ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Mounter Makers Make Strategic Step in Non-SMT Business

Major surface mount technology (SMT) manufacturers have been making strategic steps to expand their business. Some companies deploy mounters and related machines to other businesses. Meanwhile, others make foray into new business fields by applying their core technologies, while some clinch merger and acquisition (M&A) deals.

Foray in Robot Solutions

FUJI Corporation positions as flagship businesses robot solution focused on mounters, and machine tools. In the robot solution business, the company promotes FUJI Smart Factory. Since 2015, the company has been actively starting new businesses.

Thus far, the company has brought to operation Tough Plasma atmospheric pressure plasma unit, Quist delivery locker system, SmartWing compact multi-joint robots, Hug T1-02 transfer support robot, THANK community contribution business, and three-dimensional (3D) electronics printers.

Further, FUJI has advanced business deployment with FASFORD TECHNOLOGY CO., LTD., a Japanese semiconductor manufacturing equipment manufacturer, through M&A. Overall, FUJI has been steadily boosting business performance of all these new businesses.

For example, demand for transfer support robots has been increasing against the backdrop of higher nursing load on healthcare personnel. Moreover, serious shortage of caregivers amid the aging society is also a major factor.

Automated Welding Solution

Panasonic Smart Factory Solutions Co., Ltd. (PSFS), a manufacturer of mounters and other SMT machines, started operating as the Process Automation Business Division of Panasonic Connect Co., Ltd. Meanwhile, Panasonic Connect was inaugurated following transition of the Panasonic Group to a holding company on April 1.

The Process Automation Business Division positions “site process” business domain as its core business. It creates new solutions targeting customers in various fields, including the manufacturing industry. To this end, it utilizes the synergy between equipment that integrates process technologies, like mounting and semiconductors, flat panel displays (FPDs), manufacturing, and welding and laser processing; and digital technology, centering on internet of things (IoT) and machine-to-machine (M2M).

Specifically, in its welding machine business, the Process Automation Business Division has expanded integrated Welding Network Box (iWNB) for Welding Machines. iWNB is a welding robot solution of PSFS. It leverages iWNB and welding monitoring system to advance the digitalization and visualization of the entire process.

Robots for Smart Agriculture

Yamaha Motor Co., Ltd. defines its robotics business domain as one of priority businesses. The company promotes One-Stop Solution in its SMT business.

In July 2019, the company established Yamaha Robotics Holdings Co., Ltd. (YRH) with SHINKAWA Ltd., APIC YAMADA Corp., and PFA Corp. as group companies. Upon establishment of YRH, Yamaha Motor has promoted the merger of semiconductor back-end process and mounting of electronic components. With this step, it has advanced a business strategy on top of its existing business domain.

In the factory automation (FA) business, the company develops and manufactures various industrial robots necessary for automated production lines. These include single-axis robots, SCARA robots, articulated robots, and linear conveyors. The company will enter the collaborative robot market, as a new business, by the end of FY2022.

Additionally, Yamaha Motor has entered the advanced agriculture segment. It now develops products, systems and solutions targeting to achieve smart agriculture through high-level merger of robotics and mobility.

JUKI Sets Sights on Inspection Business

JUKI Corporation’s industrial equipment and systems business mainly focused on mounters. However, it has now ventured in the non-mounting business field as a priority strategy. The company targets sales ratio of 68 percent for mounters to 32 percent for non-mounters in FY2022. Moreover, it targets a sales ratio of 53 percent to 47 percent in FY2025.

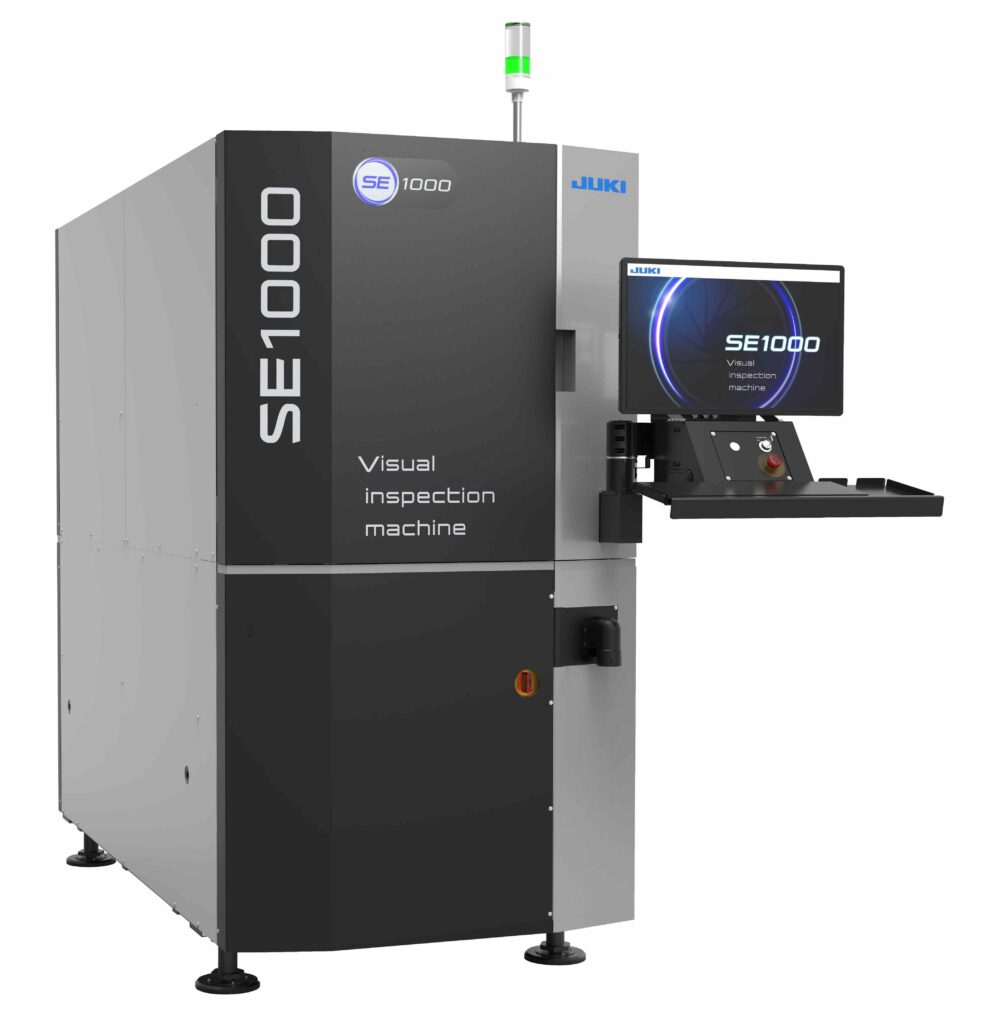

In the non-mounting field, JUKI released in Dec. 2021 the SE1000 automatic visual inspection machine through collaboration with XTIA Ltd., a Tokyo-based venture company with laser technology. SE1000 detects defects and measures dimensions of metal components for automobiles and other products. It enables high-speed, high-accuracy inspections of metal components, and contributes to deskilling, labor saving, and higher efficiency in the inspection process, which requires manpower.