ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

DX, Manufacturing Soar Thai Investments to New Heights

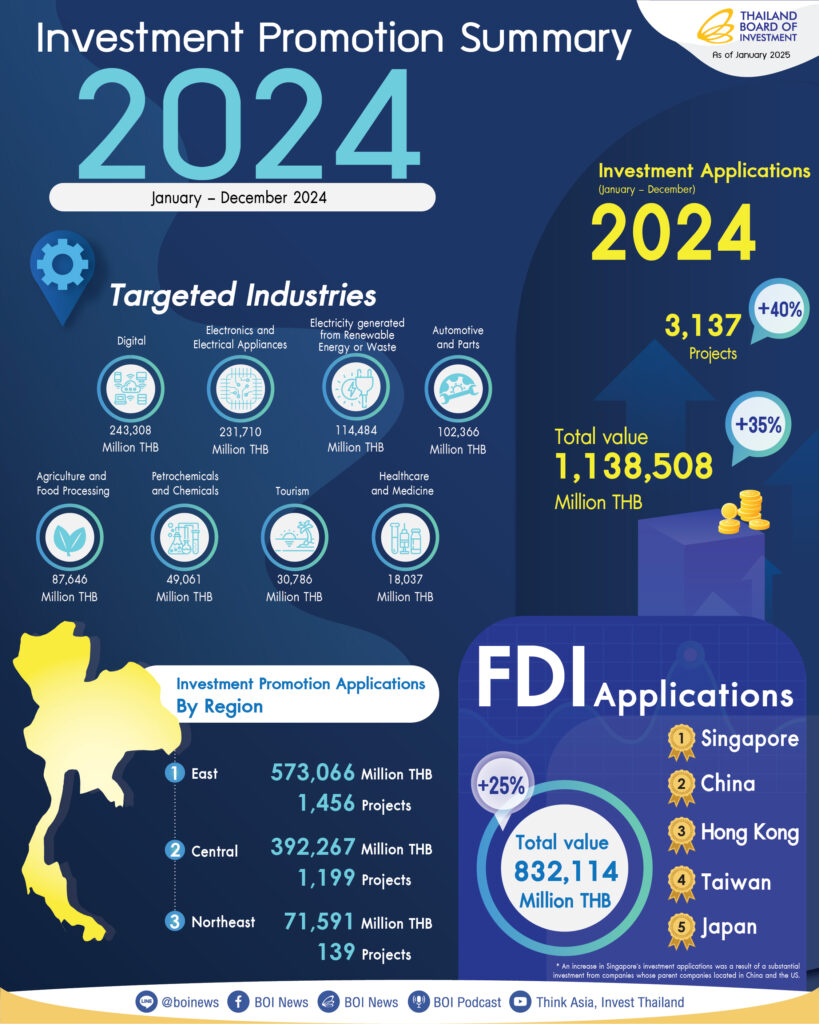

The Thailand Board of Investment (BOI) announced that applications for investment promotion in 2024 soared 35% in value to 1.14 trillion baht (about US$33 billion). Accordingly, this is the highest level since 2014, led by large foreign direct investment (FDI) projects in data centers, cloud services, as well as semiconductor and advanced electronics manufacturing.

Critical Sectors

The digital sector, which includes data centers and cloud services, topped last year for the first time the sectorial rankings by value with 150 projects worth a combined 243.3 billion baht in pledged investment. Moreover, major projects in this sector in 2024 included applications to setup large data centers by units of large tech and cloud services companies. Among them are Google (Alphabet) from the U.S., Australia’s NextDC, India’s CtrlS Datacenters, and Singapore-based GDS IDC Services PTE Ltd.

In addition, the electronics and electrical appliances (E&E) sector, which had attracted the largest share of investment in recent years, came in second last year with 407 projects worth 231.7 billion baht. Noticeable large projects in this sector last year included an investment by a unit of Foxsemicon Integrated Technology Inc. (Fiti Group) to build a factory. Accordingly, the factory will make high-precision machinery parts and equipment for the semiconductor industry. Another notable investment was that of FT1 Corporation, a Thailand-Hong Kong-Singapore wafer manufacturing joint venture between Hana Microelectronics and PTT Group to produce silicon carbide wafers.

Meanwhile, the automotive sector came in third with 309 projects worth 102.4 billion baht. Agriculture and food ranked fourth with 329 projects worth 87.6 billion baht, followed by petrochemicals and chemicals with 235 projects worth a combined value of 49.1 billion baht.

“Investors’ response to our policy to promote Thailand as a safe and neutral location for large digital sector and smart electronics projects has been very impressive last year, with important projects by groups like Google, in cloud services, and Foxsemicon, in the semiconductor supply chain,” said Mr. Narit Therdsteerasukdi, Secretary General of the BOI.

“We expect this trend to get even stronger in 2025 following the setup of Thailand’s Semiconductor Board and the need for more companies to mitigate risk in view of the current geopolitical situation.

Other Growth Drivers

In December, Thailand’s newly appointed National Semiconductor and Advanced Electronics Policy Committee (Semiconductor Board) approved the framework for the sector’s strategy. The Thai government estimates it could attract 500 billion baht investment by 2029.

Other sectors expected to see growing investment in 2025 include the production of clean energy, for which the demand is rising especially due to the demand from the digital and electronics sector, Mr. Narit said. Also showing growth potentials this year are the electric vehicles (EV) and parts industry which is still building on the growth seen in recent years. In addition, the agritech and the foodtech sectors, as well as the medical and tourism infrastructures, he added.

The total number of applications for investment promotion in all sectors filed during January to December 2024 increased 40% to 3,137 projects, from 2,235 projects in the same period of 2023. The total adjusted investment value of the project applications for all of 2023 was 846.5 billion baht.

Singapore Tops FDI Source

FDI represented 73% of the total value of applications in 2024, after rising 25% from the previous year.

Singapore led the FDI source rankings with 305 projects mostly in digital services, and electronics manufacturing, representing a total investment value of 357.5 billion baht, or 43% of total FDI applications. Most of the investments came from Chinese and American companies using Singapore as a regional base.

China was the second largest source of FDI applications with 810 projects worth a total of 174.6 billion baht led by PCB, automotive, and metal products manufacturing businesses.

Hong Kong came next with 177 projects worth a total investment value of 82.3 billion baht, including the production of wafer fab, a key raw material in the semiconductor industry, as well as data center, PCB, chemicals and plastics manufacturing.

Meanwhile, companies in Taiwan filed 126 applications worth a total of 50 billion baht.

On the other hand, Japan ranked fifth with 271 projects worth a combined investment value of 49.1 billion baht. Most projects in areas of expertise, such as the automotive and parts sector, motorcycle manufacturing, aircraft tires, digital camera and air conditioner manufacturing, all activities of importance to Thailand’s industrial sector.

28 January 2025