ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Electronic Material Makers Roll out Capex to Boost Capacity

Electronic materials manufacturers have been actively increasing production capacities. In FY2022, various companies have set forth their investment plans to boost production capacities. These investments aim to meet increasing demand for electronic materials in the medium to long term. In particular, material manufacturers set sights on growth fields, including electrified vehicles (xEVs), fifth-generation (5G) communications, next-generation semiconductor processes, and carbon neutrality. Mainly, investments are planned for this year and the next.

High Demand for ICs Spurs Electronic Materials

Since 2021, the global demand for electronic materials has been increasing steadily, reflecting economic recovery from the COVID-19 pandemic. In particular, global automotive production recovered from 2021 to first half of 2022. Also, shift to xEVs accelerated and demand for information and communications technology (ICT) equipment and data centers increased accompanying digital transformation. In addition, high functionalities of 5G smartphones advanced. Against this backdrop, higher demand for semiconductors pushed up demand for high-performance electronic materials.

Under medium- and long-term management plans, electronic materials manufacturers aim to expand sales and profits. However, recent global inflation caused partial postponement of investments in semiconductor facilities and slowdown in demand for equipment. This trend brought a sense of uncertainty in today’s electronics market. Nonetheless, manufacturers continue to actively devise capital investment strategies. They are setting their sights on the expansion of global demand for electronic materials in the medium and long term.

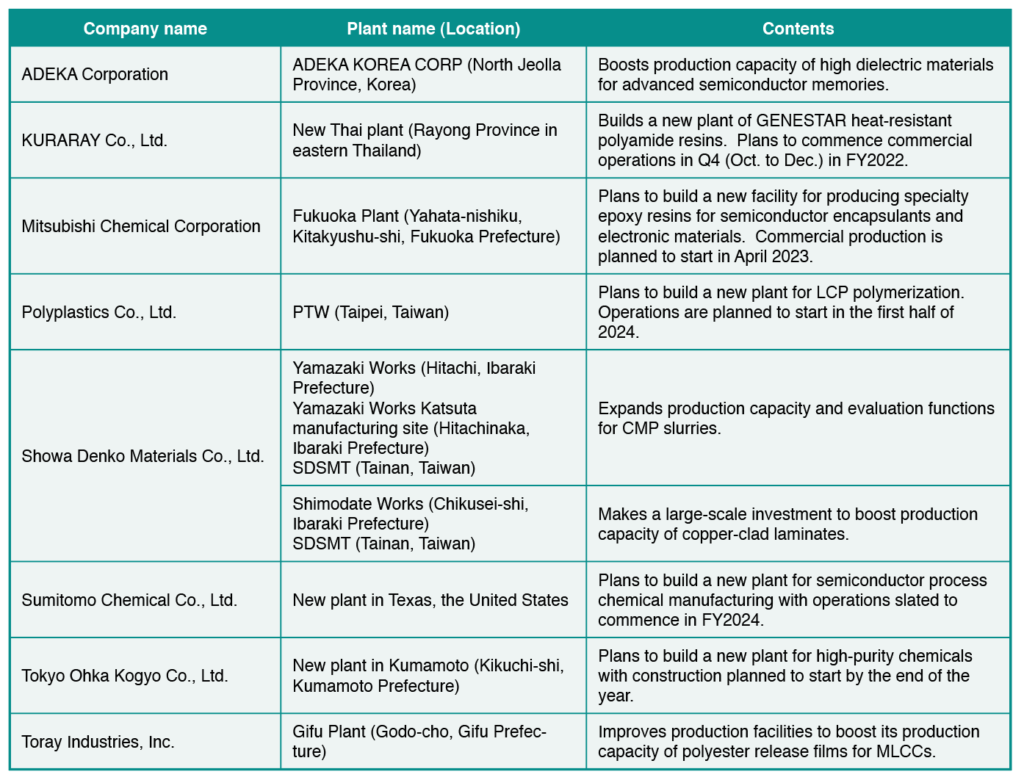

Investment Plans of Electronic Materials Makers

Japan-based Tokyo Ohka Kogyo Co., Ltd. plans to build a new factory to produce high purity chemicals in Kikuchi, Kumamoto Prefecture. The company plans to start construction of the factory by the end of the year. It is planned to become a state-of-the-art factory of high purity chemicals. This will enable Tokyo Ohka Kogyo to speedily meet the growth of the global semiconductor market. Also, it will further strengthen its domestic production base and risk distribution.

Meanwhile, Showa Denko Materials Co., Ltd. expands the production capacity and evaluation functions for chemical mechanical planarization (CMP) slurries. CMP slurries are polishing materials used for smoothing and flattening the rough surfaces created in semiconductor integrated circuits production process. The company will build new plants and introduce additional production and evaluation equipment at Yamazaki Works and in Katsuta manufacturing site in Ibaraki Prefecture. Moreover, the company will also build a new plant at its consolidated subsidiary, Showa Denko Semiconductor Materials (Taiwan) Co., Ltd. (SDSMT), in Taiwan. The company plans to invest about 20 billion yen in total for this endeavor. This expansion is expected to increase Showa Denko Materials Group’s CMP slurry production capacity by about 20 percent.

Furthermore, Showa Denko Materials has decided to make a large capacity investment, the largest scale in the past several years, to boost its production of copper clad laminates. By 2025, the company will introduce production lines and equipment for copper-clad laminates for semiconductor package substrates at Shimodate Works in Chikusei, Ibaraki Prefecture and SDSMT. The company plans to invest about 10 billion yen in this venture. This expansion is expected to roughly double Showa Denko Materials Group’s current output capacity of the product.

For its part, Toray Industries, Inc. will boost production capacity of Lumirror™ polyester release films for manufacturing multilayer ceramic capacitors (MLCCs) to 1.6-fold of its current production capacity. To this end, the company will upgrade its Gifu Plant in Godo-cho, in Gifu Prefecture. The new facilities will go on-line in 2025.

Also, ADEKA Corporation will ramp up production capacity of the ADEKA ORCERA Series high-dielectric materials for advanced semiconductor memories at its Korean subsidiary ADEKA KOREA CORP. In 2021, the company constructed an integrated production system at ADEKA KOREA’s No. 2 factory in Jeonju. This expansion will more than double its production capacity than current production.

Meanwhile, Sumitomo Chemical Co., Ltd. has decided to establish a new company in Texas in the United States through its Korean subsidiary Dongwoo Fine-Chem Co., Ltd. The company will construct a new plant for semiconductor process chemical manufacturing due to commence operations in FY2024. Sumitomo Chemical also deploys its compound semiconductor materials business at its U.S. subsidiary, Sumitomo Chemical Advanced Technologies LLC in Arizona. With the construction of the new plant, the company will further accelerate its semiconductor business in the U.S.

KURARAY CO., LTD. has almost completed the construction of its new plant in Thailand for GENESTAR heat-resistant polyamide resin. The company plans to start commercial operations of the plant in Q4 this year. Moreover, it plans to increase the operation rate of the plant in stages in 2023 and after. The Thai plant will have an annual production capacity of 13,000 tons. Combined with production in Japan, total production capacity for GENESTAR is tapped at 26,000 tons annually. Furthermore, KURARAY also to considers the second phase of investment in the Thai plant by the end of the current medium-term plan.

Polyplastics Co., Ltd. will construct a new polymerization plant with the production capacity of 5,000 tons per year at Polyplastics Taiwan Co., Ltd. (PTW) to increase its production capacity of liquid crystal polymers (LCPs). The new plant is slated to start operations in the first half of 2024. PTW has been responsible for the compounding process in the manufacturing of LCP products. The latest polymerization plant will enable PTW to conduct an integrated production of LCP products in Taiwan from polymerization to compounding.

Mitsubishi Chemical Corporation will build a new production facility for specialty epoxy resins for semiconductor encapsulants and electronic materials at its Fukuoka Plant in Kitakyushu-shi, Fukuoka Prefecture. At present, the company is producing epoxy resins at its Mie Plant in Mie Prefecture. The company decided to establish the new facility to meet robust demand of the semiconductor market and strengthen its supply chain. It plans to start commercial production in April 2023.