ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

More Investments to Soar India’s Electronics Ecosystem

India has been taking aggressive initiatives to boost its semiconductor and electronics manufacturing industry. In fact, the host of initiatives and reforms have brought major transformation to the industry.

These initiatives have already made a positive impact on India’s electronics and semiconductor industry. Thus, driving capabilities in the country for developing core components and creating an enabling environment.

In an interview with Asia Electronics Industry (AEI) and Dempa Digital, Dr Veerappan, Chairman of India Electronics and Semiconductor Association (IESA), said the country will likely witness drastic improvements in its electronics and semiconductor ecosystem in the next ten years. This as wafer fab projects of Tata Electronics are going on full swing. At the same time, the government is set to announcement more investments of similar scale that will reinvigorate the country’s electronics manufacturing ecosystem.

“Now I see a clear vision and direction by the government to promote manufacturing in the. Maybe in the next ten years…all of these ecosystems will come, it will take time but it will come definitely,” said Dr. Veerappan.

Growing Demand

Currently, the market consumption of electronics in India is about US$150 billion, which Dr. Veerappan said is likely to increase to US$400 billion by 2030. On the other hand, the market consumption of semiconductors in India currently pegs at US$30 billion, which as per IESA estimates will likely shoot to threefolds to US$100 billion in 2030.

However, the strong market consumption for semiconductors and electronics must be complemented with a healthy and strong ecosystem to further India’s potential as a global hub for electronics system design and manufacturing (ESDM).

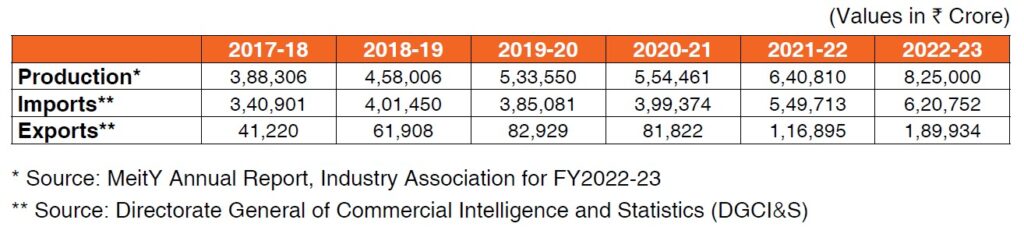

According to a recent annual report of the India Ministry of Electronics and Information Technology (MeitY), domestic production of electronic items has been increasing substantially. Specifically, from Rs3.88 lakh crore (US$60 billion) in 2017-18 to Rs 8.22 lakh crore in 2022-23 (US$101 billion), growing at a Compound Annual Growth Rate- CAGR of 16.28%. The key drivers of growth, according to the MeitY report, are the large domestic market, the availability of skilled talent, and low-cost labor.

Nonetheless, Dr. Veerapan said currently, “India imports everything”, from semiconductor chips to passives and even the rest of electronic components. Thus, the challenge is to ensure India will become a self-sufficient market as far as electronics and semiconductor market needs are concerned.

In the same MeitY report, although import ratio of electronics goods has been on a declining trend vis-a-vis production, imports remain high (Table 1). Meanwhile, CAGR for imports from FY17-18 to FY22-23 stood at 12.7% while CAGR for exports from FY17-18 to FY22-23 recorded at 35.7%.

Dr. Veerappan admitted the supply chain is a challenge in India. Nonetheless, as the Indian government supports investments and infrastructure, completing the ecosystem is just a matter of time.

Completing the Ecosystem

The Indian government, with strong support from the private sector, has been relentless in reinvigorating the country’s ESDM industry. In fact, as early as 2014, the government has launched its “Make in India” program and one of its aim is to make India as the global design and manufacturing hub. Specifically, it envisions increasing domestic manufacturing and reducing dependence on imports for a more self-sufficient ecosystem.

Last year, Tata Electronics’ announcement of building a semiconductor fab is seen as a game-changer to the country’s desire for a more self-reliant electronics manufacturing. Tata Electronics’ planned fab facility in Dholera in Gujarat is a joint undertaking with Taiwan’s Powerchip Semiconductor Manufacturing Corporation (PSMC) with projected investments of about US$11 billion.

The wafer fab will manufacture chips for applications such as power management IC, display drivers, microcontrollers (MCU), and high-performance computing logic. Thus, addressing the growing demand in markets such as automotive, computing and data storage, wireless communication, and artificial intelligence.

Meanwhile, Tata Electronics will also build a state-of-the-art, greenfield semiconductor assembly and test facility in Jagiroad, Assam. The facility will be built with an investment outlay of Rs 27,000 crore (about US$3 million).

Dr. Veerappan said the new fab, which will likely go into production in 2027, will be a big boost to make the country more self-reliant as far as electronics manufacturing is concerned. Although the planned fab, Dr. Veerappan said, will not be sufficient to meet 100 percent the country’s market consumption, the soon-to-rise facility will likely be able to meet about 20 percent of the need. “It (will) definitely not meet everything (electronics demand). One fab is not going to meet (the entire market consumption)…it will take time but we have to start somewhere and the good news it is happening,” said Dr. Veerappan.

The government is likely to announce anytime soon about “two to three more investments” similar to the scale of Tata Electronics which will form part of the India Semiconductor Mission (ISM) 2.0 program, said Dr. Veerappan.

Manufacturers from various countries have been seriously considering locating to India amid impressive programs and incentives.

“Long-term (outlook) looks very promising and the numbers (electronics consumption) are huge, about three- to fourfold increase in 2030. What we are seeing now is companies wanting to come (invest) in India. We’ve seen people coming from Japan, from Malaysia, from Singapore, we see people coming from Europe and elsewhere and they are all good news, something is happening here,” said Dr. Veerappan.

India’s Critical Verticals

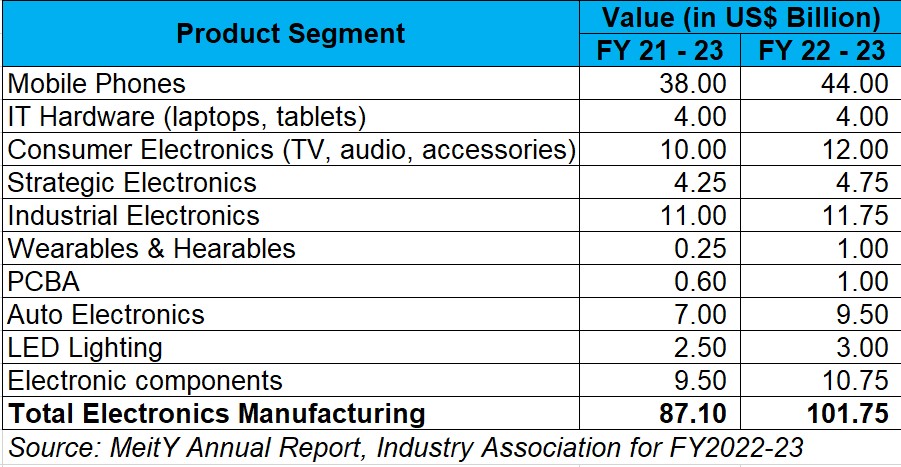

India’s electronics manufacturing has several verticals (Table 2). Without a doubt, the manufacturing of mobile phones tops the country’s production profile of electronics manufacturing with US$44 billion value in FY2022-2023, said MeitY in its annual report. India has emerged as the 2nd largest manufacturer of mobile handsets in the world in volume terms. Over 200 units are manufacturing cellular mobile phones and parts/ components thereof in the country, up from only 2 units in 2014.

Far second in terms of production value are consumer electronics, which comprise of TV, audio, accessories and others, which is US$12 billion during the period. TV is an important device in an Indian household and MeitY said it is identified as one product for which India can become the global hub for manufacturing. Quoting Federation of Indian Chambers of Commerce & Industry (FICCI), India’s TV production alone stood at US$4.24 billion in 2020-2021 period and may reach US$10.22 billion by 2025-2026.

Industrial electronics gained US$11.75 billion in production value in FY2022-2023 and key application segments that are driving growth for this sector include T&M equipment, power electronics, automation and analytical instruments, among others. These are driven by the growth in modernization, automation, and robotics ain Industry 4.0 and Smart Cities setting.

Electronic components (US$10.75 billion), automotive electronics (US$9.50 billion) came next in terms of production volume.

24 January 2024