ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

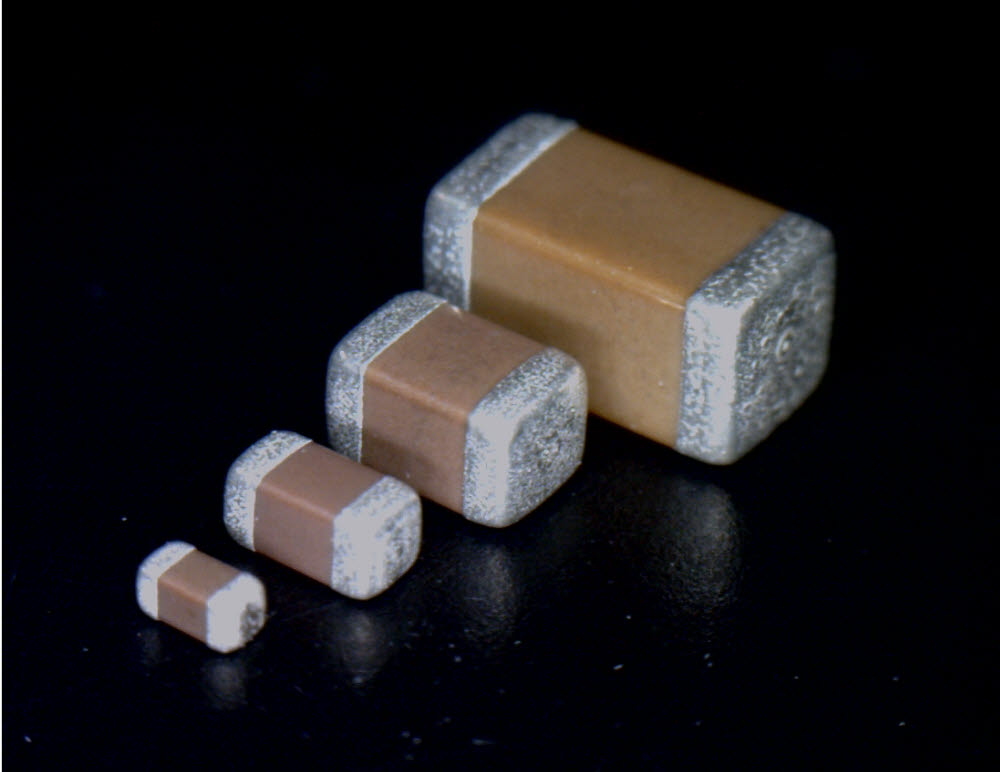

Amotech to Supply MLCCs for ZTE of China

Amotech, Korea’s electronics parts and components maker, has won a deal to supply MLCCs for Chinese telecom equipment giant ZTE.

The win is the newest and latest results of its 3 year-run efforts to first set up mass production system the multi-layer ceramic capacitors and then market and sell one of the most critical components for EVs, cellular base stations, smart phones, self-driving cars, IoT devices, and even medical equipment across the world.

MLCCs are sort of key passive components that control and regulate electric currents on PCBs, As autonomous driving, IoT and 5G communications system are proliferating across a wide variety of applications market, demand for MLCCs has been exploding in recent years, promising to create super boom cycles.

For example, EVs adopt 15,000 MLCCs over average per car, 3 times more than gasoline-powered cars. On the other hand, smartphones incorporate 600 to 1,000 MLCCs over average per unit. Automotive MLCCs are also 4 times more expensive than those for smartphones.

That’s the marketplace where Amotech bets its stake. Amotech is now mainly producing premium, high-end MLCCs like PME and BME electrode types.

A short for precious metal electrode type, PME MLCCs come built with silver, platinum and palladium. Compared with nickel and copper-built in MLCCs, the PME boasts of lower resistance value and higher permission currents. They are also heat-resistant, ensuring strong durability and reliability. So, PME MLCCs are mainly used for high voltage and high temperature applications like 5G base stations, EVs, and medical equipment.

Amotech is also churning out nickel-electrode BME type MLCCs for communications equipment market.

The company expects MLCC business to represent 20-30% of its annual revenue starting from 2022.