ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

India to Soar Grit as Global Chip Hub

For several decades, India has been mustering massive efforts to become a global semiconductor powerhouse. Thus, the recent move of Tata Electronics to build a semiconductor fab, the first in the country, as well as a chip assembly and test facility, is a game-changer to the country’s desire for self-reliance in electronics manufacturing.

The soon-to-rise semiconductor fab will bring India closer to its ambition of catching up with the world’s driving forces in the chipmaking race such as China and Taiwan. Therefore, the twin investments from Tata Electronics and among others from other companies, are sending the vibe that the South Asian country and the world’s fifth largest economy is finally gaining control of the momentum.

Massive Ecosystem Investments

Tata Electronics’ planned fab facility in Dholera, Gujarat is currently under development in collaboration with Taiwan’s Powerchip Semiconductor Manufacturing Corporation (PSMC), one of the leading global semiconductor players. Strategically located near the city of Ahmedabad, the company is likely to infuse investments of up to Rs 91,000 crores (about US$11 billion). moreover, India’s first AI-enabled Fab is likely to generate over 20,000 direct and indirect skilled jobs.

Accordingly, Tata’s wafer fab will manufacture chips for applications such as power management IC, display drivers, microcontrollers (MCU), and high-performance computing logic. Thus, addressing the growing demand in markets such as automotive, computing and data storage, wireless communication, and artificial intelligence. Furthermore, the company plans the fab to have a manufacturing capacity of up to 50,000 wafers per month. This will make India a key supply chain partner in the global semiconductor industry.

Meanwhile, Tata Electronics will also build a state-of-the-art, greenfield semiconductor assembly and test facility in Jagiroad, Assam. The facility will be built with an investment outlay of Rs 27,000 crore (about US$3 million) and is likely to generate over 27,000 direct and indirect jobs in the region.

The OSAT facility will be focusing on three key platform technologies – wire bond, flip chip, and a differentiated offering called Integrated Systems Packaging (ISP). Moreover, the company expanding the roadmap to advanced packaging technologies in the future. These technologies are extremely critical for key applications in India – like automotive (especially electric vehicles), communications, network infrastructure, and others. The proposed facility will serve the growing global demands across key market segments like AI, industrial, and consumer electronics.

High Growth Trajectory

Indian electronic manufacturing industry has undergone major transformation in the last couple of years with a host of initiatives and reforms. Moreover, the government has taken several initiatives to promote electronics manufacturing. As a result, electronics manufacturing is on a high growth trajectory.

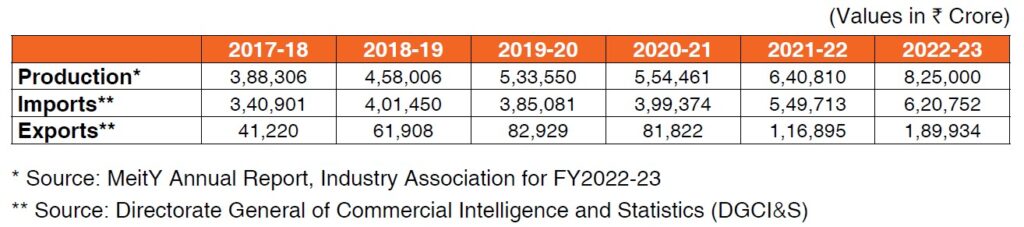

Specifically, domestic production of electronic items has increased substantially from Rs 3.88 lakh crore (US$60 billion) in 2017-18 to Rs 8.22 lakh crore in 2022-23 (US$101 billion), growing at a Compound Annual Growth Rate- CAGR of 16.28%. The key drivers of growth are the large domestic market, the availability of skilled talent, and low-cost labor.

Meanwhile, CAGR for imports from FY17-18 to FY22-23 stood at 12.7% while CAGR for exports from FY17-18 to FY22-23 recorded at 35.7%

Why a Wafer Fab Will Fill the Gap?

The Indian electronic manufacturing industry has undergone a major transformation in the last couple of years with a host of initiatives and reforms.

The Government’s “Make in India” program launched in 2014 aims to make India as the Global design and manufacturing hub. Specifically, by increasing domestic manufacturing and reducing

India’s dependence on imports and the services sector. Thus, imparting a healthy mix of contributions from all sectors to the Indian Economy.

However, that healthy mix, under the current ecosystem, does not exist as India, to become a global hub for electronics system design and manufacturing (ESDM), needs to encourage and drive capabilities and develop core components, including chipsets, in order to compete globally.

India almost have presence in almost major main components of a chip production ecosystem, except for a wafer fab, which makes semiconductor devices or what is commonly called as “chips”. With the country having a fab, it will create a market chain for effluent treatments, pure gases, among others, which would provide services to the Fab. Next, assembly, test, mark, and packaging (ATMP) companies will work on the output from the wafer fab. This in turn will create a market for equipment suppliers, which will supply complex equipment not just to the wafer fab but even to ATMP companies.

Now, as the chip production supply chain gets complete, it will also create successive components for a much bigger ecosystem. Specifically, this will invite manufacturers of PCBs, connectors, wiring harnesses, sub-assemblies, among others to India. Thus, companies making end products like computers, mobile phones, set-top boxes, among many others, will then grow in the country to set up their own production bases.

Therefore, the latest investments from Tata Electronics will spur the country’s ecosystem and would further make the supply chain bigger by drawing by-product and end-product manufacturers.

More Approvals

Aside from Tata Electronics, the government has approved several investment proposals under its program. This includes Micron Technology Inc.’s 2023 proposal for setting up an ATMP facility in India with an investment of Rs 22,516 crore.

The Indian government also approved a proposal in February 2024 from CG Power and Industrial Solutions Limited for setting up OSAT facility in India with Rs 7,584 crore. The facility is a joint venture with Renesas Electronics America.

Furthermore, the government also approved proposals from 11 startups and companies, as well as 25 semiconductor design companies.

18 December 2024