ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Semiconductor equipment vendors stay mixed on market demand

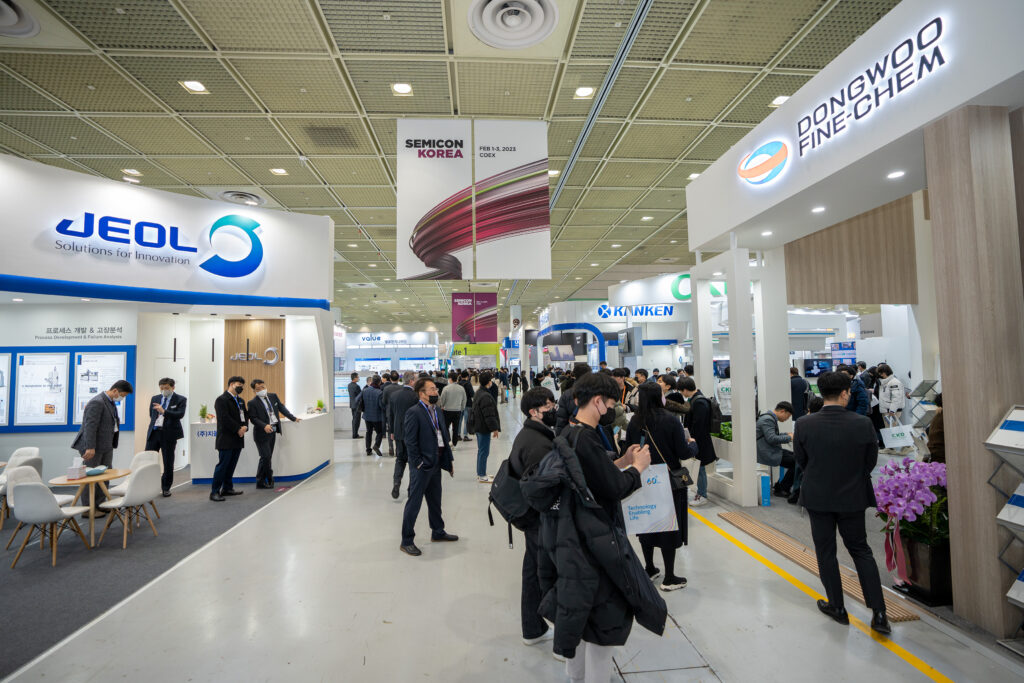

SEMICON Korea 2023 trade show had ended its 3-day hectic and bustling schedule on Feb 3 with mixed sentiments on where global semiconductor market will be heading for in 2023 and beyond.

As the 2023 trade show was the first mass gatherings in 3 years since COVID pandemic broke out in 2020 that mass public were allowed to get in, throngs of attendees were waiting in long lines to have their respective entry cards.

SEMI Korea, an organizer of the show said that there had been about 60,000 attendees were bustling around show floors during the 3-day show period to see what will be trended out a new technology solution, including chip design and fabrication engineers as well as university students.

Engineers were coming in drove to join more than 20 technical programs to get tips on new technology roadmaps, while having free talks with equipment vendors as well as raw material makers to get informed on new machines and chemical materials.

Despite the hustle and bustle there in the air, however, there were also worries over how long the industry’s down cycle will drag on, threatening to discourage investments in fab and utility equipment as well as chip design tools.

Mixed Sentiments

True enough, major chip makers across the world are curbing, or shelving their capital spending plan, blaming it on steep deteriorations in chip demand as well as prices. Reporting the worst quarterly performances in 6 years in the fourth quarter of fiscal 2022 ended on Dec. 31, for example, Intel announced that it will tightening its belts cutting back on payrolls and capital spending. SK hynix also reaffirmed that it will cut back in half its capital spending for 2023, compared with that in 2022.

According to Inna Skvortsova, market analysts and industry research and statistics with SEMI, the global semiconductor industry entered into the down cycle, ending the 3 consecutive growth years of between 2020 and 2022.

“The nature of the semiconductor industry is very cyclical, as we have seen the two boom cycles in the periods of between 2016 and 2018 and between 2020 and 2022. Inflation adjusted economic challenges and geopolitical issues will impact chip demand, the year 2023 will likely be the start of the down cycle,” she said.

Down cycle has begun

All market forecasts on 2023 semiconductor revenues point downward, varying by market research firms. The worst scenario from Future Horizon tells that semiconductor revenues will likely decline by 22%, while Omdia stay relatively optimistic with forecasts that they would edge down just 0.2% Other median forecasts tell that they would drop in a range of between 3.6% to 5.8%.

On average, the market consensus tells that the semiconductor revenues would slump by 7% from a year ago to reach US$550 billion in 2023.

Accordingly, semiconductor equipment market is forecast to contract by 16% to hit US$91.2 billion in 2023, ending the 3 consecutive years of spectacular go-go growth period between 2020 and 2022.

The contraction is already being felt widely across show floors. Kanken Techno, a Japanese maker of scrubber and gas deoxidation equipment, for example, had received only half what the company was originally supposed to secure from Korean chip makers in 2022.

Horiba, a Japanese MFC, or mass flow controller maker, said that its massively bloated backlog orders have been rapidly fading away as new orders have been tricking in, reflecting capital spending crunches across chip makers

Yet, not all of equipment vendors are necessarily falling victims to the spending crunches. Some of them, who are supplying future-proof equipment and tools like EUV lithography and related parts and components, will be relatively less affected, as those are what chipmakers can’t help investing in on their roadmap for a next generation of technology

Turn upward in 2024?

A case in point is Lasertec, a Japanese wafer and photomask inspection equipment maker. Unlike other semiconductor equipment makers that suffer from cutback in orders, the company still keeps its production lines busy with receiving a rush of new orders for EUV photomask and pellicle inspection equipment.

“EUV lithography equipment and other related peripheral tools and machines are one of sure-bets that chipmakers must keep investing in even in the down cycle, as those are the sort of future proof technologies that can surely guarantee sizeable returns on their investments when the next boom cycle begins. That helps explain why we will stay less affected even in the down cycle, “ said Lim Choon-Gab, director with Lasertec Korea Corporation, a Korean subsidiary of Lasertec of Japan.

True enough, the industry’s decades-old conventional wisdom tells that the down cycle would be the right moments to invest in future, state-of-the-art future technologies, as it will not only allow chipmakers to reap huge returns on their investments, but also widen the technology gaps with competitors.

Sticking by the maxim, for example, SK hynix confirmed that they would keep investing in high-end premium production line-up like HBM ( high bandwidth memory), 200 layer and higher 3D NAND flash memory chips, and DDR5 DRAM chips, while cutting back investments in others. The company announced that it would cut its 2023 capital spending in half compared with that in 2022, but keep investing in EUV lithography equipment to keep rolling out high-end products

Samsung Electronics is even regarding the upcoming down cycle as a blessing in disguise to further widen the technology gulf with competitors.

Industry analysts echo that EUV, 3D nanosheet, 3D DRAM chips, high-k metal, and 200 layer and higher 3D NAND flash memory chips would top chipmakers’ capital spending plan in 2023, as winners would be those who can afford or dare to invest in theses leading-edge and future-proof technologies.

Data-guzzling AI drives market recovery

“EUV will continue attracting investments from foundry as well as memory chip makers, and nanosheet-based 3D chip-making technologies like Samsung Electronics MBCFET, multi-bridge channel FET will also likely be hot investments destination, as chip makers are aggressively working on 3nm and 5nm circuitry technologies, “ said Dr. Choe Jeongdong, senior technical fellow with Tech Insights.

He added that 3D DRAM chip-processing technology would be another hotly competitive area for capital spending, as memory chip makers weighing up and down whether the 3D cell-stacking would become a more cost-effective alternative to prohibitively expensive EUV photolithography technologies.

Even though their fortunes are mixed, what semiconductor equipment makers across show floors have shared is that global semiconductor chip and equipment market would pick up in 2024, ending a short one year-run down cycle. And they put a huge bet on AI technology hoping that it would be another compelling killer app to lead the round of boom cycle, as AI lives on massive feeds of data, driving up in turn huge demand for new computing power and data storage space.

“For a long-term, the industry has a very strong growth potential, particularly driven by such mega trends as AI, Big Data Analytics, machine learning, and seamless connectivity across all the system and devices, “ Inna Skvortsova, market analyst with SEMI. “We forecast that global semiconductor industry will reach US$ 1 trillion over the next 8 years, or in 2030. That will require new fabs, new investments, new skillful workforce, ” she added.