ASIA ELECTRONICS INDUSTRYYOUR WINDOW TO SMART MANUFACTURING

SCARA Robots to Lead Robust Market Growth in 2026

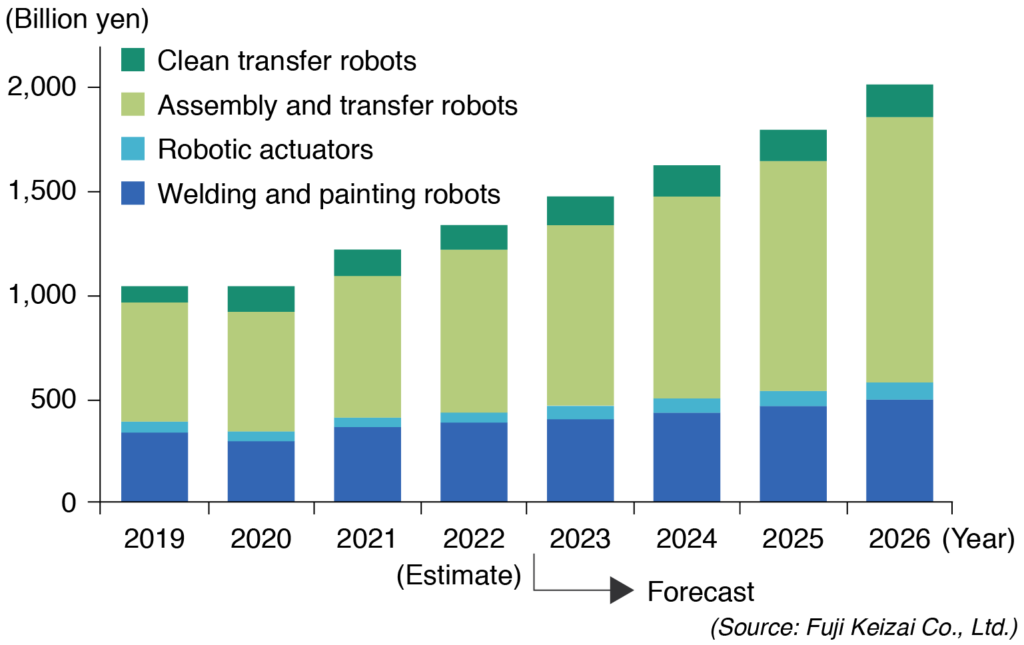

The global robots market for the manufacturing industry, including those for factory automation, is expected to top 2 trillion yen in 2026. This value represents growth of more than 60 percent from 2021 according to a survey conducted by Fuji Keizai Co., Ltd.

Needs for automation using robots have been increasing rapidly against the backdrop of manpower shortage and rising labor costs. Meanwhile, makers of smartphones, on-board batteries, and semiconductors are building up investments in plants and equipment. Reflecting these trends, it is expected that introduction of robotic actuators, and assembly and transfer robots will advance. Moreover, welding and painting robots are projected to increase, buoyed by investments in plants and equipment accompanying electric vehicles migration.

Robot Market Survey

The survey evaluated the global robot market for the manufacturing industry. It considered demand for robots for mounting of semiconductors and electronics components, and also materials, solutions, and potential services.

The results showed robots for the manufacturing industry in 2021 increased 20.6 percent from the previous year. This is supported by demand from economies that recovered from the COVID-19 pandemic, including China, and countries in the Americas and Europe. Also, manufacturers increased investments in production equipment for smartphones, on-board batteries, and semiconductors.

In particular, clean transfer robots exhibited the greatest growth year-on-year. They include robots for use in the manufacture of fifth-generation (5G)-related products, data centers, and automotive electronics. Welding and painting robots also grew, reflecting the increased investments in plants and equipment by manufacturers of finished vehicles in China, the United States, and countries in Europe.

For these reasons, the global robot market is projected to grow to 2.0132 trillion yen (US$14.9 billion) in 2026, leaping 65.2 percent from 2021. Meanwhile, robots for mounting of semiconductors and electronic components are expected to grow to 1.209 trillion yen (US$8.95 billion) in 2026, jumping 47.0 percent from 2021.

SCARA Robots at Center

SCARA robots are projected to reach 131.4 billion yen (US$972.4 million) in 2026, leaping 92.1 percent from 2021. Mainly, manufacturers actively install horizontal articulated mechanism for handling, picking, palletizing and assembly of automotive components, electronic components, optical components, foodstuffs, medical products, and chemical goods. These trends will back the market expansion of SCARA robots. In particular, the demand for SCARA robots in China has increased significantly.

Amid the popularity of EVs, needs for on-board batteries have also increased, thus propelling investments in plants and equipment.

SCARA robots are expected to continue growing this year and onward in China, the United States, and countries in Europe. In Japan, the adoption of SCARA robots is expected to increase in the manufacturing sites of semiconductors and automobiles.

Compact vertically articulated robots with a payload of 20kg or less are used for the assembly and transfer of small components and products. In 2026, the market of compact vertically articulated robots is projected to grow to 311.9 billion yen (US$2.3 billion), 2.1-fold of 2021.

Looking ahead, the growth is expected to slow down as the supply-demand balance of constituting components remains a challenge. Also, the status of future demand was brought forward in 2021. Nonetheless, the installation of compact vertically articulated robots will further advance, expanding the market.

Collaborative Robots also Enjoy Strong Demand

Collaborative robots (cobots) also exhibit robust demand. They are projected to grow to 265 billion yen (US$1.96 billion) in 2026 or three-fold of 2021. These robots are installed in the same working space of human workers to directly work with them. They are also anticipated to be used for operations and job specifications done by humans in a shared work environment. Cobots are presumed to have these capabilities in addition to conventional robot performance. Thus far, European and Japanese robot manufacturers have driven the cobot market. Recently, start-up manufacturers in China and Korea have emerged.

Mainly, countries in Europe start to use cobots. However, with the increase in sales by some European manufacturers in China, the center of the cobot market is now shifting to Asia, including China. In China, they are used in various fields, ranging from the automotive industry, to electronics, consumer electronics, and food industries.

Amid manpower shortages and rising labor costs, the demand for cobots is expected to increase steadily. The growth is supported by their ability to be installed in the working space of human workers without requiring additional space. As the market is expected to expand, more manufacturers are seen to enter the business.

High-speed Modular Mounters

High-speed modular mounters are projected to grow to 548.5 billion yen (US$4.06 billion) by 2026, jumping 55.4 percent from 2021. They are high-performance equipment used to place electronic components, such as chips and LSIs, onto printed circuit boards. In 2021, the demand for high-speed modular mounters grew mainly in China on the back of robust sales of personal computers and network equipment amid the stay-at-home trend. In Japan, the demand increased in the manufacturing site of automotive electronic components as well.

However, the impact on the market might be visible this year. Nonetheless, there are still unfilled orders, and the market still has room for expansion. In 2023 onward, needs in China for high-speed modular mounters will increase in the manufacturing sites of automotive electronic components and network equipment, such as 5G communications networks. The market in 2026 will see strong growth compared with 2021.