experienced negative growth due to declining demand from smartphone- and PC-related industries, as well as a drop in data center investment. In 2024, the recovery of the market is possible and may exceed the record high of 2022.

World Semiconductor Trade Statistics (WSTS) predicts that the global semiconductor market will grow 13.1% year-on-year in 2024. Also, U.S. research firm Gartner forecasts a 16.8% year-on-year increase in the semiconductor market to $624 billion in 2024. In addition to the recovery of the memory market, the expansion of the generative AI market will boost growth.

Building Fourth Plant for Photoresist

In April, Shin-Etsu Chemical Co., Ltd. announced its decision to expand its semiconductor lithography materials business by building a plant in Isesaki City, Gunma Prefecture. In this relation, the company has acquired a 150,000-square-meter site to build a manufacturing and development base for semiconductor lithography materials. Specifically, the company targets the first phase of construction in 2026. Moreover, the company expects to invest approximately 83 billion yen (US$529 million), including land acquisition, in the first phase of construction.

The new plant will be the company’s fourth plant for its photoresist business. This follows the Taiwan Plant (Yunlin County), which opened in 2019.

Increase Production of Materials for AI Chips

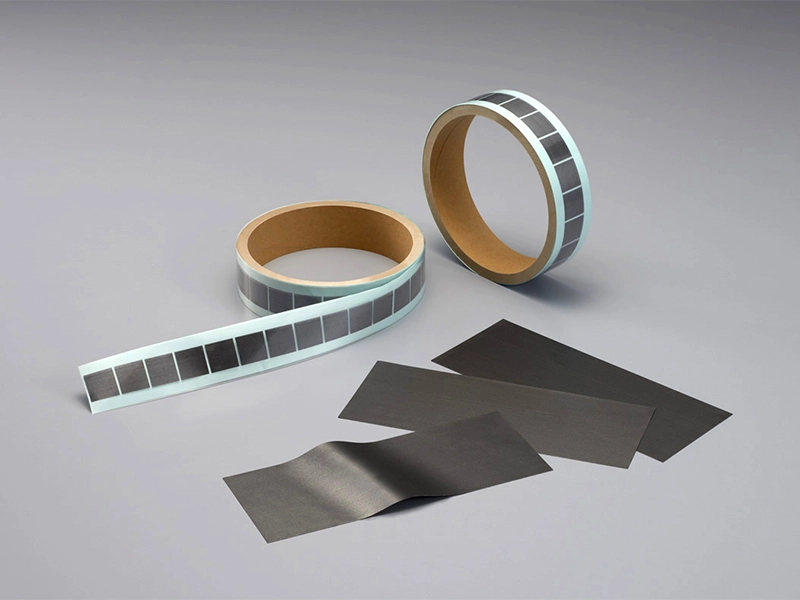

Meanwhile, Resonac Corporation will significantly increase the production capacity of materials for AI chips. To this end, it will invest about 15 billion yen (US$95.6 million) to expand the production capacity of insulating non-conductive film (NCF) and thermal conductive sheet or thermal interface material (TIM) for high-performance semiconductors, including AI semiconductors, by 3.5 to 5 times.

Construction of new buildings on the premises of the Goi Plant (Chiba Prefecture), which produces NCF, and the Yamazaki Plant -Sakuragawa (Ibaraki Prefecture), which produces TIM, respectively are in the offing. The company will start operations of the expanded facility beginning 2024 in stages.

Tokyo Ohka Kogyo to Acquire Site in Korea

For its part, Tokyo Ohka Kogyo Co., Ltd. (TOK) has decided to acquire a factory site in South Korea for the construction of a new factory. Its subsidiary, TOK Advanced Materials Co., Ltd. (TOKAM, Incheon Metropolitan City) will acquire the factory site in Pyeongtaek, Gyeonggi Province.

Particularly, the new smart factory will promote automation and manpower saving. It will maximize the synergy with the existing Incheon Plant (Incheon Metropolitan City) to prepare for future business expansion. Construction will begin in 2027. However, the scale of operation has not yet been determined, it is expected to start in 2028. Accordingly, the company will acquire 55,560sqm of land for approximately 3.1 billion yen (US$19.8 million) for this purpose.

In addition, the company is constructing a new plant to manufacture high-purity chemicals in Kikuchi City, Kumamoto Prefecture. Completion is set in the first half of FY2024 and operation in the first half of FY2025.

Also, to increase semiconductor photoresist production capacity toward 2030, a new photoresist production building will be constructed at the Koriyama Plant (Fukushima Prefecture). This will be the largest in Japan. Construction will begin in the second half of FY2024, with operations to start in the second half of FY2026. Additionally, the new facility will increase production capacity. It will also improve quality of KrF (Krypton Fluoride) photoresists and EUV (Extreme Ultraviolet) photoresists.

Adds New Building in Korean Plant

In February, ADEKA Corporation decided to build a new manufacturing building in the Jeonju 3rd Plant of its Korean subsidiary, ADEKA Korea Corporation. Mainly, the new facility in North Jeolla Province will house a mass production system for materials for next-generation semiconductors. Completion of construction is set in September.

Mainly, ADEKA Korea manufactures advanced semiconductor materials at Jeonju 2nd Plant. Meanwhile, the new production facility will mass-produce materials for next-generation DRAM and next-generation logic and NAND semiconductors. ADEKA Korea is aggressively investing in facilities to increase production and expand its product lineup of the ADEKA ORCERA Series of high-k materials for advanced semiconductor memories, for which ADEKA has the world’s top share.

This is an English translation of an original Japanese article published in Dempa Shimbun Daily.

-06 May 2024-