ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Japanese Parts Makers Eye Sales, Profit Rebound

Many Japanese-affiliated electronic component manufacturers have expressed optimism for FY2024 (April 1, 2024 to March 31, 2025). Most importantly, many are eyeing a better business performance than the previous fiscal year.

In its 2024 Management Survey, Dempa Publications ran a survey among major Japanese electronic component manufacturers in December 2023. Accordingly, nearly 40 percent of the companies surveyed plan double-digit sales growth for FY2024. Moreover, half of the companies plan double-digit or higher operating profit growth.

The electronic components market continues to be in an adjustment phase and remains somewhat weak at present. Nonetheless, the industry is bracing for a return to a growth trajectory in FY2024.

Bullish Projection

In addition, about 75 percent, or 24 of the 32 surveyed companies, said their sales target for FY2024 will “increase” compared to FY2023. Moreover, about 12 companies answered they would “increase by double digits or more” and another three companies responded “same level as the previous year”. Meanwhile, about five companies thought their sales would “decrease” in FY2024.

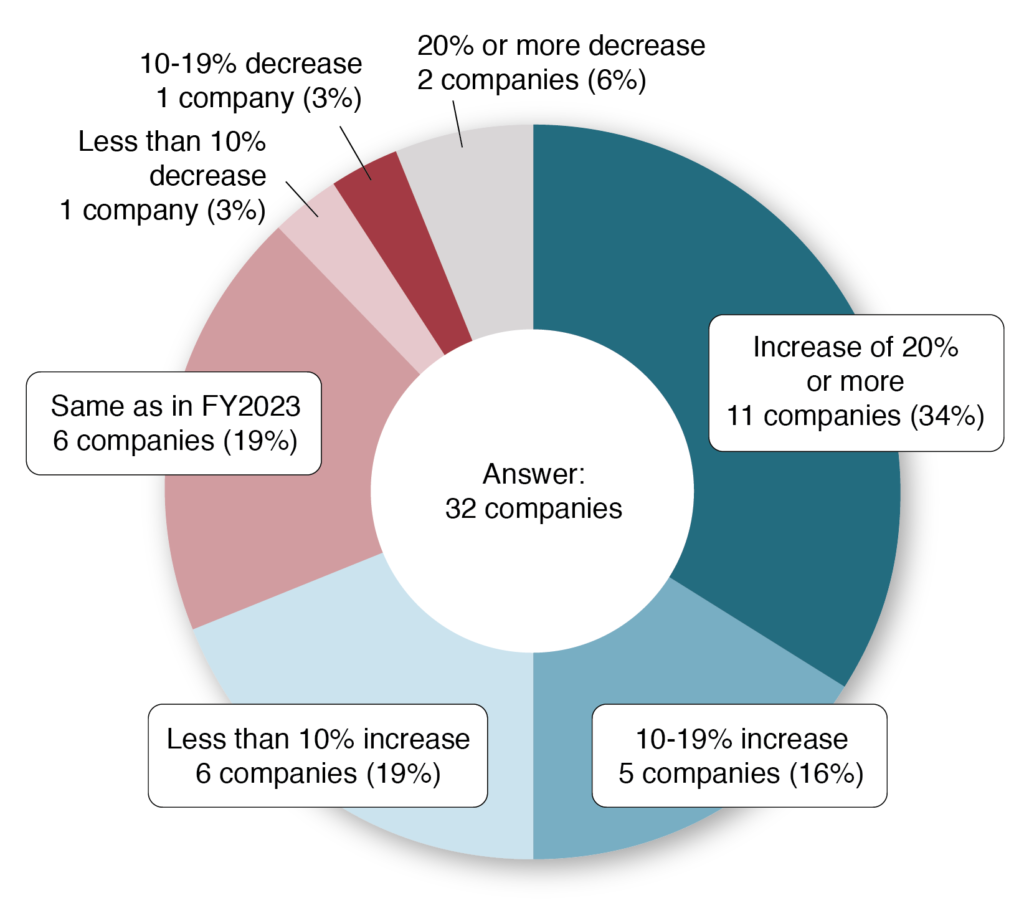

About 70 percent (22 companies) said they will see an “increase” in operating for FY2024 while 16 companies said they will experience double-digit increases.

Meanwhile, 11 companies thought their operating income would “increase by 20 percent or more,” about one-third of the total surveyed. On the other hand, three companies reported they might suffer a “double-digit or greater” decrease in profits.

Gradual Recovery

Global demand for electronic components bottomed out in the first half of 2020. Particularly, during the height of the global outbreak of the new coronavirus disease. It somehow reversed in the second half of 2020, with strong growth from 2021 to 2022. Specifically, from the second half of 2021 onward, the performance of component companies expanded favorably. Thus, benefiting from BCP inventory buildups by component users against supply chain disruptions and the weak Japanese yen. In addition, many electronic component manufacturers posted record-high performance in FY2022.

On the other hand, the electronic components market in 2023 has been weak since the beginning of the year. Particularly, due to sluggish demand for components for consumer and industrial equipment, etc.

In the second half of FY2023, the current order situation remains weak due to the longer-than-expected parts inventory adjustment in the industrial equipment market. Furthermore, the further deterioration of the Chinese economy.

On the other hand, customer demand for parts has been softening after a prolonged period of adjustment. The demand for electronic components is likely to recover gradually from the spring of 2024 onward. That is, with the considerable progress in supply chain inventory adjustments.

Profitable Future

In addition, electronic component companies will accelerate marketing and technology development targeting growth and new fields, aiming for further earnings growth through self-help efforts.

By field, the companies will capture new business by catching up with demand in the automotive market driven by electric vehicles and Advanced Driver-Assistance Systems (ADAS), Artificial Intelligence (AI), and decarbonization.

Meanwhile, in terms of operating income, profitability is likely to improve through progress in structural reforms and optimization of sales prices of electronic components.

Note:

The aforementioned article was translated from a Japanese article originally published in the Dempa Shimbun Daily.