ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

Countries Join Onshore Fab Build-up Frenzy for Stable Supply

Geography suddenly comes to matter in the race for global leadership in foundry chip market.

The Covid-19 pandemic has been restricting cross-border movements of goods, services, and even human, threatening to disrupt an entire global supply chain network for everything from chips to automobiles to smartphones.

To make its economies less susceptible from the possible disruption, advanced countries across the world are looking inwards to establish their own chip-making eco-system in their home turf or somewhere nearest to and from their home countries, which are geopolitically stable

That onshore production is a compelling move to make their key industries like automotive less immune from the disruption, as chip are becoming increasingly important key technology enablers to produce everything from EVs to autonomous cars to smart phones to 5G to AI and IoT solutions.

National security is another convincing motive for creating their own chip-making ecosystem build-up project, as semiconductors have already become one of each country’s strategically important national assets for aerospace and military build-ups -as crucial as petroleum oil.

Leading the shift in the Asia-centric geographical concentration of global chip-making ecosystem into home countries or geopolitically stable countries is the U.S., which is aggressively attracting foreign chip makers and their suppliers in Asia and Europe alike to invest in the U.S. territory to join the U.S. government’s initiative to create its own chipmaking ecosystem.

Fabs at Home

An epicenter of technological innovations for chip-making and chip-designing, the U.S. is home to an army of fabless chip makers as well as crucial chip-making equipment and software tool makers, but mostly depends on Asian foundry chip makers’ wafer fab facilities for chip production.

Feeling fearful that the dependance would undermine its economies and national security to the root, the U.S. is angling to reestablish its own chip-making ecosystem on its home turf, attracting foreign foundry contract chip makers with preferential investment policy.

For foundry chip-makers, the invitation presents new challenge as well as new market opportunities, as they have to take risks to raise big enough money to invest, but also can seize the opportunities to expand their reach.

Th world’s two foundry contract chip-making rivals – TSMC and Samsung Electronics – are already moving in that direction to cash in on the invitation, finding the geographical proximity as important in winning contract chipmaking orders from fabless chip makers as technology ramp-up plan and economies of scale in the post-Covid-19 era

Samsung Electronics announced on Nov. 24 that it will invest about US$17 billion won to build a brand new 300mm foundry wafer fabrication facility in the city of Taylor, Texas, U.S. With the construction expected to begin in 2022, the new fab facility will come online by 2024.

The investment marks Samsung’s first mammoth capital spending on the U.S soil ever in 28 years since 1998 when the chip maker invested in Austin Texas, a 40km away from Taylor City to build its first offshore wafer fabrication facility.

The closely located facilities will work in sync to serve as a major player to support a newly-to-be-built U.S. wafer fabrication ecosystem, as the U.S government is now trying to rebuild a globally-scattered semiconductor chip supply chain network around its own U.S.-based manufacturing cluster.

TSMC is also constructing its first U.S. foundry fab facility in Arizona, U.S. Scheduled to come online by 2024, the US$12billion wafer fab facility will mainly produce 5nm-wider circuitry chips of U.S. fabless chip makers’ designs.

Serve Fabless in U.S.

True enough, working in geographical proximity to their customers’ premises -fabless chipmakers- will allow foundry chip makers to faster respond to quick and constant changes in the customers’ request for the chip design layouts, compared with when they are far away from each other.

More importantly, it will make the in-between supply chain network relatively more stable and more reliable, allowing engineers from each side to travel far shorter distances.

Back in late 2010s, Samsung Electronics had already benefited from the geographical proximity of its Austin, Texas foundry fab to Cupertino, San Jose-based Apple’s premises, suggesting it as one of its competitive advantages for winning the outsourcing orders to fabricate Apple’s AP chips

TSMC of Taiwan has recently turned very active in this offshore fab build-up project, too, as countries like Japan and India are luring it to build up fab facilities in their home turfs with the preferred offerings of various investment incentives.

The world’s largest foundry chip maker announced in early November that it would invest US$7 billion in Japan to build its foundry fab facilities in Kumamoto. Scheduled to come online by 2024, the foundry fab facilities will mainly produce chips of 22nm and 28nm circuitry for automotive and industrial market.

With Sony taking a 20% stake, the JV fab called as JASM plans to operate at a monthly wafer input of 45,000 wafers for the beginning. The Japanese government reportedly may offer subsidies to cover up to 50% of the total fab investments.

The mutual interests of the two parties – the Japanese government and TSMC – are a good fit for the onshore fab facility build-up project.

For Japan, TSMC’s fabs in Japan are a sure-bet to steadily and reliably supply their automotive and other key industrial industries with little risk of supply chain disruption.

For TSMC, the investment will guarantee foundry contract chip-making orders from various Japanese customers.

India is also joining the ‘fab-at-home” frenzy, as its economy is increasingly getting digitalized, clamoring for more of chips to domestically produce a wide variety of electronic goods.

Onshore Fab Build-up Frenzy

The Indian government is now in talks with TSMC of Taiwan to attract the Taiwanese foundry chipmaker’s investments with a full package of investment incentives from tax and tariff breaks to subsidies.

TSMC is reported to negotiate with the Indian government to execute its plan to build a US$7.5 billion wafer fab facility in India to mainly fabricate chips of 20nm circuitry for automotive and home appliances.

Indian government are concerned that possible disruption in the global chipmaking supply chain or supply shortages would undermine its efforts to digitalize its economy, weakening its national competitiveness. Under its so-called “Made-in India” policy initiative, India promises to offers US$1 billion to every semiconductor chip company, who set up fabs in India.

India is forecast to produce four times more electronics goods over the next 5 years than now, setting its sights on jumping to world’s No. 2 mobile phone producer after China.

Europe is no exception to this fab-at-home movement. Home to the world’s car and industrial production, Europe is in dire need for stable and reliable supply of chips. To the end, Europe is executing “2030 Digital Compass” project, of which top priority is to develop manufacturing capacities of below 5nm nodes and then ramp up to 2nm and 10 times more energy efficient chip-making technology. Europe’s ultimate goal is to represent at least 20% of the world’s semiconductor chip production in terms of value

Foundry Fab Going Global

Intel is betting on that plan, as the world’s largest PC microprocessor chip maker is expanding its business into a foundry contract chip-making service.

In early September 2021, Intel announced an ambitious, long-term plan to invest US$95 billion to build 8 mega foundry fab facilities in Europe over the next 10 years.

So far, the global semiconductor industry has been running on three business models – IDMs or integrated device manufacturers, fabless chip makers, and foundry contract chip makers. Well-organized division of labor by region also has been a rule of the game. Europe and U.S plays a role in chip design and IP development and equipment. Japan has supplied raw materials and consumable tools, while Korea and Taiwan have been a center of wafer fab production.

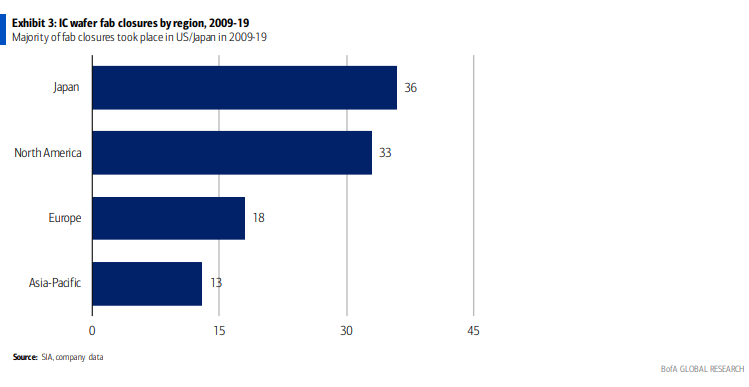

The well-established, decades-old industrial labor division is giving way to a new order of on-shore fab build-up frenzy, promising to burden chip makers with higher fab build-up and operating costs. According to BofA Global Research, unit costs of producing chip in the U.S. would be higher than in Taiwan and Korea.

IDMs are a sort of chip makers that manufacture chips of their own design at their own fab facilities, Meanwhile, fabless chip makers just design their chips and outsource the fabrication to foundry chipmakers, which just fabricate no chips of their own design, but chips of other fabless chip makers’ design.

Pioneered by TSMC’s founder Morris Chang, the foundry business model begun in Taiwan in early 1990s to mainly serve U.S. fabless chipmakers, operating its fab facilities in Taiwan.

Yet, the Covid-19 pandemic has been prompting foundry chip makers to move their facilities closer to their customers’ premises to ensure stable and reliable chip supply, making the geographical proximity as crucial as scale and technology innovation in the competition for market leadership.