ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

New Trends to Propel FA, Equipment Investments

This year, the industry expects capital investment in the manufacturing industry to recover. Moreover, factory automation and the manufacturing equipment industry are likely to come back to life as well.

There are strong prospects that a variety of factors will accelerate innovation and lead to increased demand for evolving FA and manufacturing equipment. This includes the relocation of production sites due to heightened geopolitical risks and production automation as the population declines and young people leave the manufacturing industry. Also, more factories will introduce robots and more factories will adopt smart measures.

In 2023, the FA and mounter equipment industry expected semiconductor and parts and materials shortages, which started in 2022. Moreover, the electrical and electronics equipment manufacturing industry will fulfill its backlog of orders. Furthermore, investment in new SMT equipment will likely expand amid emerging trends such as 5G, electric vehicles (EVs), carbon neutrality, and digitalization (DX).

Nonetheless, the cautious capital investment in the electrical and electronics equipment manufacturing industry remains. Particularly, amid heightened geopolitical risks and uncertainty, which is likely to impact the SMT industry. Thus, resulting to declining sales and profits in the first half of FY2023.

Joji Isozumi, President and COO of FUJI Corporation said, “In the second half of 2023, there will be a movement in capital investment in China’s local smartphones, automotive applications, EMS, etc. In addition, there will be an increase in demand for the introduction of equipment evaluations. In 2024, we expect capital investment to start recovering based on these signs.”

The Indian Market in the Spotlight

India’s remarkable economic growth is attracting global attention, and Japanese manufacturers are actively investing in the country by setting up factories.

In the factory automation industry, Mitsubishi Electric Corporation established a new production facility in Talegaon, Pune in December 2023. It will produce inverters and expand as a global production base.

On the other hand, THK Co., Ltd. established a new plant with a land area of 205,000sq.m, with a floor area of 37,000sq.m, in Sri City, Andhra Pradesh. Particularly, the new plant will produce the LM Guide direct drive unit.

For the time being, the plant will produce products for overseas markets such as countries in Southeast Asia and Europe as well as in the United States. If demand in India increases, 90 percent of the production will cater to domestic market. In the future, the Indian plant will likely become the company’s main plant.

Japanese EMS companies are also expanding their investment in India. KATOLEC Corporation established a manufacturing company in Pune in 2018.

Meanwhile, Rexxam Co., Ltd. also started production activities in its EMS business in 2022 through a joint venture with Dixon Technologies (India) Ltd. While China has accounted for 70% of the company’s EMS business, the company plans to expand both its Thai and Indian plants as global production bases.

In the area of mounting machines, FUJI established a subsidiary, FUJI INDIA Corporation Pvt. Ltd. in Gurugram city in India’s Haryana state in March 2020. Meanwhile, JUKI established a central sales office and showroom in Bangalore. The company is also doing business in Mumbai and Delhi.

On the other hand, Yamaha Motor Co., Ltd. established a new company, MOTO Business Service India Pvt. Ltd., in Bengaluru in March 2022.

Active Investments in Mexico

Japanese manufacturers are actively investing in Mexico. Electronic equipment manufacturers, including SMT-related and EMS companies, are accelerating their expansion into Mexico. Particularly, targeting demand for in-vehicle electrical components and other products.

JAPAN UNIX Co., Ltd. is expanding its soldering business globally, centering on soldering robots. The company has opened an office in Monterrey, its second base in Mexico after Guadalajara. This brings the company’s total number of overseas bases to nine, including two in China, Korea, Malaysia, Taiwan, North America, and India.

In the SMT field, Saki Corporation entered Mexico and opened a new office in Zapopan, Jalisco in August 2023. Located in Guadalajara, the Mexico office is home to the company’s Mexican subsidiary, Saki America de México S.A. de C.V. (Saki Mexico). Particularly, this subsidiary provides customers throughout Mexico and the Americas. Thus, it is an important base for providing state-of-the-art AOI and SPI solutions to customers throughout Mexico and the Americas.

In EMS, KAGA Electronics Co., Ltd. is constructing its second new plant in Mexico at Parque Industrial Millenium, Arroyos, San Luis Potosí, in the Arroyos Millennium Industrial Park. Operations will commence in April 2024.

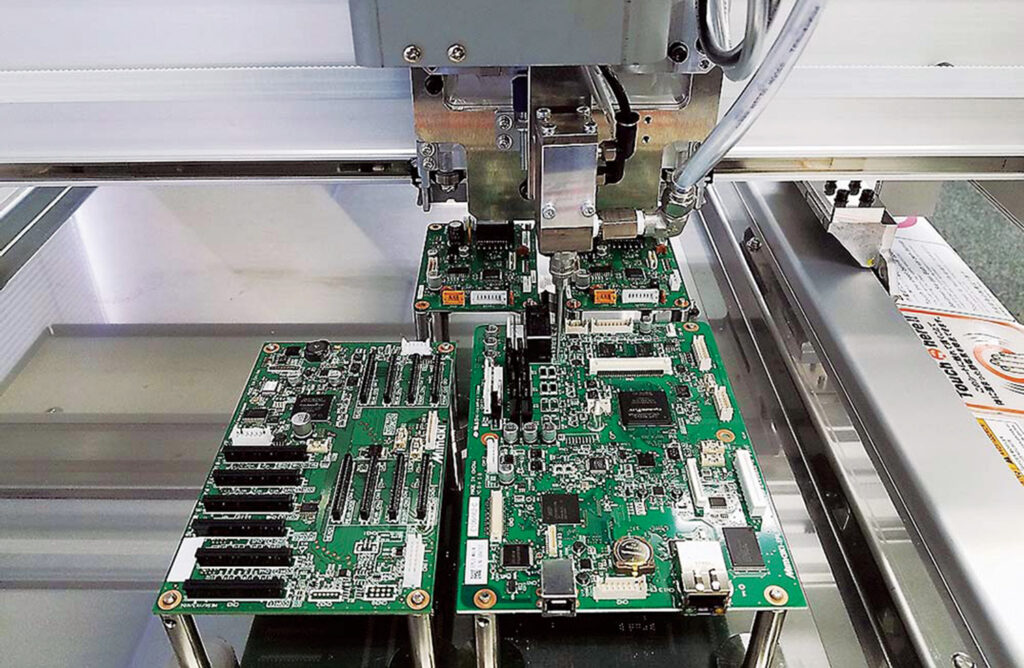

Among Japanese EMS companies, SIIX Corporation is already operating in San Luis Potosí, San Luis Potosí, San Luis Potosí. The company produces board mounting mainly for the automotive equipment field, mainly for the North American market.