ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Smart Manufacturing Prospects to Reach Full Throttle

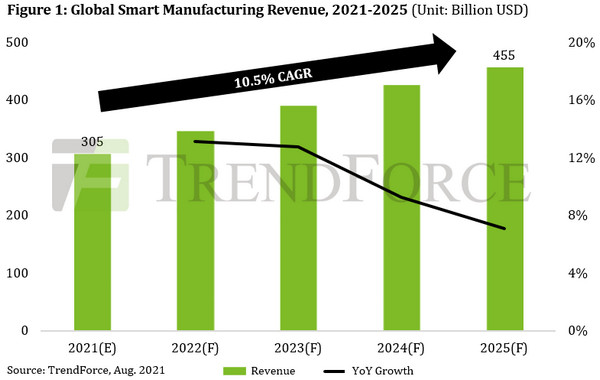

Research and market intelligence provider TrendForce said the global smart manufacturing market is expected to welcome a golden period of growth across five years, starting with an annual revenue of US$305 billion in 2021. The growth is expected to even surpass in US$450 billion in annual revenue in 2025 at 10.5 percent compound annual growth rate (CAGR).

This growth can be attributed to several factors, including the accelerating digital transformation efforts from enterprises, the increased demand from industrial automation and stay-at-home applications, and the emergence of fifth generation (5G) communications, advanced artificial intelligence (AI) technologies, and other value-added services.

For next year, TrendForce believes the outlook of smart manufacturing has evolved from such conservative strategies as improving the resilience of the manufacturing industry itself, to increasing the industry’s production capacity as well as efficiency while reducing both energy expenditure and carbon emissions. These advantages are expected to serve as the main drivers propelling the growth of the smart manufacturing market next year.

Key Metrics for Smart Manufacturing

The core feature of smart manufacturing lies in its ability to deliver instant feedback by integrating virtual data and real, physical equipment. Hence, low latency, high security, and fast computing power have become increasingly important for smart manufacturing development. This will revolve around edge computing and 5G applications, including AR/VR, machine vision, digital twins, and predictive maintenance, all of which will experience considerable upgrades in functionality thanks to smart manufacturing.

Furthermore, as the issue of global warming gains more and more media coverage, 137 countries have now committed to achieving carbon neutrality. This pursuit of environmentally friendly outcomes is also reflected in the current state of Industry 4.0 development. For instance, companies including Henkel, Johnson & Johnson, Siemens, and Tata Steel all operate manufacturing facilities that qualify them for membership in WEF’s Global Lighthouse Network. These companies have ensured their facilities operate with optimized energy consumption, highly effective manufacturing processes, and reduced carbon emissions through the adoption of computer simulation/modeling and smart management. TrendForce expects the future design of smart manufacturing equipment and factories to center on the use of environmentally friendly IoT technologies.

Taiwanese Makers to Seize Shares

The Taiwanese manufacturing industry possesses certain competitive advantages in the global market, including a highly consolidated supply chain, a relatively comprehensive smart manufacturing value chain, and the ability to deliver highly customized solutions. Various Taiwanese manufacturers specialize in full-service, integrated smart solutions that feature equipment health monitoring and machine vision functionalities, thereby significantly lowering the barrier for adoption. If the domestic industry can continue leveraging their existing competitive advantages and furthering their current developments, TrendForce expects micro-factories to become the key factor through which Taiwanese companies can find commercial success in the global smart manufacturing industry.

Although the smart manufacturing value chain has historically had its various verticals spread throughout the world, recent trends such as a return of domestic manufacturing and tectonic shifts in the manufacturing industry have resulted in the rise of shortened supply chains as well as localized operations.

These developments have led to the recent surge of micro-factories. Research by TrendForce indicate that, in addition to their high degree of automation and analytical accuracy, micro-factories deliver improved manufacturing outcomes while minimizing resource consumption and yielding such benefits as a flexible supply chain, lean human resources, and low initial cost. Micro-factories have already seen widespread usage in the global automotive and electronics industries considering these benefits. Likewise, TrendForce believes that Taiwanese manufacturers of bicycle chains, steel nuts/bolts/screws, and suitcases will likely succeed in their respective niche markets by upgrade their manufacturing operation with micro-factories.