ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

IC Equipment Sales to Top Breakthrough US$100B Mark

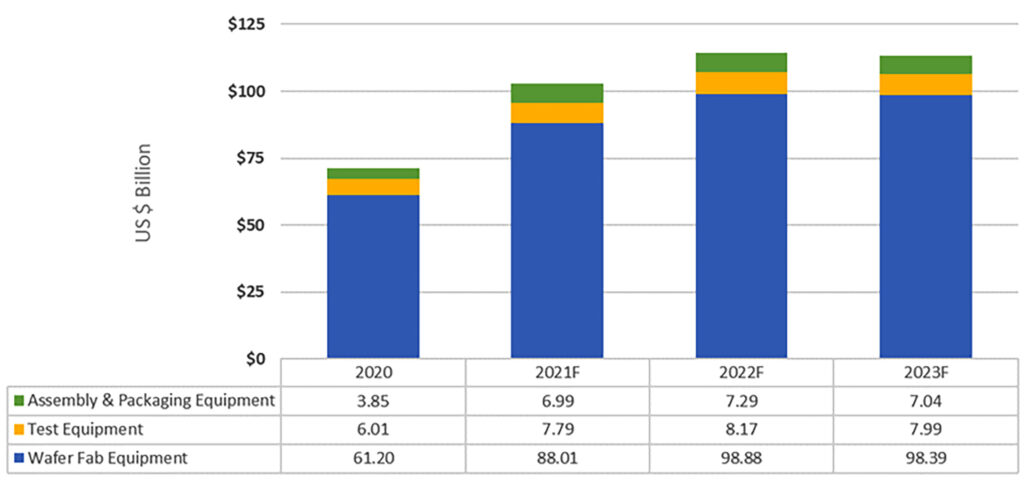

SEMI forecasted total semiconductor manufacturing equipment by original equipment manufacturers to reach a new high of US$103 billion in 2021. Incidentally, this surge is 44.7 percent higher from previous year’s US$71 billion.

Recently, SEMI released its Year-End Total Semiconductor Equipment Forecast – OEM Perspective and announced highlights at SEMICON Japan in Tokyo.

SEMI said it expects the growth to continue with the global total semiconductor manufacturing equipment market expanding to US$114 billion by 2022.

Expansion of Front End, Back End

Ajit Manocha, SEMI President and Chief Executive Officer said crossing the US$100 billon mark in semiconductor manufacturing equipment is a big feat already. Therefore, Manocha said this reflects global semiconductor industry’s concerted and exceptional drive to expand capacity to meet strong demand. “We expect continuing investments in the digital infrastructure buildout and secular trends across multiple end markets to fuel healthy growth in 2022.”

Both the front-end (wafer fab) and back-end (assembly/packaging and test) semiconductor equipment segments are contributing to the global expansion. Particularly, the forecast said wafer fab equipment segment, which includes wafer processing, fab facilities, and mask/reticle equipment, will expand 43.8 percent. Hence, this will hit a new industry record of US$88 billion in 2021, followed by a 12.4 percent increase in 2022 to US$99 billion. Wafer fab equipment in 2023, however, will decrease slightly by -0.5 percent to US$98.4 billion.

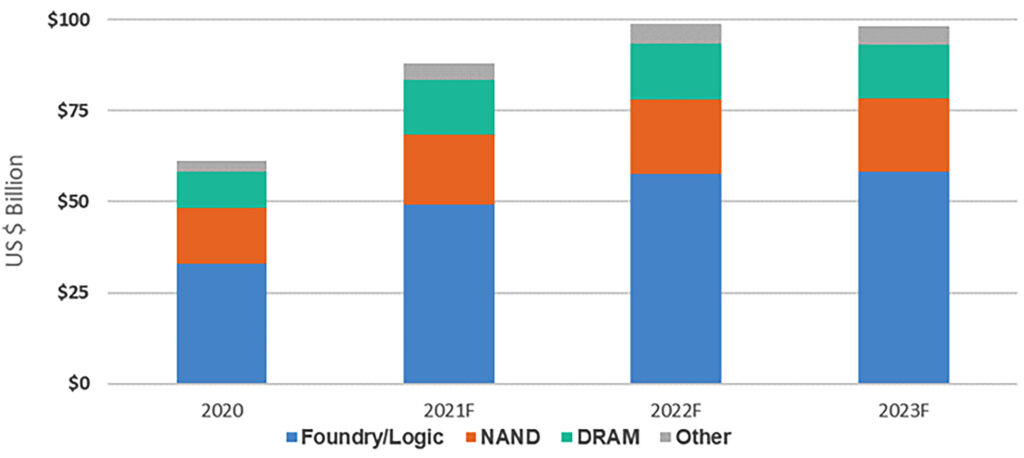

The foundry and logic segments, accounting for more than half of total wafer fab equipment sales, will surge 50 percent year-over-year to reach US$49.3 billion in 2021. Consequently, demand for both leading-edge and mature nodes drove the growth for the year. The study expects growth momentum to continue in 2022 with the foundry and logic equipment investments rising 17 percent.

Strong enterprise and consumer demand for memory and storage is contributing to strength in DRAM and NAND equipment spending. The DRAM equipment segment is leading the expansion in 2021 surging 52 percent to US$15.1 billion and growing 1 percent in 2022 to US$15.3 billion.

China Maintains Top Post for Equipment Spending

On the other hand, the NAND equipment market will grow 24 percent to US$19.2 billion this year. Consequently, it will grow 8 percent in 2022 to US$20.6 billion.

After seeing robust 33.8 percent growth in 2020, the assembly and packaging equipment segment will surge 81.7 percent to US$7 billion in 2021. Meanwhile, its growth will continue in 2022 by another 4.4 percent increase driven by advanced packaging applications.

SEMI expects the semiconductor test equipment market to grow 29.6 percent in 2021 to US$7.8 billion. It will continue to expand by 4.9 percent in 2022 on demand for 5G and high-performance computing (HPC) applications.

Correspondingly, SEMI forecasted China, Korea, and Taiwan to remain the top three destinations for equipment spending in 2021. China maintains the top position, which it claimed for the first time in 2020. Moreover, Taiwan will regain the top position in the market in 2022 and 2023. Equipment spending for all regions tracked are like to grow in 2021 and 2022.

Tracks Opportunities in Japan

Meanwhile, SEMICON Japan opened Wednesday (Dec. 15) at Tokyo Big Sight with a focus on innovation opportunities and business growth potential. More than 450 exhibitors will join microelectronics industry leaders and visionaries from across the electronics supply chain at SEMICON Japan 2021 Hybrid.

Themed Forward as One, SEMICON Japan 2021 Hybrid features leading-edge technologies that are driving demand. Among the pavilions include 5G/Post 5G Pavilion, FLEX Japan, Power and Compound Semiconductor, Quantum Computing, Smart Mobility, among others.

“I am happy to welcome the industry back to the show floor as we work together to help solve some of the world’s greatest microelectronics challenges,” said Jim Hamajima, President of SEMI Japan.