ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

To Beat Rising Costs, Makers Study New Solder Base

Prices of non-ferrous metals have been rising of late. Because of these, skyrocketing prices of tin, silver, and copper, which are main materials of solders, have been impacting the solder industry. The price of tin has climbed sharply, and solder manufacturers have been struggling to cope with rising costs. Because of this, manufacturers are exploring ways to find new solder base.

Solder is a kind of alloy and in the past, the mainstream components are tin (Sn), copper (Cu), and lead (Pb)-based solders. Nowadays, however, solder products that use Sn and Cu as base employ silver (Ag) in lieu of Pb because of its impact to the environment.

Eyes New Solder Base

Since 2000, the Japan Electronics and Information Technology Industries Association (JEITA) has set an industry standard in Japan. It endorsed Sn-3Ag-0.5Cu (SAC305), which employs Sn and Cu as base materials and includes 3 percent Ag (mass ratio). Home electric appliances and audio-video (A/V) equipment manufacturers widely adopt the SAC305 standard.

The challenge however lies on the price of silver. In 2000, the price of 1g of silver was only ¥20 and went up to ¥50 in 2010 and has increased steadily since then. Although the price decreased briefly in 2019, it recorded an average price of ¥90 to ¥100 in 2021.

Silver accounts to about half of the total price of solder. Pressured by the increase in price of silver, solder manufacturers have been advancing the development of low-silver and silver-less solders by decreasing silver content. They are exploring to include other materials, such as indium (In), cobalt (Co), antimony (Sb), and germanium (Ge). They are also studying the possibility of using multiple elements.

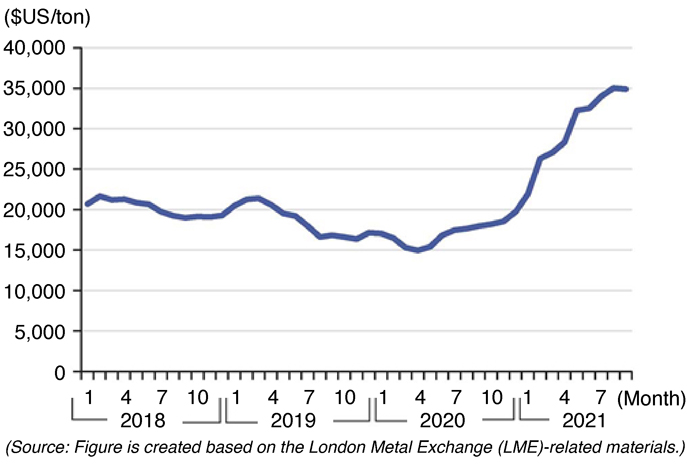

Sn prices have also made steep increases and the international price indicator is the London Metal Exchange (LME). From US$21,920 per ton in January 2021, the average price shot up to US$36,000 per ton in September.

China and Indonesia produce nearly half of the global production of Sn. Indonesia exports the largest amount, while China accounts for 40 percent. Other countries that produce Sn include Myanmar, Peru, Brazil, Bolivia, Nigeria, Congo, Australia, Vietnam, and Malaysia.

COVID-19 pandemic-related lockdowns forced temporary suspension of Sn production, which caused the drop in supply. However, as global economies return to normalcy in recent months resulted to sudden expansion of demand. Analysts say notion this caused the supply-demand balance to collapse, leading to Sn price hikes.

Revisits Pricing System

Cu prices surpassed US$9,000 per ton in 2011 after the 2008 financial crisis. However, the price turned to a downward trend in the second half of 2014 with the plunge of crude oil prices.

Since 2016, however, the expansion of investments and infrastructures in China swirled Cu prices and this has been the case until recently. Closure of copper mines because of the pandemic also reduced Cu supply and contributed to the price hikes.

Another major factor is the global trend towards decarbonization. Copper has high conductivity and reduces energy consumption necessary for power generation facilities. Hence, the demand spiked for copper wires with high conductivity for environment-friendly infrastructure, such as smart grids and wind-power generation systems. The supply component, however, was not able to catch up. Hence, decarbonization efforts might contribute incessant price hikes within the next ten years, which analysts predict to reach US$15,000 per ton.

To cope with skyrocketing tin and copper prices, solder manufacturers have been revisiting their pricing system until supplies stabilize.