ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Study Sees Additive Manufacturing Surge to $50B

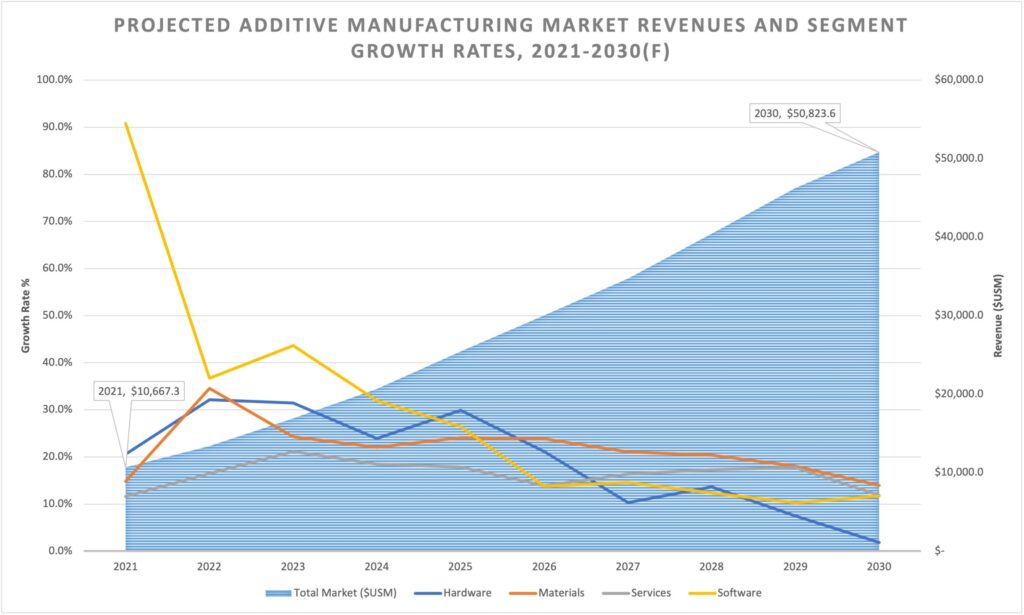

Market research firm SmarTech Analysis said Q4 of 2021 capped a strong year for additive manufacturing markets. Similarly, it saw the growth rate for all additive hardware, materials, software, and outsourced services in 2021 at 18 percent year-on-year to US$10.6 billion.

SmarTech projected total additive manufacturing market to reach US$50.8 billion by 2030.

Specific to metals, the market grew 16 percent, to US$3.9 billion in 2021. Specific to polymers, the market grew 13 percent, to US$5.8 billion. Meanwhile, SmarTech believed software have grown significantly from 2020 to account for the remainder and worth US$900 million in 2021.

Q4 Signals Recovery Trend

Beyond the annual data, the report also provides numbers for Q4 2021. The fourth quarter saw the recovery trend continue with strong single digit year-over-year growth, and healthy continued sequential growth compared to Q3 2021.

Scott Dunham, SmarTech Analysis EVP Research, commented, “Clarity and context are extremely important when considering 3D printing market data. Our top line numbers comprise additive hardware, materials, software, and outsourced services only.”

Dunham added these totals do not include ancillary equipment used in additive manufacturing production, or service contract revenue from machines sold. “Even without these peripheral markets, the 3D printing industry’s core market data supports a very consistent historical upward trend.”

Nonetheless, Dunham said a slight COVID-related downtick in 2020 has given way to increased adoption due to technological improvements and increasing economies of scale. Perceived value of AM technologies has ramped up with consideration towards risks to globalization posed by the pandemic and the Russia-Ukraine war.”

SmarTech’s “Core Metals” and “Core Polymers” market data products include four years of historical quarterly data and provide 10-year forward forecasts. Quarterly reports on the metal and polymer additive manufacturing markets are available as well as SmarTech’s website.

From the Report

One of the primary underlying growth drivers for the 2022 additive manufacturing outlook is the advancement of standardization at the industry level. Throughout 2021, progress was visible in development projects.

Furthermore, several key product refreshes in the metal powder bed fusion segment throughout 2021 proved to capitalize on the forward momentum and interest in additive technologies. Especially, these trends coincided with the Formnext trade event.

New product lines and system updates from 3D Systems, Additive Industries, Renishaw, and others will all likely come to market this year to reenergize the competitive landscape. In addition, this will provide prospective users with even more opportunities to leverage additive manufacturing to create value in their organizations

Particularly, two end user markets stood out in terms of additive manufacturing adoption in 2021. Especially, during a year of numerous ongoing challenges with supply chain delays and disruptions.